Rolling Stock Market

Rolling Stock Market by Component, Product Type (Locomotive, Rapid Transit, Coach), Locomotive Technology (Conventional, Turbocharged, Maglev), Application (Passenger Transportation, Freight Transportation) and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The rolling stock market is projected to grow from USD 30.94 billion in 2025 to USD 41.79 billion by 2032 at a CAGR of 4.4%. Electro-diesel and full electrification are gaining traction as rail operators and governments seek to balance climate commitments, rising fuel costs, and service reliability. High-speed rail projects and urban transit expansion are increasingly being designed with electrified traction as the baseline, given its efficiency and sustainability advantages. Operators are phasing out diesel fleets not only due to emissions and air quality concerns but also due to lower lifetime operating costs. Rather than a one-size-fits-all approach, the market is moving toward a multi-technology model, overhead electrification for high-density mainlines, hybrid or battery-electric solutions for regional routes, and hydrogen fuel-cell trains for non-electrified corridors. This shift marks a clear transition toward greener, more resilient rolling stock strategies that align with long-term transport modernization goals.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe rolling stock market by product type is segmented into locomotives, rapid transit, coaches, wagons, and others, with the rapid transit segment accounting for a dominant share due to rising urbanization and growing demand for metro and light rail systems worldwide.

-

BY COMPONENTRising demand for reliable, electrified rolling stock and digital maintenance solutions is boosting traction motors, pantographs, and train control systems. At the same time, aftermarket and refurbishment services create steady revenue for component suppliers.

-

BY LOCOMOTIVE TECHNOLOGYAdvances in materials have made turbochargers more durable and efficient for locomotives. Conventional locomotives remain popular for their reliability, cost-effectiveness, and ability to operate in areas with limited infrastructure.

-

BY APPLICATIONEconomic growth, urbanization, and industrial activities drive the demand for freight wagons. Commuter patterns, tourism, and urban planning influence the demand for passenger coaches, which is further boosted by modern technologies such as Wi-Fi connectivity and real-time passenger information systems.

-

BY REGIONNorth America is projected to witness the fastest growth rate attributed to significant investments in fleet modernization, expansion of urban transit systems, and a strong focus on electrification and advanced rolling stock technologies. Additionally, supportive government policies and funding for sustainable transportation further accelerate market growth in the region.

The decarbonization of non-electrified rail corridors is driving the adoption of alternative traction technologies. Battery-electric trains are deployed on short-to-medium-distance routes where charging through electrified sections or fast-charge points is viable. Hydrogen fuel-cell trains offer a cost-effective solution for longer or low-traffic lines with impractical overhead wires, provided a green hydrogen supply is available. Meanwhile, hybrid diesel-battery systems and biofuels act as transitional options, enabling operators to cut emissions while moving toward fully sustainable rail operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the rolling stock market reveal current and future trends. As the market shifts from conventional diesel locomotives to electrified, battery, and hydrogen-powered trains, new revenue pockets are emerging in alternative fuel technologies, advanced traction systems, and charging/refueling infrastructure. Growth in digital solutions, including predictive maintenance, real-time monitoring, and passenger information systems, also opens recurring service and aftermarket opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of railroad network and freight corridors

-

Energy-efficient and sustainable transportation shift

Level

-

High capital intensity and investment barriers

-

Optimization of the existing fleet through refurbishment

Level

-

Adoption of hydrogen fuel cell locomotives

-

Rising rail demand from industrial and mining expansion

Level

-

Rising overhaul and maintenance cost burden

-

Intensive R&D investment requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of railroad network and freight corridors

Rising global trade and economic activity boost demand for efficient rail transport, especially for bulk and long-distance goods. Investments in freight corridors, electrification, and advanced technologies have increased rail capacity and efficiency. The surge in global trade and infrastructure investments in countries such as China and India drives record freight volumes and enhances rail transport efficiency worldwide.

Restraint: Optimization of the existing fleet through refurbishment

The rolling stock refurbishment market is growing as operators seek to increase capacity, improve efficiency, and modernize vehicles. For instance, Indian Railways modernized ICF coaches with improved interiors, bio-toilets, and safety features. Rising refurbishment programs may limit demand for new rolling stock by extending the life of existing fleets.

Opportunity: Adoption of hydrogen fuel cell locomotives

The rolling stock industry is adopting hydrogen fuel cell locomotives as a zero-emission and cost-efficient solution for non-electrified routes. Pilot projects in Europe have proven their feasibility, and major manufacturers such as CRRC, Alstom, Siemens, and Hyundai Rotem are driving development, positioning hydrogen as a key alternative to diesel alongside battery-electric and hybrid systems.

Challenge: Rising overhaul and maintenance cost burden

Rolling stock requires periodic and costly maintenance to ensure reliability, including depots and component upkeep. High-speed trainsets can cost up to USD 1 million annually for maintenance, with major overhauls needed at mid-life. These recurring costs may constrain rolling stock market growth.

rolling stock market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Operates freight trains to efficiently transport automotive parts and manufactured goods across multiple European countries | Reduces road congestion, lowers overall transport costs, and ensures the timely delivery of goods across long distances |

|

Uses heavy-duty freight wagons to move large volumes of iron ore from remote mines to coastal ports for export | Enables high-volume bulk transport efficiently, reduces reliance on road transport, and supports large-scale mining operations |

|

Operates electric multiple units (EMUs) to transport millions of daily commuters across the metropolitan area reliably | Provides fast, energy-efficient, and reliable urban mobility while reducing traffic congestion and emissions |

|

Uses rail freight to transport large volumes of consumer goods from central warehouses to regional distribution hubs | Accelerates delivery times, reduces carbon emissions compared to road transport, and optimizes long-distance logistics |

|

Transports chemicals and petrochemical products in specialized tank wagons safely across Europe | Facilitates bulk movement while minimizing handling risks, ensuring safety, and maintaining product quality during transit |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The rolling stock market ecosystem includes raw material and component suppliers, rolling stock manufacturers, technology providers, infrastructure providers, regulatory & policy makers, maintenance & service providers, and rail operators. Some of the major rolling stock manufacturers include CRRC Corporation Limited (China), Siemens AG (Germany), Alstom SA (France), Stadler Rail AG (Switzerland), and Wabtec Corporation (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rolling Stock Market, By Product Type

The locomotives segment is expected to lead the market due to its key role in freight and passenger transport. Rising industrial growth and international trade are driving demand for powerful, efficient locomotives. The shift toward electrification and energy-efficient models further strengthens locomotives in the market.

Rolling Stock Market, By Component

The rolling stock market relies on key components such as traction motors, pantographs, brakes, couplers, and train control systems, each ensuring efficient operation and safety. Advanced technologies in high-speed trains enhance performance, while ongoing maintenance and part replacement drive continuous demand.

Rolling Stock Market, By Locomotive Technology

Conventional locomotives dominate the market due to their reliability and compatibility with existing rail infrastructure. Electro-diesel models, such as Siemens’ Vectron Dual Mode, can operate on both electrified and non-electrified tracks, supporting sustainability goals with HVO fuel. Electric locomotives are increasingly adopted amid global electrification efforts.

Rolling Stock Market, By Application

Freight transportation application to lead the rolling stock market. The growing demand for transporting industrial and commercial goods is driving the market for freight, as rail transport provides a more efficient and cost-effective solution, leading many countries to promote its use actively.

REGION

North America is projected to grow at the fastest rate in the global rolling stock market during the forecast period.

North America is expected to witness the fastest growth in the rolling stock market, driven by the modernization of aging fleets, the adoption of advanced technologies, and infrastructure investments aimed at improving efficiency, safety, and passenger comfort. The rise of electrification and hybrid systems, along with expanding urban transit and freight networks, is further boosting demand, supported by regulatory initiatives and federal funding, such as Canadian Pacific Kansas City’s USD 100 million Patrick J. Ottensmeyer International Rail Bridge, which enhances cross-border cargo mobility.

rolling stock market: COMPANY EVALUATION MATRIX

In the rolling stock market matrix, CRRC Corporation Limited (Star) leads with a strong global presence and comprehensive rolling stock offerings, driving market expansion and revenue growth through strategic partnerships and supply contracts. MITSUBISHI HEAVY INDUSTRIES, LTD. (Emerging Leader) is gaining traction with advanced propulsion technologies and customized rolling stock solutions. The company shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 30.94 Billion |

| Market Forecast in 2032 (Value) | USD 41.79 Billion |

| Growth Rate | CAGR of 4.4% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Units) and Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Oceania, Europe, North America, Middle East & Africa, and the Rest of the World |

WHAT IS IN IT FOR YOU: rolling stock market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Rolling Stock OEM (Europe) | Competitive benchmarking of CRRC, Alstom, Siemens Mobility Product roadmap tracking for electric & hydrogen rolling stock | Identify technology white spaces in zero-emission propulsion Support R&D prioritization and investment strategy |

| Rail Operator (Asia Pacific) | Fleet modernization analysis for passenger coaches and EMUs Lifecycle cost analysis of refurbished vs. new rolling stock | Optimize capital expenditure decisions Extend service life and improve ROI |

| Tier-1 Component Supplier (North America) | Partnership mapping with leading OEMs Technology adoption study in braking, traction, and digital control systems | Expand client base via targeted partnerships Align product portfolio with next-gen rolling stock trends |

| Technology Provider (Global) | Assessment of digitalization trends (IoT, predictive maintenance, CBTC) Competitive positioning of major telematics and connectivity players | Identify growth opportunities in smart train solutions Build recurring revenue models through digital offerings |

RECENT DEVELOPMENTS

- September 2025 : CRRC Corporation Limited (China) developed new-generation intercity EMUs for service in Malaysia. Each train can carry 312 passengers, including 36 in business class, and features modern interiors with bistro areas. The EMUs are designed to handle curves with a radius of 100 m, equipped with an intelligent driver assistance system, and comply with current impact resistance and fire safety standards. They also include 640 A⋅h batteries that allow emergency operation for up to two hours.

- August 2025 : Alstom SA (France) unveiled the design of the Traxx Universal electric locomotive developed for the Romanian Railway Reform Authority (ARF). The contract covers 16 locomotives and 20 years of maintenance and repair services. These four-axle electric locomotives can reach a maximum speed of 200 km/h and can haul up to 16 passenger cars.

- June 2025 : Stadler and Federal Railways (ÖBB) unveiled the KISS double-deck train in Vienna. The 14 ordered trains will gradually enter service on the Vienna Salzburg route from the end of 2026, reaching speeds of up to 200 km/h. They provide about 20% more seating and offer improved comfort and accessibility.

- June 2025 : Cargounit ordered 22 new Vectron MS locomotives from Siemens Mobility. The order includes 12 locomotives under an existing framework agreement and 10 additional units co-financed through Poland’s National Recovery and Resilience Plan (KPO), managed by the Centre for EU Transport Projects. Deliveries are scheduled between 2025 and 2026.

- March 2025 : Wabtec Corporation (US) has signed an agreement with Vale (Brazil) to supply 50 new Evolution Series locomotives for the Vitória a Minas Railroad (EFVM) and Carajás Railroad (EFC). The locomotives will be manufactured at Wabtec’s plant in Contagem, Brazil, and deliveries will begin in 2026.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the rolling stock market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included rolling stock industry organizations [American Railway Association (ARA), Brazilian Association of the Railroad Suppliers (ABIFER), China Railway Society (CRS), China Academy of Railway Sciences (CARS), Gulf Cooperation Council (GCC), Indian Railway Conference Association (IRCA), Indian Railway Institute of Electrical Engineering (IRIEEN), International Union of Railways (UIC), Japan Association of Rolling Stock Industries (JARI), Mexican Association of Railway], corporate filings [such as annual reports, investor presentations, and financial statements], and trade, business, whitepapers, and databases, and articles from recognized associations and government publishing sources. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

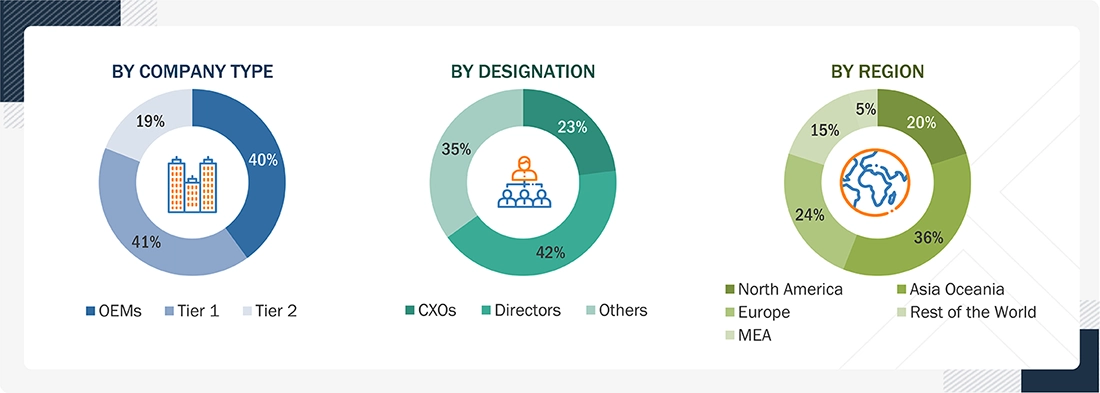

Extensive primary research was conducted after acquiring an understanding of the rolling stock market through secondary research. Several primary interviews were conducted with market experts from both the demand (railway operators, system integrators, country-level government associations, and trade associations) and supply (OEMs and component manufacturers) sides across major regions, namely, North America, Europe, Asia Oceania, the Middle East & Africa, and the Rest of the World. Approximately 40% and 60% of primary interviews were conducted from the demand and supply sides, respectively. The primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were considered to provide a holistic viewpoint in this report.

Brief sessions with highly experienced independent consultants were conducted to reinforce findings from primaries after interacting with industry experts. This, along with the opinions of the in-house subject matter experts, led to the findings described in the remainder of this report.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

Note: Tiers of companies are based on the value chain of the rolling stock market; companies’ revenues have not been

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up and top-down approaches were used to estimate and validate the total size of the rolling stock market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Rolling Stock Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Rolling stock refers to railway vehicles. They are powered as well as unpowered vehicles such as locomotives, railroad cars, coaches, and wagons. Rolling stock is used for freight and passenger transport and plays a vital role in the transport infrastructure of a city or country. Rapid urbanization and industrialization, and the increasing use of public transport to reduce traffic congestion, are the key factors driving the growth of the rolling stock market.

Stakeholders

- Rolling stock manufacturers

- Rolling stock component and subsystem suppliers

- Rail technology providers

- Leasing companies and financial institutions

- Maintenance, repair, and overhaul (MRO) service providers

- Government bodies and regulatory authorities

- Rail infrastructure developers

- Investors and public-private partnerships (PPPs)

- Rail operators and service providers

Report Objectives

- To segment and forecast the size of the rolling stock market in terms of value (USD million) and volume (units)

- To define, describe, and forecast the market-based product type, locomotive technology, application, components, and region

-

To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size by product type (locomotives, rapid transit, wagons, and coaches)

- To provide a qualitative analysis of other product types

- To segment and forecast the market size by locomotive technology (conventional locomotives and turbocharged locomotives), with qualitative insights on Maglev

- To segment and forecast the market size by application (passenger transportation and freight transportation)

- To provide a qualitative analysis of component segments (pantographs, axles, wheelsets, traction motors, passenger information systems, air conditioning systems, auxiliary power systems, train control systems, brakes, baffle gears, couplers, and gearboxes)

- To forecast the market size by region [North America, Europe, Asia Oceania, the Middle East & Africa (MEA), and the Rest of the World (RoW)]

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Impact of AI/Gen AI

- Trend and Disruption Impact

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Investment and Funding Scenarios

- Strategic Pathways for Alternative Propulsion Systems

- Rail Infrastructure Modernization Strategy

- Implementation Framework for Autonomous Train Technology

- Success Stories and Real-world Applications

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the impact of recession on the market

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, contracts, partnerships, collaborations), product developments and launches, and other activities carried out by key industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Rolling stock market, by technology type at the country level (For countries covered in the report)

- Rolling stock market, by product type at the country level (For countries covered in the report)

- Company information

- Profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Rolling Stock Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Rolling Stock Market

robert

May, 2022

what is the market size for rolling stock market and also want to more details about forecast year 2022 to 2027. .