Circuit Breaker Market Size, Share, Growth, Analysis

Circuit Breaker Market By Insulation Type (Vacuum, Air, Gas, Oil), Voltage (Low, Medium, High), Installation (Indoor, Outdoor), End User (T&D Utilities, Industrial, Commercial & Residential, Renewables, Railways, Other End Users), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global circuit breaker market is projected to reach USD 30.32 billion by 2030 from USD 22.70 billion in 2025, registering a CAGR of 6.0%. The circuit breaker market is experiencing steady growth, driven by the rising need for safe, reliable, and efficient power distribution across residential, commercial, industrial, and utilities sectors. Rapid urbanization, expansion of transmission and distribution networks, and the increasing integration of renewable energy sources are accelerating the demand for advanced protection devices. Government initiatives focused on grid modernization, electrification, and infrastructure development are further supporting market expansion. Technological advancements in arc-flash mitigation, digital monitoring, remote diagnostics, and eco-efficient insulation gases are enhancing system safety and operational reliability. Additionally, collaborations among OEMs, utilities, EPC contractors, and smart-grid solution providers are enabling large-scale deployments of modern circuit breakers across substations, data centers, industries, and emerging renewable installation projects.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to register the highest CAGR of 6.6% during the forecast period.

-

BY INSTALLATIONBy installation, the indoor segment dominated the market with a share of 57.8% in 2024.

-

BY VOLTAGEBy Voltage, Low-voltage segment captured the largest market share of 66.7% in 2024.

-

BY INSULATION TYPEAir-insulated circuit breakers are expected to record the highest CAGR, driven by their increasing adoption in commercial buildings, industrial facilities, and data centers. Their advantages, including easy maintenance, strong arc-quenching performance, and suitability for low-voltage distribution systems, are driving demand.

-

BY END USERBy end user, the T&D utilities segment is expected to dominate the market, driven by demand for distributed and reliable power generation.

-

COMPETITIVE LANDSCAPEABB, Eaton, Siemens, Schneider Electric, and Mitsubishi Electric Corporation has been identified as Stars in the circuit breaker market due to its technological innovation, strong global footprint, and large-scale deployment of circuit breakers.

-

COMPETITIVE LANDSCAPEAISO Electric and Efacec have emerged as notable startups, leveraging advanced material innovations and compact system designs to strengthen their presence in small and distributed energy applications.

The circuit breaker market is driven by the rising demand for stable and high-quality power across industrial, commercial, and residential sectors. Growing industrial automation, renewable energy integration, and data center expansion are key growth drivers. Governments and industries are focusing on improving power reliability and efficiency, further boosting the adoption of advanced circuit breakers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The consumers’ business is impacted by evolving customer requirements and technological advancements. End users such as utilities, industrial plants, data centers, commercial buildings, and infrastructure operators form the primary client base for circuit breaker manufacturers. Shifts in power demand, the expansion of renewable energy integration, and the need for enhanced grid reliability are key factors influencing this market. These trends directly affect the revenues of end users, as advanced circuit protection minimizes equipment failures, operational downtime, and safety risks. As a result, the growing demand for high-performance, digitally enabled circuit breakers drives revenue opportunities for OEMs, system integrators, and solution providers (hotbeds), ultimately contributing to the overall market growth of circuit breaker manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investment in the grid and rising electricity demand

-

Electrification of transportion sector marked by the rise of electric vehicles (EVs), along with advancements in railways and industrial processes

Level

-

Strict environmental and safety standards for SF6 circuit breakers

-

Availability of low-cost products offered by local players in unorganized sector

Level

-

Growing adoption of smart grid technologies for power protection and control

-

Urgent need to upgrade aging grid infrastructure and develop reliable transmission and distribution (T&D) networks

Level

-

Cybersecurity risks associated with modern circuit breakers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing investments in grids and rising electricity demand

Global electricity demand is entering one of its strongest multi-year growth phases, and this shift is directly expanding the addressable market for circuit breakers across transmission, distribution, industrial, and data center applications. According to the IEA, global electricity consumption rose by 4.3% in 2024 and is projected to continue rising at nearly 4% annually through 2027, adding an unprecedented 3,500 TWh over the period. This surge is being fueled by higher industrial activity, the rapid electrification of transport and heating, the widespread adoption of air conditioning in emerging markets, and the accelerated expansion of hyperscale data centers. Emerging economies will generate 85% of the additional electricity demand to 2027, while electrification in China is advancing even faster, with electricity already representing 28% of its final energy consumption—significantly higher than the United States (22%) and the European Union (21%). China’s data center load alone is expected to potentially double by 2027, intensifying the need for modern substation equipment and reliable MV/HV protection systems.

Restraint: Stringent environmental and safety regulations for SF6 circuit breakers

According to the Kyoto Protocol, SF6 is one of the most potent greenhouse gases (GHGs), with a global warming potential (GWP) of 23,000. The Intergovernmental Panel on Climate Change (IPCC) has listed it as a highly harmful GHG. Accordingly, the Kyoto Protocol stipulates the reduction of emissions. Currently, no nearest alternative could work as efficiently as SF6. Thus, high procurement costs and policies against SF6 are expected to hamper growth. Imperfect joints in the manufacturing of SF6 circuit breakers lead to the leakage of the SF6 gas, which is a choking gas to some extent. At the time of leakage in the breaker tank, the SF6 gas settles in the surroundings as it is heavier than air, and this gas precipitation may lead to the suffocation of the operating personnel. The arced form of the SF6 gas is poisonous and can be harmful if inhaled. The US Environmental Protection Agency (EPA) has taken measures to find a solution to detect the leakage of the SF6 gas in the breaker tank of SF6 circuit breakers, as the leakage is destructive when an arc is formed.

Opportunity: Growing adoption of smart grid technologies to protect and control power equipment

A smart grid is a digital technology that modernizes electricity networks by providing 2-way communication between the utility and its customers. Global power utilities are increasingly investing in smart grid technologies to control and protect their power equipment. At the end-user level, smart grids can enable demand flexibility and consumer participation in energy system operations through distributed generation and storage. The expansion of the IoT has fostered the development of smart technologies in fields such as power transmission and distribution systems (as is the smart grid). The network communication infrastructure for a smart circuit breaker system has high requirements in terms of functionality, performance, and security, given the large number of distributed connected elements and the need for real-time information transmission and system management. In addition, smart circuit breakers (SCB) can offer improved protection and “smart” detection and management of grid faults. It also focuses on enhancing the capability of communication over a network for data transmission and remote control. It also offers advantages such as automatic reconnection, high-speed disconnection, data fusion (where one device detects all events), and disconnection in the case of zero-crossing detectors, which reduces the generated perturbations.

Challenge: Cybersecurity risks associated with modern circuit breakers

Cybersecurity has become a fundamental requirement for any automation project in the power industry. The installation of modernized circuit breakers faces multiple challenges that pose a threat to a country’s economy. Smart devices aid the optimal functioning of the system, but they can also pose a security threat from anti-social elements. Cyberattacks in circuit breakers can become a major concern throughout the grid communication networks and software platforms that operate and manage the entire grid. According to the World Economic Forum, the utility and energy sectors rank the second highest in losing USD 17.2 million per company per year from cybercrime. Circuit breakers face various cyber threats, such as grid instability, data theft, or security breach, which can be done by bypassing securities on remote access, leading to blackouts and power outages. These outages result from incorrect settings in a relay or circuit breaker, which determines the device's response (or non-response). Incorrect settings may have serious effects on the power system operation. This can be avoided by developing dedicated secure networks for monitoring and controlling the devices/equipment. Developing such a network and assuring control of elements poses a challenge as well as providing opportunities for industry players to develop a secure and safe solution for data acquisition and monitoring along with new age devices.

circuit-breaker-and-fuse-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ABB supplied medium- and low-voltage power distribution solutions to the KCY Cloud Data Center in Sichuan, China, which operated as a large AI-focused hyperscale facility with a computing capacity of about 500 petaflops. The project used ABB circuit breakers and switchgear to support reliable, efficient power distribution for high-density IT loads. | The integrated breaker and switchgear solution increased power system reliability, reduced unplanned outages, and improved energy efficiency by enabling detailed monitoring and control | The data center safely supported growth in AI workloads while maintaining high availability and optimizing its PUE over time. |

|

Schneider Electric provided power distribution and digital energy management solutions for EcoDataCenter in Falun, Sweden, which operated as a high-performance colocation and HPC facility. The project used Schneider Electric’s EcoStruxure architecture and connected circuit breakers to support a low-carbon, energy-efficient, and highly available data center. | The solution helped EcoDataCenter reach very high electrical efficiency with low PUE while preserving 2N redundancy and strong reliability| Digital circuit breakers and smart panels enabled granular insight into power quality and asset health, simplified maintenance, and supported EcoDataCenter’s position as one of the most sustainable and resilient colocation providers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The circuit breakers ecosystem comprises raw material suppliers, end users , regulatory bodies, circuit breaker manufacturers, ancillary equipment manufacturers, and others involved in circuit breaker delivery. Each entity in the ecosystem affects and is affected by the others, and they compete and collaborate with each other to survive. The below-mentioned figure provides details about the entities in the circuit breaker ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Circuit Breaker Market, By Installation

In 2024, the indoor circuit breaker segment accounted for the largest market share, primarily due to the rise in new installations in commercial buildings, industrial facilities, data centers, and urban substations, where space-optimized enclosed switchgear is preferred. Indoor systems provide enhanced safety, improved protection against environmental factors such as dust, moisture, and temperature fluctuations, and require less maintenance compared to outdoor units.

Circuit Breaker Market, By Voltage

In 2024, low-voltage circuit breakers held the largest market share due to their widespread use in residential, commercial, and industrial facilities, where most electrical loads operate below one thousand volts. The increasing construction activity and rapid expansion of commercial spaces, data centers, retail outlets, and small-scale industries drive the continuous demand for low-voltage protection equipment. Additionally, these breakers are essential for panel boards, distribution boards, and control cabinets, resulting in significantly higher installation volumes compared to medium or high-voltage units.

Circuit Breaker Market, By Insulation type

In 2024, the air segment held the largest market share, as air is the most widely adopted and cost-effective insulating medium for circuit breakers in residential, commercial, and industrial applications. Air-insulated breakers feature simpler designs, lower installation and maintenance costs, and are easier to integrate into standard switchgear assemblies. Their reliability, suitability for indoor environments, and strong adoption in low- and medium-voltage systems used in buildings, manufacturing units, and infrastructure projects further drive demand.

Circuit Breaker Market, By End User

In 2024, the T&D utilities segment accounted for the largest market share. This is because utilities operate extensive transmission and distribution networks that require continuous upgrades and large quantities of circuit breakers to ensure grid reliability and fault protection. Rising electricity demand, aging grid assets, and the acceleration of renewable energy integration are prompting utilities to expand and modernize substations, deploy advanced switchgear, and strengthen both medium- and high-voltage lines.

REGION

Asia Pacific is expected to witness the highest CAGR in global circuit breaker market during forecast period

Asia Pacific is expected to register the highest CAGR in the circuit breaker market, driven by rapid urbanization, large-scale industrialization, and expanding electricity demand across emerging economies such as China, India, Indonesia, and Vietnam. Massive investments in power generation, transmission, and distribution infrastructure along with the integration of renewable energy sources are accelerating the adoption of advanced circuit protection equipment. Government-led electrification programs, smart-grid initiatives, and rural grid expansion further strengthen market growth in the region. Additionally, Asia Pacific benefits from strong manufacturing capabilities, competitive production costs, and the presence of major domestic and global OEMs. The rise of data centers, EV charging networks, and industrial automation is creating new demand for reliable circuit-breaking solutions. With continuous infrastructure development and increasing focus on energy efficiency and electrical safety, the region is set to maintain its dominance and highest growth trajectory over the forecast period.

circuit-breaker-and-fuse-market: COMPANY EVALUATION MATRIX

ABB (Star) leads the circuit breaker market, backed by its strong portfolio spanning low-, medium-, and high-voltage technologies designed for utilities, industries, infrastructure, and renewable energy applications. The company’s advanced solutions, featuring digital monitoring, arc-flash protection, and eco-efficient insulation alternatives, enable high reliability and grid stability across diverse environments. With a strong global presence, deep engineering expertise, and continuous investment in smart and sustainable switchgear technologies, ABB maintains a dominant position and is widely recognized as a market leader. Emerson Electric Co. has been identified as an emerging leader in the circuit breaker market supported by its growing portfolio of intelligent protection solutions advanced monitoring and automation capabilities and increasing penetration across industrial process facilities data centers and utility distribution networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ABB (Switzerland)

- Eaton (Ireland)

- Siemens (Germany)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- Emerson Electric Co. (United States)

- Fuji Electric Co., Ltd. (Japan)

- Rockwell Automation (United States)

- LS ELECTRIC Co., Ltd. (South Korea)

- TOSHIBA CORPORATION (Japan)

- Powell Industries (United States)

- OG Power & Industrial Solutions Ltd. (India)

- CHINT (China)

- Tavrida Electric (United States)

- Sécheron (Switzerland)

- HD HYUNDAI ELECTRIC CO., LTD. (South Korea)

- TE Connectivity (Ireland)

- Kirloskar Electric Company (India)

- Legrand (France)

- Phoenix Contact (Germany)

- Efacec (Portugal)

- Mangal Electrical Industries Limited (India)

- AISO Electric (China)

- Sriwin Electric (India)

- Oresco (China)

- BRUSH (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 22.70 Billion |

| Market Forecast in 2030 (value) | USD 30.32 Billion |

| Growth Rate | CAGR of 6.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million)/Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: circuit-breaker-and-fuse-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America: Power Conditioning Unit Market Assessment |

|

|

RECENT DEVELOPMENTS

- September 2025 : ABB announced its plan to invest USD 110 million to expand its US manufacturing footprint, including a new production line in Senatobia, Mississippi, dedicated to the Emax 3 air circuit breaker. The investment also supports facility expansions in Richmond, Virginia, and Pinetops, North Carolina, and adds capacity in Puerto Rico, all to meet rising demand from data centers, grid infrastructure, and critical electrification markets.

- September 2025 : LS Electric secured a contract to supply power distribution equipment to a hyperscale AI data center in the US, serving a major global tech firm. The project involves delivering power distribution solutions for gas-powered generation units within a microgrid system, with phased deliveries starting in February 2026. This contract underscores LS Electric's technological credibility in the global market and its role in enhancing critical power infrastructure for large-scale AI data centers.

- August 2024 : Mitsubishi Electric Corporation signed a contract with Siemens Energy to jointly develop DC switching stations for next-generation multi-terminal HVDC systems, with a key focus on creating detailed DC circuit-breaker requirement specifications to enable stable and flexible future DC grids. This collaboration supports large-scale renewable energy integration and strengthens both companies’ positions in advancing critical HVDC protection technologies worldwide.

- July 2024 : CG Power & Industrial Solutions Ltd. announced the execution of a USD 80 million capacity expansion over the next 18 months, funded via internal accruals. The expansion will scale up production of motors, transformers, switchgears, and circuit breakers, including medium-voltage switchgear and GIS.

- July 2024 : Toshiba Energy Systems & Solutions Corporation signed a contract with TEPCO Power Grid to supply a 72 kV gas-insulated switchgear (GIS) for its Fuchu substation, using natural-origin gases instead of SF6. GIS, jointly developed with Meidensha Corporation, incorporates a vacuum circuit breaker (VCB) provided by Meidensha. Type testing is complete, and the product is being sold under Toshiba’s AEROXIA brand.

Table of Contents

Methodology

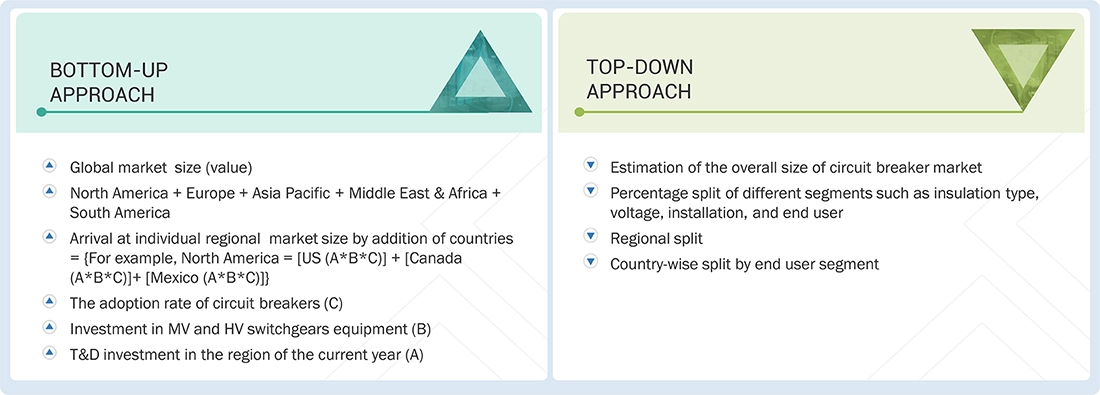

To determine the current market size for circuit breakers, several key activities were undertaken. Extensive secondary research was conducted to gather information on the market and related industries. These findings were then validated through primary research, which involved discussions with industry experts across the entire value chain. Both top-down and bottom-up approaches were employed to estimate the overall market size. Additionally, market breakdown and data triangulation techniques were utilized to calculate the market size of specific segments and subsegments.

Secondary Research

This research study utilized a wide range of secondary sources, including directories, databases, and reputable sources such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, US DOE, and IEA. These sources were instrumental in gathering valuable information for a comprehensive analysis of the global circuit breaker market from technical, market-oriented, and commercial perspectives. Additional secondary sources included annual reports, press releases, investor presentations, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

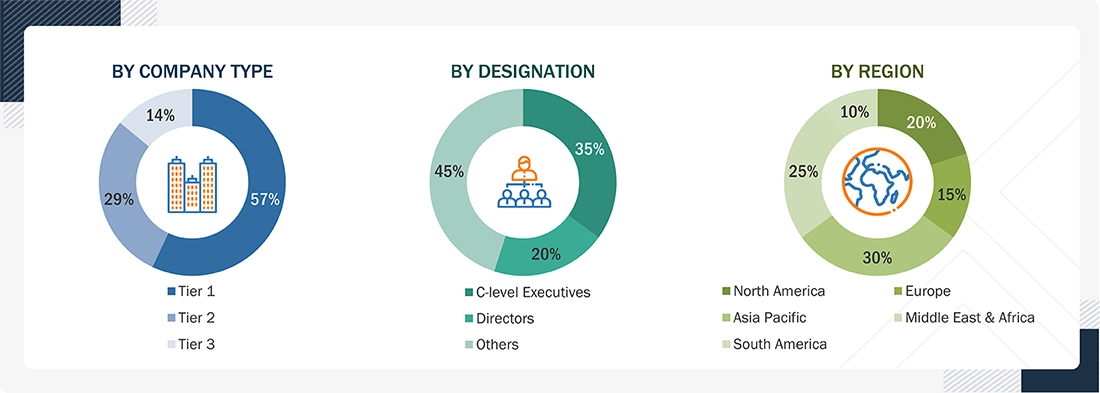

The circuit breaker market encompasses a diverse range of stakeholders, including public and private electric utilities, distribution companies, circuit breaker manufacturers, dealers, suppliers, circuit breaker component manufacturers, energy and power sector consulting firms, and other relevant entities. To understand the market dynamics, primary sources were interviewed from both the supply and demand sides. These sources provided qualitative and quantitative insights into the market. The breakdown of primary respondents is as follows—

Note: The tier of companies has been defined based on their total revenue as of 2024: Tier 1 = >USD 5 billion, Tier 2 = USD 1 billion to USD 5 billion, and Tier 3 = USD 1 billion. Others include sales managers, engineers, and regional managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been employed to estimate and validate the size of the global circuit breaker market, as well as its dependent submarkets. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Circuit Breaker Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was segmented into subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, where applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A circuit breaker is a crucial component in an electric circuit that safeguards equipment from potential damage resulting from excessive current flow, which can occur due to overload or short-circuit situations. It functions as an automated switch that can both open and close circuits. Circuit breakers can be manually operated for maintenance purposes or automatically trip to interrupt the circuit in the event of a short circuit occurrence. These devices come in two main types: AC circuit breakers, which handle alternating current, and DC circuit breakers, which are designed for direct current applications.

The circuit breaker market refers to the global market for devices designed to protect electrical circuits from excessive current flows and short circuits. Circuit breakers are automatic switches that can interrupt electrical currents when they exceed safe levels, thereby preventing damage to equipment, electrical systems, and potentially hazardous situations, such as fires. The circuit breaker market is expected to witness growth during the forecast period, driven by the expanding capacity additions and improvements in transmission and distribution (T&D) networks across key regions, including North America, South America, Europe, Asia Pacific, and the Middle East & Africa. This growth is driven by the need to meet the increasing electricity demand and maintain a reliable power supply across these regions. Investments in enhancing T&D networks will facilitate the efficient transmission and distribution of electricity, creating opportunities for the circuit breaker market to expand.

Key Stakeholders

- Government utility providers

- Independent power producers

- Circuit breaker manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Switchgear manufacturers, distributors, and suppliers

- Switchgear and circuit breaker original equipment manufacturers (OEMs)

Report Objectives

- To define, describe, circuit breaker market, based on insulation type, voltage, installation, and end user

- To provide detailed information on the major factors influencing the growth of the circuit breaker market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the circuit breaker market with respect to individual growth trends, prospects, and the contribution of each segment to the market

- To analyze market opportunities for stakeholders and the details of a competitive landscape for market leaders

- To forecast the growth of the circuit breaker market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, & Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as product launches, contracts and agreements, investments and expansions, and mergers and acquisitions, in the circuit breaker market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Circuit Breaker Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Circuit Breaker Market