Wire and Cable Management Market

Wire and Cable Management Market by Cable Type (Power Cables, Communication Wires & Cables), Material (Metallic, Non-metallic), Installation (Overhead, Underground, Submarine), End User (Industrial End User, Commercial End User, Residential End User), Product, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The wire and cable management market is expected to reach USD 39.55 billion by 2030, up from USD 26.44 billion in 2025, with a CAGR of 8.4% from 2025 to 2030. The market is growing rapidly, mainly due to large infrastructure investments, the growth of smart buildings, and the rising use of digital technologies across various sectors. Upgrading electrical networks and adopting renewable energy systems are making the market more complex and driving innovation in cable management solutions, from sustainable materials to advanced systems designed for safety and environmental friendliness. New safety and environmental regulations are encouraging companies to collaborate across the supply chain to offer integrated, cost-effective, and reliable solutions. The outlook for the industry remains positive, with ongoing adaptation and strategic partnerships seen as essential to reaching its full potential.

KEY TAKEAWAYS

-

BY END USERThe end-user segments include industrial, commercial, and residential. The industrial segment is driven by automation, infrastructure development, and the need for reliable power and data transmission.

-

BY PRODUCTThe product segment includes conduits & trunking, cable trays & ladders, cable raceways, glands & connectors, boxes & covers, wiring ducts, ties, fasteners & clips, and other products. The conduits & trunking segment is driven by increasing construction activities, modernization of existing wiring infrastructure, and stricter regulatory mandates ensuring cable safety and maintainability.

-

BY CABLE TYPEThe cable type segment consists of power cables and communication wires and cables. The rising adoption of power cables in renewable energy projects, grid modernization, and infrastructure development is accelerating the demand for advanced cable management solutions in this segment.

-

BY MATERIALThe material segment includes metallic and non-metallic materials. Metallic materials are widely used owing to their high strength and durability.

-

BY INSTALLATIONBy installation, the market includes overhead, underground, and submarine. Overhead installation dominates due to its cost-effectiveness and ease of installation, driving its widespread use in power distribution networks.

-

BY REGIONThe regions considered are North America, Europe, the Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific leads due to rapid urbanization, large-scale grid expansion, and aggressive electrification efforts.

-

COMPETITIVE LANDSCAPEMajor market players use organic and inorganic strategies, such as partnerships and investments, to drive growth in wire and cable management applications. Companies such as Eaton, Atkore, and nVent have entered various collaborations, partnerships, and acquisitions and enhanced product innovation to meet the increasing demand for wire and cable management in innovative uses.

Growth in the wire and cable management market is propelled by the drive for more secure, organized, and efficient electrical networks, spurred by industrial and government efforts to modernize infrastructure and improve energy reliability. Increasing digitalization, stricter safety regulations, and the expansion of renewable energy systems require advanced cable routing and protection solutions. Demand is further fueled by the construction boom, urbanization, and the need for safe, scalable systems in manufacturing and commercial environments. Industry players prioritize integrated, adaptable cable management products to help clients meet evolving standards for safety, performance, and long-term sustainability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The wire and cable management market is projected to grow at a CAGR of 8.4% during the forecast period by value. Rising sustainability goals and increasing demand for operational efficiency are driving market expansion. Global infrastructural developments promoting the adoption of wire and cable management are expected to offer significant growth opportunities for market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging investments in clean energy

-

Emphasis on infrastructure modernization

Level

-

Susceptibility of raw materials to fluctuations

-

Extensive documentation, training, and quality control measures

Level

-

Substantial investments in submarine cable infrastructure

-

Growing emphasis on clean cable and cybersecurity initiatives

Level

-

Issues related to counterfeit products and quality assurance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Emphasis on infrastructure modernization

Rising investments in power grids boost wire and cable management demand. Government programs like India's RDSS and GEC fund infrastructure upgrades, expanding networks with high- and low–voltage feeders, substations, and cable handling—necessitating complex cable management tools for efficiency and reliability. Growing underground cables and electrification further increase the need for safe, well-designed cable solutions for system maintenance. Internationally, the IEA emphasizes ongoing investments in transmission and distribution to meet rising electricity needs and integrate renewables. Upgrading grids with modern, resilient technology requires extensive wiring and cable management, supporting digital control and monitoring systems. This global trend aims to reduce losses, enhance grid reliability, and improve cable management efficiency.

Restraint: Susceptibility of raw materials to fluctuations

The main challenge in the wire and cable management market is raw material price volatility, especially for commodities like copper, aluminium, and polymers. This volatility exposes the industry to geopolitical risks, supply chain issues, and fluctuating demand, increasing costs and squeezing profit margins. The inability to pass higher costs to customers, particularly in competitive or fixed government contracts, hampers profitability and complicates long-term planning and investment. Price fluctuations also disrupt supply, cause delays, and raise operational costs, making manufacturers less reliable. Companies try to mitigate these risks through supplier diversification, alternative materials, and cost management, but price volatility remains a key obstacle to growth and profit.

Opportunity: Growing emphasis on clean cable and cybersecurity initiatives

The popularity of clean cable initiatives and strict cybersecurity programs offers significant growth opportunities in the cable management industry. Governments and organizations prioritize securing critical infrastructure, like submarine cables, essential for connectivity and financial stability. Regulatory policies limiting untrusted vendors push manufacturers to adopt more sophisticated management systems, creating demand for secure, tamper-proof cables and advanced systems that meet compliance standards and enhance infrastructure resilience. The market expands further with cybersecurity initiatives integrating intelligent technologies, such as real-time monitoring and intrusion detection, to counter physical and cyber threats proactively. These smart systems require high-level management solutions for sensor protection and network reliability. As digital infrastructure investment grows in developing cyber-resilient solutions, the wiring and cable management market is set to benefit from rising demand for secure, durable, and tech-enabled cable systems..

Challenge: Issues related to counterfeit products and quality assurance

Issues affecting the wire cable management market include counterfeits and quality assurance. Fake cables are often poor quality, unsafe, and non-compliant, risking safety, performance, and system failures. They erode customer trust and lower market prices at the expense of reliability. High standards require investment in testing, certification, and traceability. Counterfeits complicate supply chains, increasing costs and delaying market entry. Quality assurance relies on skilled labor and advanced tech, but gaps in expertise, especially in automation and sustainable engineering, create hurdles. Lack of trained manpower and environmental regulations further raise compliance costs. Ensuring product authenticity and quality remains a key challenge, impacting profits and growth.

Wire and Cable Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Simplified cable management for 500 temperature controllers using Panduit’s Cable Entry System for efficient, organized cable transition and environmental protection | Saved enclosure space and installation time, maintained IP66/NEMA 4X protection |

|

Improved cable management by deploying Ratchet P-Clamps for fast, reliable, and tool-free installation of secure cable runs across varying environments | Reduced labor time by 75%, enhanced cable reliability and consistency, supported compliance and efficient project execution |

|

Affordable Wire Management (AWM) optimized cable routing and reduced costs through proprietary ampacity optimization, allowing smaller cables to be strategically placed to improve design, reduce materials, and drive cost savings in the Hickory Solar Park | Lower project design costs, improved cable placement accuracy, and overall cost savings |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map provides a quick snapshot of the key stakeholders involved in the wire and cable management market, from wire and cable management manufacturers, component providers, distributors, and end users. This list is not exhaustive and is meant to give an idea of the key market players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wire and Cable Management Market, By End User

The highest CAGR of the wire and cable management market is likely to be experienced by the industrial segment of the market, owing to the soaring industrialization and automation witnessed in the manufacturing, energy, and infrastructure sectors. Advanced cable management systems, which allow efficient and reliable distribution of power and data connections, are of growing demand due to increasing growth in smart factories, electrification projects, and expanding implementation of the Industry 4.0 technologies. Also, the increasing trend in using renewable power sources, along with the growing industrial power infrastructures, calls upon advanced cable systems to produce power safely, scale to fit industrial demands, and simultaneously provide efficient operations. All these contribute to improving market growth in this segment.

Wire and Cable Management Market, By Cable Type

The communication wires & cables segment is set to expand as the demand for civilized, secure, and efficient cable management systems increases in residential, commercial, and industrial markets. The surge is driven by the rapid proliferation of digital infrastructure, including 5G networks, smart cities, and data centers, which require advanced communication cables to support high-bandwidth applications. These systems protect cables from physical damage, environmental conditions, and fire hazards, ensuring compliance with stringent safety and performance standards. The increasing adoption of IoT devices and the expansion of telecommunications networks further underscore the need for structured cable management, fostering innovation in durable, high-performance products that enhance connectivity and longevity.

Wire and Cable Management Market, By Material

The quickest expanding section of material within wire and cable management is non-metallic. The non-metallic segment in cable management is rapidly growing due to its affordability, resistance to corrosion, and suitability for telecom, underground, and eco-friendly applications, making it a strong substitute for metal alternatives. With a rising focus on sustainability, there is an increasing demand for recyclable materials such as PVC and HDPE. These materials help lower installation and production expenses, making them attractive for large-scale and urban projects. Their resistance to rust and chemicals ensures reliability in demanding environments like coastal or underground areas. This segment is anticipated to maintain steady growth, supported by a global movement toward sustainable, economical solutions and ongoing advances in hybrid materials and safety features, which mitigate previous drawbacks and reinforce its importance in telecom and green infrastructure initiatives.

Wire and Cable Management Market, By Product

The faster-growing product segment is conduits & trunking. Conduits and trunking are vital solutions for protecting, organizing, and managing electrical cabling in residential, commercial, and industrial settings. They come in both rigid and flexible versions, made from metal, PVC, fiber, and clay, delivering strong defense against physical damage, moisture, and chemicals. Trunking typically features modular enclosures with removable covers, simplifying installation, allowing for easy cable separation, and enabling future adjustments. With its lightweight nature, plastic trunking suits indoor environments such as offices and residences, while steel variants offer greater durability in industrial use. These products help ensure workplace safety by managing cables across different installations and play an important role in meeting ever-stricter electrical safety regulations. Rising construction activity and the need to upgrade existing wiring systems and regulatory requirements are key factors driving growth in this segment.

Wire and Cable Management Market, By Installation

The submarine segment is the fastest-growing installation category in the Wire and Cable Management market. The submarine installation category is experiencing the fastest growth in the wire and cable management market due to the surging need for robust global telecommunications networks and the rapid expansion of offshore renewable energy infrastructure. Submarine cables are essential for transmitting vast amounts of internet traffic across continents and play a key role in connecting renewable offshore energy projects, such as wind farms, to onshore grids. High-profile investments, like large contracts for Dutch offshore wind initiatives and the completion of major cross-sea cable systems, are accelerating demand for advanced submarine cable solutions. Furthermore, the proliferation of 5G, cloud services, and increased data transfer requirements has intensified the demand for high-capacity, low-latency cabling under the sea. Ongoing technological innovations in optical repeaters and HVDC cables enable longer distances and greater data efficiency, further propelling this segment’s growth. Additionally, the challenging nature of subsea environments drives continuous investment in research and development, ensuring that submarine cable management remains the industry’s fastest-developing installation area.

REGION

Asia Pacific to be the fastest-growing region in the global Wire and Cable Management market during the forecast period

The Asia Pacific region is currently the fastest-growing in the wire and cable management market, driven by large infrastructure investments, rapid digitalization, and strong industrial growth in countries like China, India, and Japan. China leads with major projects in telecommunications, green energy, electric vehicles, and eco-friendly urban development, all supported by significant government incentives and a push for Industry 4.0 adoption. This creates steady demand for innovative, sustainable cable management solutions. Meanwhile, India's market is growing quickly due to increased investment in power and transit infrastructure, digital rollouts, and major government initiatives such as the Smart Cities Mission and Power for All. Faster internet deployment, expanded electrification into rural areas, and substantial real estate development make the Asia Pacific the most dynamic and rapidly expanding region for advanced wire and cable management solutions today.

Wire and Cable Management Market: COMPANY EVALUATION MATRIX

Eaton (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across end users. HellermanTyton (Emerging Leader) is gaining traction with a higher product coverage among multiple end users. While Eaton dominates with scale, HellermanTyton shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Eaton (Ireland)

- Atkore (US)

- nVent (US)

- Legrand (France)

- ABB (Switzerland)

- Panduit Corp. (US)

- Beden Inc. (US)

- Schneider Electric (France)

- Hubbell (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 24.49 Billion |

| Market Forecast in 2030 (Value) | USD 39.55 Billion |

| Growth Rate | CAGR 8.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product: Conduits & Trunking, Cable Trays & Ladders, Cable Raceways, Glands & Connectors, Boxes & Covers, Wiring Ducts, Ties, Fasteners, & Clips, Other Products By Cable Type: Power Cables, Communication Wires & Cables By Material: Metallic, Non-Metallic By Installation: Overhead, Underground, Submarine By End User: Residential, Commercial, Industrial |

| Regions Covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Wire and Cable Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of customers with segmentation by end user & cable type Benchmarking of adoption rates across utilities, industrial, and commercial. Analysis of barriers for customers | Insights on revenue shifts towards emerging end users Pinpoint cross-industry substitution risks and opportunities Enable targeting of high-margin products |

RECENT DEVELOPMENTS

- March 2025 : ABB (Switzerland) completed the acquisition of Siemens’ Wiring Accessories business in China, enhancing its smart building portfolio and expanding market reach. Generating over USD 150 million in 2024 revenue, the business brings a broad product range—including wiring accessories, smart home systems, and door locks—plus distribution across 230 cities and 350 skilled employees.

- December 2024 : ABB (Switzerland) acquired Solutions Industry & Building (SIB) in 2024, expanding its premium cable protection and electrification solutions portfolio. This acquisition strengthens ABB's presence in specialized markets like rail, industrial, and hazardous environments with advanced cable gland and protection products.

- November 2024 : Legrand (France) UK & Ireland expanded its Cablofil range with the launch of Cablobend, a flexible and configurable solution that improves the steel wire cable tray installation process.

- August 2023 : Eaton (Ireland) expanded their B-line series KwikSplice cable channel to include solid bottom, slotted tray, and pass-through tray.

- April 2023 : TE Connectivity (Ireland) launched an EVSW, a flame-retardant tubing that enables fast identification. It is designed to work with the cable and component sizes used in electric vehicles' power trains. It is made from a modified Polyolefin material, which means it is semi-flexible and easy to install using already available tooling.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the wire and cable management market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary ReseThis research study on the wire and cable management market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect useful information for a technical, market-oriented, and commercial study of the global wire and cable management market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

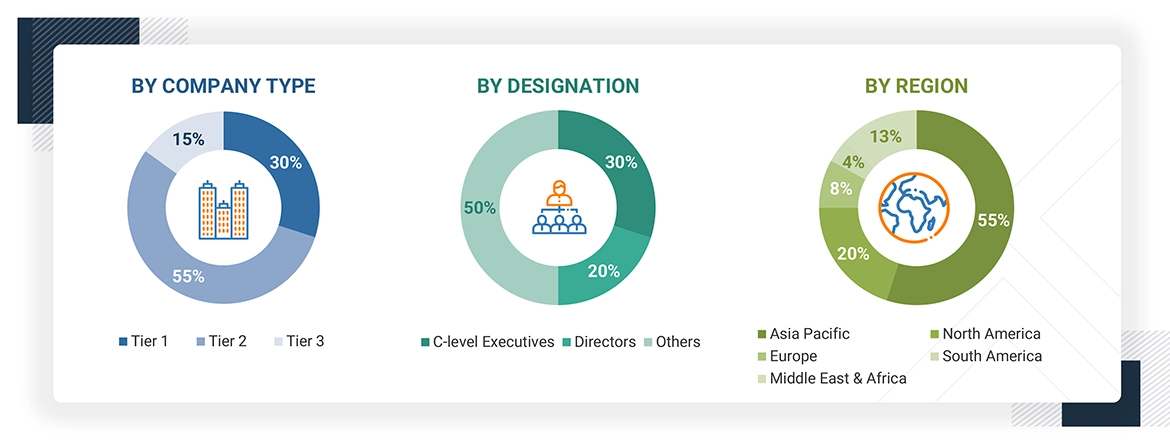

The wire and cable management market comprises stakeholders such as wire and cable management product manufacturers, technology providers, and support providers in the supply chain. The demand side of this market is characterized by the rising demand for energy-efficient systems in countries due to increasing needs for sustainability, reduced carbon emissions, and cost-effective power generation. The supply side is characterized by rising demand for contracts from industrial users and utilities, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier

2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the wire and cable management market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the wire and cable management market.

Wire and Cable Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Wire and cable management products are components, systems, and accessories designed to organize, route, support, protect, and secure electrical wires and communication cables in residential, commercial, and industrial applications. These solutions include cable ties, clips, clamps, raceways, conduits, ducts, glands, trays, and related accessories that ensure safe installation, efficient routing, reduced clutter, protection against mechanical stress, and compliance with electrical and safety standards.

Stakeholders

- Government and Research Organizations

- Institutional Investors and Investment Banks

- Investors/Shareholders

- Environmental Research Institutes

- Raw Material and Component Manufacturers

- Cable Manufacturers, Dealers, and Suppliers

- Petroleum Companies (Diesel and Natural Gas Suppliers)

- Power Grid Infrastructure Companies

- Power Plant Project Developers

- Renewable Energy Companies

- Manufacturers Associations

- Process Industries and Power Industry Associations

- Refinery Operators

- Manufacturing Industry Players

- Energy Efficiency Consultancies

Report Objectives

- To describe and forecast the wire and cable management market based on product, cable type, material, installation and end user, and region in terms of value

- To assess the wire and cable management market based on region in terms of volume

- To evaluate the wire and cable management market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To offer a detailed overview of the wire and cable management value chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations and codes, pricing analysis, Porter’s five forces analysis, impact of AI, and US Tariff impact.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To understand opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the market’s competitive landscape

- To analyze growth strategies adopted by market players, such as joint ventures, acquisitions, and product launches, in the wire and cable management market

Micromarkets1 are defined as the segments and subsegments of the wire and cable management market included in the report.

Core competencies2 of companies are captured in terms of their key developments and product portfolios, as well as the key strategies adopted by them to sustain their position in the wire and cable management market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the wire and cable management products, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the wire and cable management market size in 2024?

The wire and cable management market size was USD 24.49 billion in 2024.

What are the major drivers for the wire and cable management market?

The wire and cable management market is mainly driven by strategic investments in power grid modernization, accelerating infrastructure, and increased housing construction and renovation.

Which region is projected to be the fastest-growing wire and cable management market during the forecast period?

Asia Pacific is expected to be the fastest-growing market during the forecast period due to rapid industrialization, infrastructure development, and digitalization across various sectors.

Which will be the largest segment, by cable type, in the wire and cable management market during the forecast period?

The power cables segment is expected to hold the dominant share of the wire and cable management market, which can be attributed to the increasing need for a reliable power supply in data centers, smart cities, and industrial automation.

Which segment is projected to be the largest end user in the wire and cable management market during the forecast period?

The industrial segment is estimated to account for the largest market share during the forecast period, owing to the extensive reliance on robust, efficient, and safe cable management solutions to support complex manufacturing processes and automation technologies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wire and Cable Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wire and Cable Management Market