Bare Metal Cloud Market Size, Share, Growth, Latest Trends

Bare Metal Cloud Market by Service Model (Bare Metal Servers, Instances, Managed Services), Application (HPC, AI/ML & Data Analytics, Gaming & Media, General-purpose Infrastructure), Deployment Type (Public, Private, Hybrid) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The bare metal cloud market is projected to reach USD 36.71 billion by 2030 from USD 14.32 billion in 2025, at a CAGR of 20.7% from 2025 to 2030. The growth of the bare metal cloud market is driven by the rising demand for advanced analytics that deliver superior performance, efficiency, and sustainability in AI workloads.

KEY TAKEAWAYS

- Asia Pacific is expected to grow the fastest, at a CAGR of 26.5%, driven by rapid digital transformation and large-scale adoption of bare metal cloud services in countries such as China, Japan, and India.

- By service model, bare metal instances will account for the fastest growth rate achieving a CAGR of 26.0%.

- AI/ML and data analytics dominate growth and are driven by real-time analytics, data lakes, and scientific simulations. Gaming, media, and AR/VR drive the adoption of low-latency bare metal for immersive digital experiences.

- Public bare metal is growing among cloud-native firms seeking scalability with hardware-level control and is expected to achieve the largest market share in the bare metal cloud market.

- SMEs accelerate BMaaS adoption for digital transformation without upfront CapEx burdens and are expected to grow the fastest with a CAGR of 27.7% during the forecast period.

- Software & IT services hold the largest share, driven by cloud-native adoption, AI/ML integration, and demand for scalable, high-performance infrastructure. Healthcare & life sciences record the highest CAGR, driven by genomics, imaging, precision medicine, and increasing use of AI in diagnostics and drug discovery.

- CloudaOne Digital, Openmetal.io, and Oman Data Park have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

The bare metal cloud market is projected to reach USD 36.71 billion by 2030 from USD 14.32 billion in 2025, at a CAGR of 20.7%. The global bare metal cloud market is experiencing rapid growth, driven by demand for performance-intensive workloads, customizable compute configurations, and enhanced security for regulated industries. Direct hardware access supports AI, HPC, and machine learning, while isolated infrastructure ensures compliance. Government initiatives and data sovereignty regulations reinforce bare metal as a foundation for high-performance, localized cloud deployments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the major trends and disruptions influencing customer businesses, focusing on how revenue models are shifting toward emerging technologies and new use cases. It emphasizes the changing priorities of key client segments such as digital native platforms, gaming and esports, and healthcare and life sciences, and connects their strategic imperatives to measurable client outcomes such as efficiency, security, compliance, and enhanced customer experience.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI workloads increasing the demand for low-latency compute

-

Demand for customizable compute configurations

Level

-

Limited automation versus virtualized cloud services

-

Cost of implementation of bare metal cloud

Level

-

Expansion of GPU-backed bare metal offerings

-

Growing adoption of edge computing infrastructure for real-time data processing

Level

-

Inability to scale infrastructure instantly under variable load

-

Lack of isolation in multi-tenant environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: AI workloads are increasing the demand for low-latency compute

The rising demand for AI workloads requiring ultra-low latency is accelerating bare metal cloud adoption. Enterprises deploy specialized hardware directly on bare metal to maximize efficiency and eliminate bottlenecks. Recent moves by IBM and Equinix highlight a shift toward GPU-optimized bare metal instances, enabling deterministic performance for large-scale AI training and inference.

Restraint: Limited automation versus virtualized cloud services

Limited scalability continues to restrain the bare metal cloud market. Unlike virtualized platforms that enable instant auto-scaling, bare metal often requires manual provisioning and reconfiguration, slowing deployment and reducing agility. Documentation from Oracle and Rackspace highlights the added complexity, with the absence of seamless automation limiting workload flexibility, CI/CD integration, and cloud-native adoption.

Opportunity: Expansion of GPU-backed bare metal offerings

Expansion of GPU-backed bare metal offerings presents a major opportunity for vendors and providers in the bare metal cloud market. Rising demand for AI training, inference, and data-heavy simulations drives the adoption of GPU-integrated nodes, offering raw performance and hardware-level control. Enterprises increasingly seek turnkey, accelerated bare metal platforms tailored for sector-specific AI workloads and verticalized solutions.

Challenge: Inability to scale infrastructure instantly under variable load

The inability to scale bare metal infrastructure instantly under variable loads limits adoption in latency-sensitive environments. Unlike virtualized clouds, physical provisioning causes delays. Over 50% of suppliers cited inaccurate capacity forecasting as a key challenge. Vendors can address this through automation frameworks, orchestration tools, and hybrid integrations to enhance responsiveness, mobility, and SLA compliance.

Bare Metal Cloud Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Straker Translation leverages IBM Cloud to power scalable online translation services | Reduced operational cost to 1/3 compared to VPC infrastructure, secure workload segregation with dedicated bare metal environments |

|

Altair enhances HPC and simulation workloads with Oracle bare metal cloud infrastructure | Deployed bare metal HPC environments under 1 hour versus 8-12 weeks on-premises, achieved up to 20% higher price-performance for CFD & structural simulation solvers |

|

Cycle.io simplifies hybrid cloud management with Vultr bare metal cloud | High-throughput deployments with 10Gbps burstable bandwidth achieved ultra-fast server response and boot times for containerized workloads |

|

Nitarado expands global gaming footprint with Gcore bare metal infrastructure in Japan & Brazil | Delivered consistent low-latency gameplay through optimized hardware and direct network routes, strengthened Nitarado’s global presence and ability to support 130+ games across five countries |

|

FossHub scales global software delivery with pheonixNAP’s bare metal cloud infrastructure | Achieved over 500 million software downloads with zero critical downtime, improved infrastructure stability with 24/7 platform availability worldwide |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The bare metal cloud ecosystem covers hardware, connectivity, storage, and automation providers. Companies such as HPE, Dell, and Cisco supply servers, while AT&T, Verizon, and NTT ensure low-latency networking. Storage solutions from Pure Storage and Veeam support data resilience, and automation tools such as Terraform and Kubernetes streamline deployment, enabling secure, high-performance infrastructure for compute-intensive, mission-critical enterprise workloads.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Bare Metal Cloud Market, By Service Model

Bare metal instances will account for the largest market share during the forecast period. Bare metal instances are driving opportunities in the bare metal cloud market by providing single-tenant, non-virtualized compute resources with hardware-level control. Providers such as AWS, Oracle, and IBM are expanding GPU- and memory-optimized instances for AI, analytics, gaming, and high-frequency trading. Dedicated hardware ensures predictable performance, low latency, and compliance, enabling vendors to deliver scalable, hybrid-ready, enterprise-grade solutions.

Bare Metal Cloud Market, By Deployment Type

Public bare metal will register the largest market share during the forecast period. Public bare metal cloud presents a significant opportunity for emerging vendors and solution providers to capture market share by delivering single-tenant physical servers with high-performance compute, automation, and scalability. By designing offerings that merge bare metal’s raw power with cloud agility, they can provide predictable performance, rapid deployment, flexible scaling, and simplified operations for compute-intensive workloads.

Bare Metal Cloud Market, By Application

AI/ML & data analytics is expected to hold the largest market share during the forecast period. AI/ML and data analytics present a high-impact opportunity for emerging bare metal cloud vendors and solution providers. Dedicated infrastructure enables high-performance, low-latency execution of large-scale models and real-time analytics. By offering GPU-optimized, turnkey solutions such as Oracle Bare Metal GPU instances or HPE’s AI platforms, new entrants can capture enterprise demand across healthcare, BFSI, retail, and other data-intensive industries.

Bare Metal Cloud Market, By Vertical

Software and IT services will hold the largest market share during the forecast period. The software and IT Services sector offers significant opportunities for emerging vendors and solution providers to deliver high-performance, secure, and dedicated bare metal infrastructure. By building tailored solutions for SaaS, IT services, and cybersecurity firms, providers can enable low-latency, scalable, and compliant environments that support data-intensive workloads and real-time service delivery.

REGION

Asia Pacific to be the fastest-growing region in the global bare metal cloud market during forecast period

Asia Pacific is expected to register the highest CAGR during the bare metal cloud market forecast period. Asia Pacific is emerging as a key growth region for bare metal cloud, driven by accelerated AI adoption, government-backed digitalization, and investments in high-performance computing. Rising demand for low-latency, hardware-optimized infrastructure in countries like Japan, Singapore, India, and South Korea highlights opportunities for vendors to deliver scalable, secure, and high-performance bare metal solutions.

Bare Metal Cloud Market: COMPANY EVALUATION MATRIX

In the bare metal cloud market matrix, Oracle (Star) leads with a strong market presence and comprehensive portfolio, driving large-scale adoption across industries such as AI, analytics, and gaming. OVHcloud (Emerging Leader) is gaining traction with scalable, GPU-optimized bare metal solutions for data-intensive workloads. While Oracle dominates with scale and enterprise reach, Alibaba Cloud shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | 11.55 Billion |

| Market Forecast in 2030 (value) | 36.71 Billion |

| Growth Rate | 20.70% |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Bare Metal Cloud Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- June 2025 : Oracle and AMD expanded their collaboration to bring AMD Instinct MI355X GPUs to Oracle Cloud Infrastructure (OCI). OCI will deploy zettascale AI superclusters with up to 131,072 MI355X GPUs to support large-scale AI training and inference workloads. The offering leverages OCI's bare-metal GPU architecture for enhanced performance, memory bandwidth, and compute efficiency.

- May 2025 : Alibaba Cloud partnered strategically with LuLu Financial Holdings and Ant Digital Technologies in the UAE to accelerate financial innovation through AI-powered cloud solutions. The collaboration leverages Alibaba Cloud’s infrastructure, including Elastic Compute Service (ECS), Disaster Recovery as a Service, PolarDB, and EMAS, enabling LuLuFin’s multi-cloud strategy, disaster recovery, and AI-driven services while developing Treasury AI using Alibaba’s Qwen model.

- April 2025 : Oracle and Google Cloud expanded their collaboration to offer OCI Exadata X11M bare metal infrastructure and serverless Autonomous Database in Google Cloud regions. The update added features such as cross-region disaster recovery, customer-managed encryption keys (CMEK), and extended availability of bare metal Oracle systems for latency-sensitive workloads.

- March 2025 : Fresche Solutions partnered with IBM to deliver managed services for IBM Power Virtual Server (PowerVS). The collaboration enables global businesses to migrate mission-critical IBM i workloads to IBM Cloud with enhanced security, high availability, disaster recovery, hybrid cloud integration, and 24/7/365 specialist support for operational efficiency and modernization.

- March 2025 : Lumen delivered Edge Bare Metal infrastructure and supporting services to improve ultra-low-latency voice workflows and compliance for Donor Network West. The deployment combined geo-diverse bare metal compute with storage and voice services to reduce call dropouts, enhance routing control, and stabilize always-on and on-demand recording for time-critical donor operations.

- December 2024 : poolside entered a strategic partnership with AWS to deploy its generative AI foundation models on EC2 bare metal instances. The collaboration enables enterprise users to run poolside’s software engineering assistant with AWS Trainium-powered EC2 infrastructure, ensuring performance, data privacy, and secure custom model training within existing AWS environments.

Table of Contents

Methodology

This research study on the bare metal cloud market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred bare metal cloud service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the bare metal cloud spending of various countries was extracted from the respective sources.

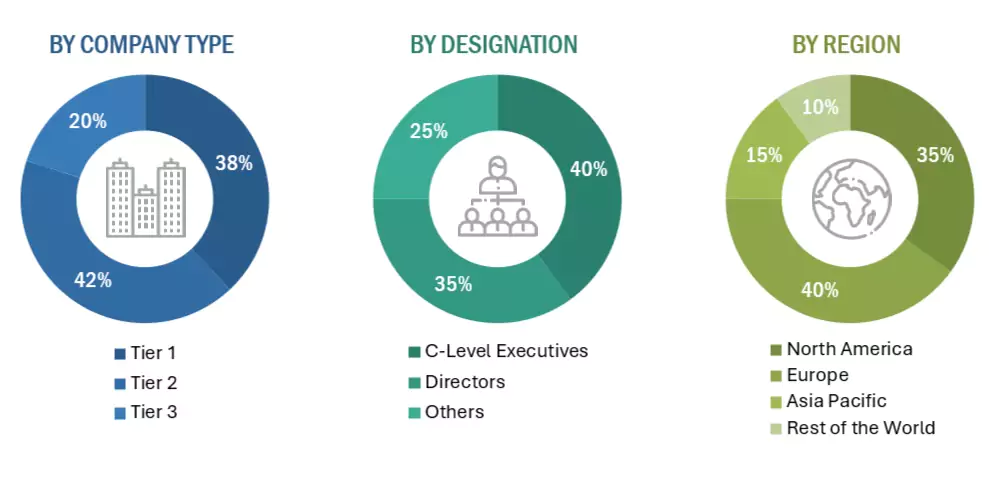

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and bare metal cloud service providers. It also included key executives from bare metal cloud vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million

and USD 1 billion. Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

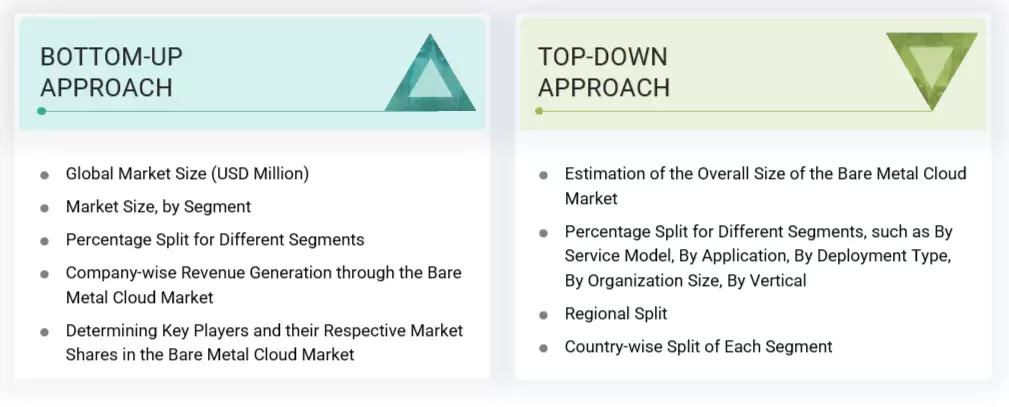

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the bare metal cloud market. The first approach involved estimating the market size by companies’ revenue generated through the sale of bare metal cloud services.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the bare metal cloud market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach identified the adoption rate of the bare metal cloud services among different verticals in key countries, considering their regions contributing the most to the market share. For cross-validation, we analyzed the adoption of bare metal cloud services among enterprises and other use cases in various regions. The identified use cases in different areas were evaluated to calculate the market size.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the bare metal cloud market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major bare metal cloud service providers, and organic and inorganic business development activities of regional and global players were estimated.

Bare Metal Cloud Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines bare metal cloud as “a subset of Infrastructure-as-a-Service (IaaS) that delivers dedicated, physical servers on demand through a cloud-like model. Unlike virtualized cloud instances, it gives users direct access to hardware with full control over the operating system and applications, while still offering the scalability, flexibility, and pay-as-you-go benefits of the cloud. It is commonly used for performance-intensive and compliance-sensitive workloads such as AI/ML, databases, gaming, and analytics.”

Stakeholders

- Technology service providers

- Bare metal cloud vendors

- Colocation providers

- Government organizations

- Networking companies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information technology (IT) infrastructure providers

- System integrators (SIs)

- Regional associations

- Independent software vendors (ISVs)

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the bare metal cloud market based on service model, application, deployment type, organization size, vertical, and region

- To forecast the market size for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American bare metal cloud market

- Further breakup of the European bare metal cloud market

- Further breakup of the Asia Pacific bare metal cloud market

- Further breakup of the Middle East & Africa bare metal cloud market

- Further breakup of the Latin American bare metal cloud market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

How can one reduce latency for real-time AI and machine learning workloads?

By directly connecting to GPUs and high-performance CPUs, bare metal cloud services eliminate the “noisy neighbor” effect and virtualization overhead common in shared environments. This delivers the raw, unvirtualized performance necessary for real-time AI inference, model training, and data processing at the edge.

What is the best cloud solution for mission-critical databases and financial trading platforms?

For applications requiring deterministic performance and the highest levels of security, bare metal cloud is the superior choice. Its single-tenant architecture ensures data isolation and physical hardware separation, which is crucial for meeting SOX, HIPAA, and GDPR compliance standards and protecting sensitive financial or customer data.

How to choose between a virtualized cloud instance and a bare metal server?

Choose a bare metal server when the application demands predictable, high-IO performance and direct access to underlying hardware for specialized workloads (e.g., high-performance computing and large language model training). Opt for a virtualized cloud instance for less intensive, burstable, or variable workloads where rapid provisioning and flexible scalability are the top priorities.

Can bare metal cloud reduce cloud computing costs in the long run?

Bone metal can be more cost-effective than virtualized services for consistent, high-intensity workloads. While per-hour pricing may seem higher, the improved performance often allows to complete jobs faster and use fewer resources over time. This translates to a predictable, lower total cost of ownership (TCO) for sustained projects.

What are the key differences between managing a bare metal cloud and a virtual machine?

Bare metal gives complete control over the operating system, hypervisor, and application stack, but requires more hands-on management. Unlike virtual machines, bare metal provisioning can take longer (hours instead of minutes), and scaling may require more planning. However, this level of control is essential for specialized configurations and software licensing optimization.

How does bare metal cloud improve data security and compliance for business?

The single-tenant model of bare metal inherently provides a higher level of security by removing the shared infrastructure risks of multi-tenant environments. This physical separation is often a requirement for regulatory compliance in industries like finance, healthcare, and government, making it a secure foundation for sensitive data.

What are the key trends in bare metal cloud for 2025 and beyond?

Key trends include a shift toward GPU-optimized bare metal instances, the integration of bare metal with hybrid and multi-cloud strategies, and the emergence of “neoclouds” specializing in bare metal for specific high-performance use cases. The ever-increasing demand for specialized, high-performance computing drives these trends.

What role does bare metal cloud play in the future of generative AI and edge computing?

Bare metal is becoming the infrastructure of choice for GenAI and Edge due to these technologies' immense compute and low-latency demands. It provides the dedicated GPU access needed for training large language models and the predictable performance required for real-time inference at the network’s edge.

How are bare metal cloud vendors addressing the limited automation challenge?

Leading bare metal providers are rapidly developing new API-driven automation frameworks and developer tools to bridge the gap with virtualized cloud services. This allows for faster provisioning, automated scaling, and seamless integration into modern DevOps workflows, making bare metal more agile and easier to manage than ever before.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Bare Metal Cloud Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Bare Metal Cloud Market