Sports Analytics Market Size, Share, Opportunities & Latest Trends

Sports Analytics Market by Offering (Performance Analytics, Predictive Analytics, Video Analytics), Application (Player Performance Analysis, Tactical Analysis, Injury Risk Prediction, Fan Engagement, Social Media Analytics) – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Sports Analytics Market was valued $2.29 billion in 2025 and is anticipated to reach over $4.75 billion by 2030, with a robust CAGR of 15.7%. Sports analytics is transforming the landscape of modern athletics by facilitating smarter, data-driven decision-making and encouraging strategic innovation. Trends such as AI-powered predictive modeling, real-time odds adjustment, micro-betting on individual plays, and personalized betting recommendations are redefining user engagement and strategy by empowering better players and fantasy players to leverage comprehensive statistical insights, transforming the fan experience and broader business of sports through greater accuracy, personalization, and transparency.

KEY TAKEAWAYS

- North America dominates the Sports Analytics market by 35.3% market share in 2025.

- By offering, predictive analytics tools segment is expected to be the fastest growing segment, with CAGR of 17.7%, during the forecast period.

- By deployment mode, the cloud segment dominates the market, with market share of 38.1% in 2025.

- By sports type, the online or virtual sports segment is expected to grow the fastest, during the forecast period.

- By application, the on-field segment is projected to dominate the market.

- By end user, the sports leagues & governing bodies segment is expected to be the fastest growing segment, during the forecast period.

- Sportradar, Stats Perform and Catapult are identified as some of the star players in the Sports Analytics market, given their strong market share and product footprint.

- Kitman Labs, SportLogiq and Veo Technologies, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

The sports analytics market is experiencing accelerated growth, driven by increasing demand for intelligent, scalable, and performance-driven solutions that enhance athlete evaluation, tactical analysis, and fan engagement across sports organizations. The market is expected to rise from about USD 2.29 billion in 2025 to USD 4.75 billion by 2030, at a CAGR of 15.7%. Teams, leagues, and governing bodies are widely adopting cloud-native analytics platforms, AI-powered insights, and modular architectures to optimize player performance, unify operational workflows, and deliver seamless, data-informed decision-making across training, match-day operations, and fan interaction touchpoints.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on sports organizations stems from evolving technology trends and market disruptions. Core sports segments, such as professional teams, leagues, and governing bodies, are the main adopters of sports analytics platforms. These platforms are used for performance optimization, tactical analysis, and engaging fans. Changes in platform adoption and innovation cycles directly reshape training, match-day operations, and athlete management. This influence cascades across the sports ecosystem, driving analytics investment, enhancing organizational performance, and improving competitive outcomes, eventually fueling growth and adoption within the global sports analytics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing reliance on advanced analytics to optimize player performance

-

Rising adoption of fan data analytics for personalized engagement and revenue growth

Level

-

Fragmented data ecosystems undermining cross-functional analytics

Level

-

Increasing deployment of modular analytics for performance optimization in emerging sports

-

Rising e-sports sector fueling real-time analytics innovation and audience-centric expansion

Level

-

Inadequate data security exposing sensitive player movement and tactical analytics

-

Frequent software updates disrupting workflow continuity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing Use of Advanced Analytics Optimizes Player Performance

Advanced analytics are transforming sports performance, with teams using AI, machine learning, and player tracking to optimize biomechanical efficiency, physiological load, and tactical responsiveness. Real-time data from video, performance logs, and movement tracking enable precise assessment of athlete condition, fatigue, and training needs, supporting coaching and medical decisions. Centralized, interoperable platforms consolidate multiple metrics into unified dashboards. Over 75% of elite sports franchises leverage real-time analytics, while automation and predictive modeling provide actionable insights, enhancing decision-making and driving evidence-based performance optimization.

Restraint: Fragmented Data Ecosystems Undermine Cross-functional Analytics

Fragmented data sources limit the effectiveness of sports analytics, as teams often manage information independently across performance tracking, fan engagement, ticketing, media, and CRM systems. This lack of consolidation hinders timely insights, reduces model accuracy, and restricts scalability. Outdated infrastructure, non-standardized taxonomies, and limited vendor compatibility further complicate integration, forcing manual reconciliation and slowing predictive modeling, behavior segmentation, and automated reporting. Addressing these challenges requires investment in interoperable platforms, adoption of shared data standards, and enhanced collaboration between internal teams and external technology providers to build a unified, scalable analytics foundation.

Opportunity: Emerging Sports Drive Modular Adoption, Real-Time Insights, and New User Segments

Modular analytics solutions present a significant opportunity to expand sports analytics access across emerging segments, including youth academies, women’s teams, and semi-professional clubs. Platforms, such as Hudl, support over 315,000 teams across 40+ sports, offering configurable modules for performance tracking, video analysis, and scouting tailored to different competition levels. This approach reduces entry barriers, enabling targeted adoption without full-platform costs. By integrating into existing workflows, modular solutions facilitate efficient performance evaluation, athlete development, and tactical refinement, allowing vendors to prioritize flexibility, sport-specific design, and scalable pricing to capture this high-growth market.

Challenge: Frequent Software Updates Disrupt Workflow Continuity and Constant Adaptation

The rapid evolution of AI models, computer vision, and real-time data processing poses challenges for sustained sports analytics adoption among smaller clubs and academies. Frequent platform updates improve prediction accuracy and insights, but require recurring investment in upgrades, integration, and workforce training. Limited resources delay adoption, reducing tactical analysis and benchmarking across seasons. For instance, analytics providers often release refined player modeling frameworks, yet implementation may be postponed due to cost or training constraints. Vendors must prioritize modularity, version transparency, and scalable operations to ensure equitable access.

Sports Analytics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IBM and ESPN transform fantasy football using AI-powered insights | AI delivers 48 billion personalized insights, helping 11 million fantasy football managers make data-driven roster choices. |

|

Orlando Magic leverages SAS analytics to boost fan engagement and ticket revenue | Predictive analytics optimizes pricing for 41 home games, boosting revenue and operational efficiency. |

|

Boston Celtics enhances sports analytics with AWS Cloud migration and mission Cloud expertise | Migrating to AWS Cloud reduced data processing time by over 75%, enabling faster decision-making. |

|

FC Bayern Munich enhances fan experience and operational efficiency with SAP solutions | SAP S/4HANA consolidates over 50 systems, improving data consistency and operational efficiency. |

|

Apostemos enhances player retention across Latin America with Sportradar’s AI-driven CRM | Personalized campaigns re-engaged 85% of targeted regular players, resulting in nearly four times higher sales revenue. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The sports analytics ecosystem comprises solution providers delivering platforms across key categories, including performance analytics software, video analytics platforms, predictive analytics tools, and other solutions for performance optimization, injury prevention, and fan engagement. These platforms enable teams, leagues, and governing bodies to enhance competitiveness, optimize operations, improve player performance, and elevate fan experiences, driving measurable outcomes, strategic growth, and long-term success in an increasingly data-driven sports landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sports Analytics Market, By Solution

Video analytics platforms hold the largest market share in the sports analytics market due to their ability to capture, process, and analyze vast amounts of match and player footage in real time. These platforms provide actionable insights for performance optimization, tactical decision-making, injury prevention, and fan engagement. Integration with AI and machine learning enhances predictive analytics and personalized experiences. Additionally, sports organizations and broadcasters increasingly rely on video data to improve coaching, scouting, and content monetization, making video analytics a critical and widely adopted solution across professional and amateur sports.

Sports Analytics Market, By Deployment Mode

Cloud deployment is witnessing the fastest growth in the sports analytics market due to its scalability, flexibility, and cost-efficiency. Cloud-based solutions enable real-time data collection, storage, and analysis from multiple sources, supporting AI-driven performance insights, fan engagement platforms, and predictive modeling. Teams and sports organizations are increasingly adopting cloud deployment to cut IT costs, improve collaboration, and access analytics remotely. The rising use of SaaS-based sports analytics tools is further driving this trend in professional and amateur sports worldwide.

Sports Analytics Market, By Sports Type

Team sports hold the largest market share in the sports analytics market due to the high demand for performance optimization, strategic planning, and injury prevention across players and coaching staff. Football, basketball, and cricket generate massive volumes of data from matches, training sessions, and wearable devices, which analytics platforms leverage for tactical insights and fan engagement. Additionally, the commercial value of team sports, driven by broadcasting rights, sponsorships, and merchandising, encourages extensive adoption of analytics solutions to improve competitiveness and maximize revenue streams.

Sports Analytics Market, By End User

Sports leagues and governing bodies are witnessing the fastest growth in the sports analytics market as they increasingly adopt data-driven strategies to enhance competition, player performance, and fan engagement. These organizations leverage analytics for scheduling, officiating, injury prevention, and performance benchmarking across teams. The rising focus on standardized data collection, broadcast optimization, and fan experience personalization drives demand for advanced analytics solutions. Additionally, investments in AI-powered tools and cloud-based platforms enable leagues and governing bodies to efficiently manage large datasets, making them a rapidly expanding segment in sports analytics.

REGION

Asia Pacific to be fastest-growing region in sports analytics market during forecast period

The Asia Pacific region is witnessing the fastest growth in the sports analytics market, driven by the rapid adoption of AI-powered performance analytics and data-driven insights. Increasing investment in real-time data analytics and fan engagement platforms is transforming sports operations and experiences across leagues and clubs. Governments and sports authorities are promoting smart sports programs and analytics-driven initiatives, further boosting adoption. Additionally, the rise of regional sports tech startups, expanding professional leagues, and strong investments in AI-driven coaching and broadcast analytics are positioning Asia Pacific as a dynamic hub for sports analytics innovation.

Sports Analytics Market: COMPANY EVALUATION MATRIX

In the sports analytics market matrix, Sportradar (Star) leads with a strong market presence and a comprehensive data, AI, and analytics ecosystem, driving large-scale adoption across professional sports, betting, and media. Zebra Technologies (Emerging Leader) is gaining traction with innovative player tracking and real-time performance analytics solutions, supporting teams and organizations in enhancing athlete performance and fan engagement. While Sportradar dominates with scale and extensive enterprise reach, Zebra Technologies demonstrates strong growth potential, moving toward the stars’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.90 Billion |

| Revenue Forecast in 2030 | USD 4.75 Billion |

| Growth Rate | CAGR of 15.7% from 2025–2030 |

| Actual Data | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Sports Analytics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- May 2025 : European League of Football entered into a multi-year partnership with Stats Perform to deliver Opta’s official live data and AI-powered analytics to all 16 teams. Starting with the 2025 season, the collaboration enhances real-time coverage, fan engagement, and storytelling through broadcast, digital, and social platforms across Europe.

- May 2025 : Sportlogiq and Just Play formed a strategic partnership to integrate Sportlogiq’s AI-powered analytics and video with Just Play’s coaching and recruiting platform for college hockey. This collaboration enables data-driven player teaching, scouting, and roster strategies, delivering advanced insights and instant video breakdowns directly within coaching workflows nationwide

- March 2025 : Kitman Labs partnered with Unrivaled, a women’s 3-on-3 professional basketball league, to deploy its Intelligence Platform. This advanced system will unify medical and performance data, offering real-time, holistic player insights to optimize health, readiness, and performance, supporting evidence-based decisions across the league and its clubs.

- February 2025 : Major League Baseball and Sportradar extended their exclusive partnership with MLB, acquiring an equity stake in Sportradar. Sportradar will exclusively distribute MLB’s official data, media, and AV content globally, enhance integrity with fraud detection, and co-develop AI-driven fan engagement products leveraging player tracking data.

- February 2025 : Hudl acquired Balltime, an AI-driven volleyball analytics platform, to enhance its volleyball technology offerings worldwide. This strategic move will integrate Balltime’s rapid, advanced analytics into Hudl’s suite, enabling faster video analysis and deeper insights for coaches and athletes at all levels, supporting the sport’s accelerating global growth.

Table of Contents

Methodology

This research study on the sports analytics market involved the use of extensive secondary sources, such as directories, IEEE Communication-efficient Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred sports analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the sports analytics spending of various countries was extracted from the respective sources.

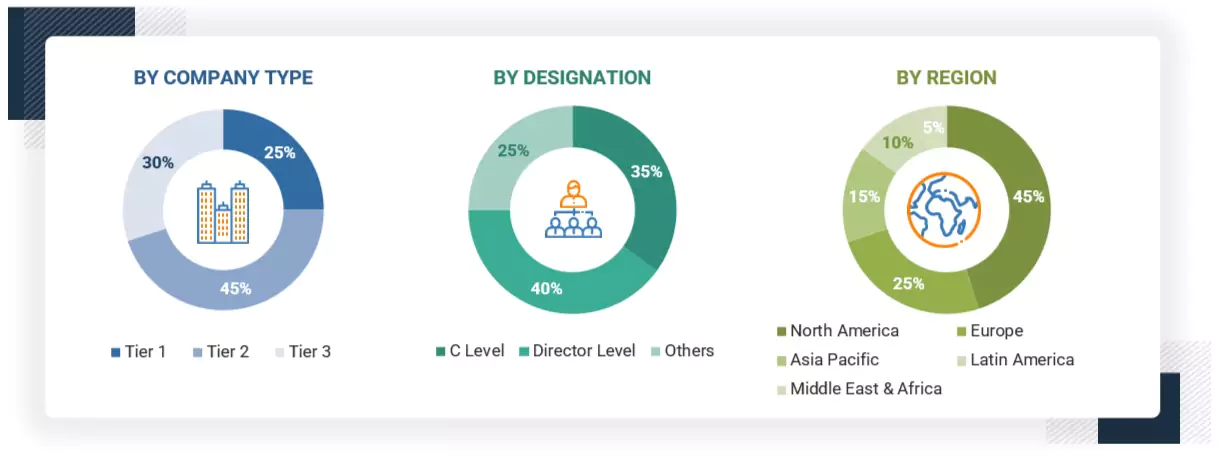

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and sports analytics. It also included key executives from sports analytics solution and service vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range

between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million

and USD 1 billion. Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

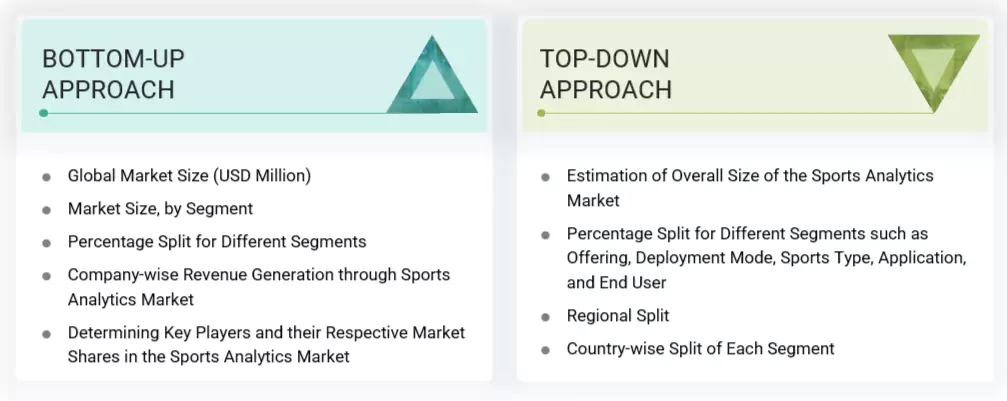

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the sports analytics market. The first approach involved estimating the market size by companies’ revenue generated through the sale of sports analytics solutions.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the sports analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on offering, deployment mode, sports type, application, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of sports analytics solutions across various verticals in key countries within their respective regions was identified as the main contributor to the market share. Cross-validation revealed the adoption of sports analytics solutions among enterprises, along with various use cases by region. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included analyzing the sports analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major sports analytics providers, and organic and inorganic business development activities of regional and global players were estimated.

Sports Analytics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Catapult, sports analytics is the integration of data science and performance technology to support evidence-based decisions in sports. It involves collecting and analyzing real-time athlete data such as movement, load, and fatigue using video systems and software tools. The goal is to optimize individual and team performance, reduce injury risk, and refine tactical strategies. Catapult emphasizes removing guesswork from coaching by transforming raw performance data into clear, actionable insights. Its approach is deeply embedded in elite sport environments, enabling practitioners to track trends, benchmark results, and tailor interventions based on precision analytics.

Stakeholders

- Sports analytics providers

- Distributors and value-added resellers (VARs)

- Independent software vendors (ISV)

- Service providers

- Support & maintenance service providers

- System integrators (SIs)

- Technology providers

- Coaching staff & performance analysts

- Athlete monitoring & tech companies

- Sports technology & performance optimization firms

Report Objectives

- To define, describe, and forecast the sports analytics market by offering, deployment mode, sports type, application, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the sports analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American Sports Analytics market

- Further breakup of the European Sports Analytics market

- Further breakup of the Asia Pacific Sports Analytics market

- Further breakup of the Middle East & African Sports Analytics market

- Further breakup of the Latin American Sports Analytics market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the sports analytics market?

The sports analytics market refers to the use of advanced data analysis tools, machine learning algorithms, and real-time monitoring technologies to collect, process, and interpret data related to athletic performance, team strategy, fan engagement, and business operations across the sports ecosystem. Driven by the rising demand for competitive edge, injury prevention, player tracking, and fan personalization, the market has evolved to encompass on-field applications such as performance optimization and video analysis, as well as off-field use cases like predictive modeling, ticketing, sponsorship valuation, and fan behavior analytics. With the integration of AI, computer vision, and IoT, sports analytics is transitioning from traditional statistical analysis to intelligent, automated, and immersive decision-making support.

Which are the key end users adopting sports analytics market solutions and services?

Key end users adopting sports analytics solutions and services include sports teams and clubs, sports academies and colleges, sports leagues/associations and governing bodies, broadcasters and media companies, sponsorship and marketing agencies, sports equipment manufacturers, sports betting companies, and others.

What are the major factors driving the growth of the sports analytics industry?

The growth of the sports analytics market is fueled by increasing reliance on data-driven strategies to elevate player performance, personalize fan experiences, and optimize engagement. Additionally, predictive analytics plays a critical role in accelerating the expansion of betting and fantasy sports, driving new revenue streams and operational efficiencies.

What challenges are hindering the widespread adoption of sports analytics?

Sports analytics faces challenges including maintaining data confidentiality, ensuring system integrity, and managing secure access controls. Additionally, the rapid pace of software evolution creates barriers for smaller teams to adopt or upgrade analytics solutions, limiting equitable access to advanced tools and hindering widespread implementation across varying organizational scales.

Who are the key vendors in the sports analytics market?

The key vendors in the global sports analytics market include IBM (US), SAS Institute (US), SAP (Germany), HCL Technologies (India), Salesforce (US), Zebra Technologies (US), Catapult (Australia), EXL (US), Chyron (US), GlobalStep (US), Stats Perform (US), Exasol (Germany), DataArt (US), TruMedia Networks (US), Orreco (Ireland), Sportradar (Switzerland), Whoop (US), Kitman Labs (Ireland), Hudl (US), Trace (US), Kinduct Technologies (Canada), Oracle (US), Uplift Labs (US), SportLogiq (Canada), SportAnalytics (Serbia), L2P Limited (UK), Quant4Sport (UK), Veo Technologies (Denmark), Carv (UK), Real Sports AI (UK), Vekta (US), Zone14 (Austria), SportAI (US), BodyPro (US), HIT Coach (US), Pulse (Various), PunchLab (Italy), Marelli (Italy), MoTeC (Australia), Race Technologies (US), and PandaScore (France).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sports Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Sports Analytics Market

MnM Analyst

Feb, 2023

Because of the growing amount of data available and technological advancements, sports analytics has become a promising field in recent years. In the market for sports analytics, the following new business opportunities are listed:

Overall, the market for sports analytics presents many exciting business opportunities for firms that can use technology and data to spur innovation in the sports sector..

Rush

Feb, 2023

What are the new business opportunities in Sports Analytics Market?.