Europe Food Encapsulation Market

Europe Food Encapsulation Market by Shell Material (Lipids, Polysaccharides, Emulsifiers, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

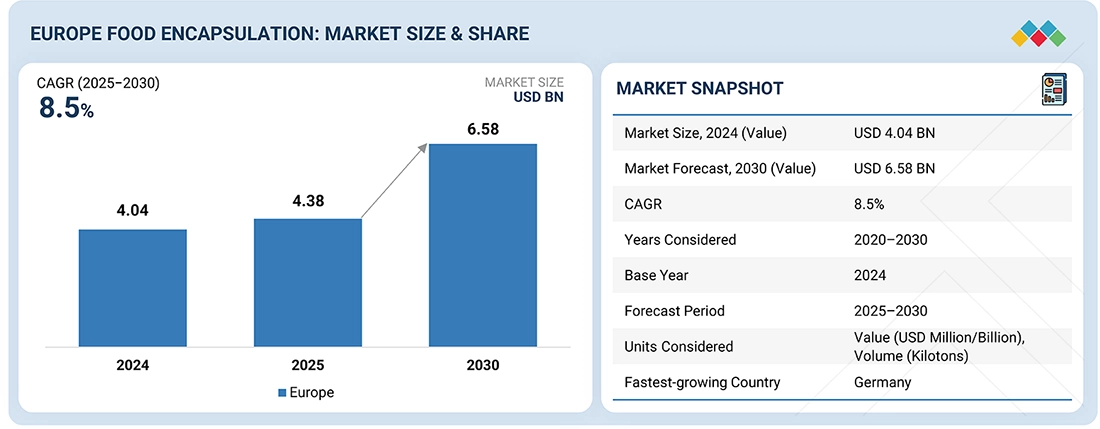

The Europe food encapsulation market is estimated to be valued at USD 4.38 billion in 2025 and is projected to reach USD 6.58 billion by 2030, growing at a CAGR of 8.5%. Due to increased use of food encapsulation to protect sensitive ingredients, the market is expanding steadily. These systems are used by manufacturers to control the release of flavors, nutrients, and active compounds as well as to increase shelf life. Functional foods, dietary supplements, drinks, baked goods, and dairy products are in high demand throughout Europe. Food manufacturers use encapsulation to lessen bitter or off-tastes and increase ingredient stability. They can also meet clean-label and product quality requirements thanks to this. The European food industry is using technologies like spray drying, emulsification, and lipid-based systems more frequently as the market for fortified and health-conscious foods grows.

KEY TAKEAWAYS

-

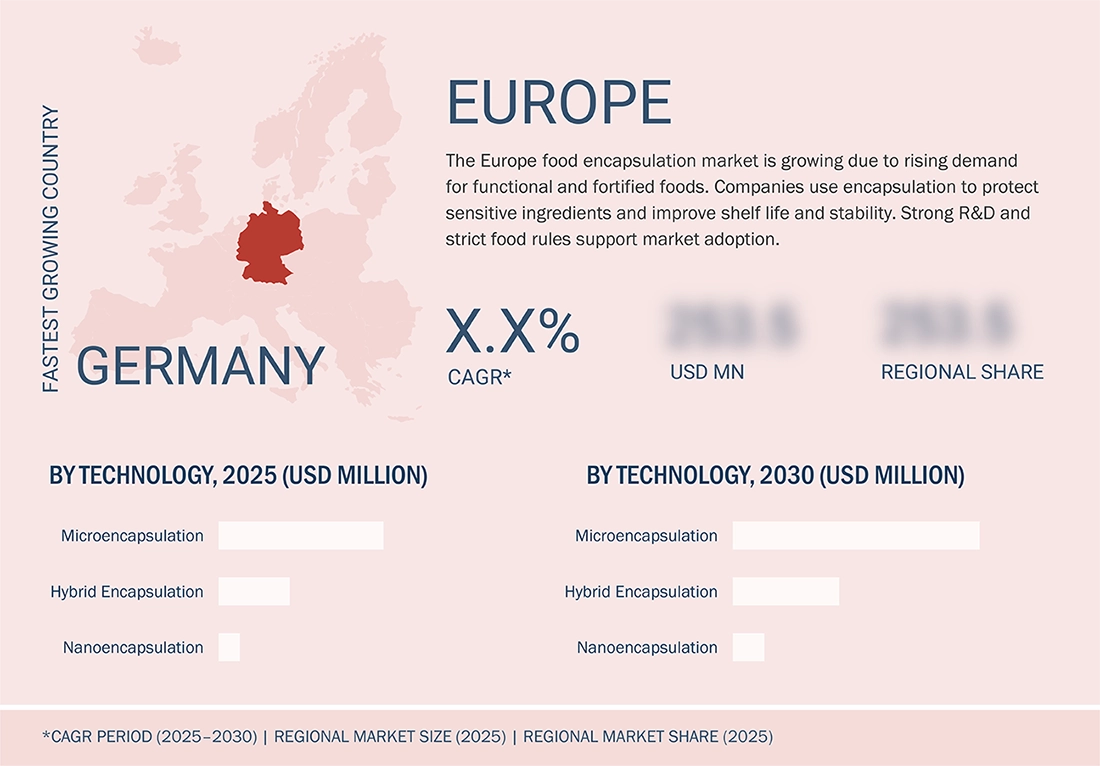

BY COUNTRYGermany led the Europe food encapsulation market, with a share of 26.56% in 2024.

-

BY CORE PHASEIn the core phase, the vitamins & minerals segment is projected to dominate the market during the forecast period.

-

BY TECHNOLOGYBy technology, the nanoencapsulation segment is estimated to register the highest CAGR during the forecast period.

-

BY SHELL MATERIALBy shell material, polysaccharides dominated the market in 2024 with 45.93%

-

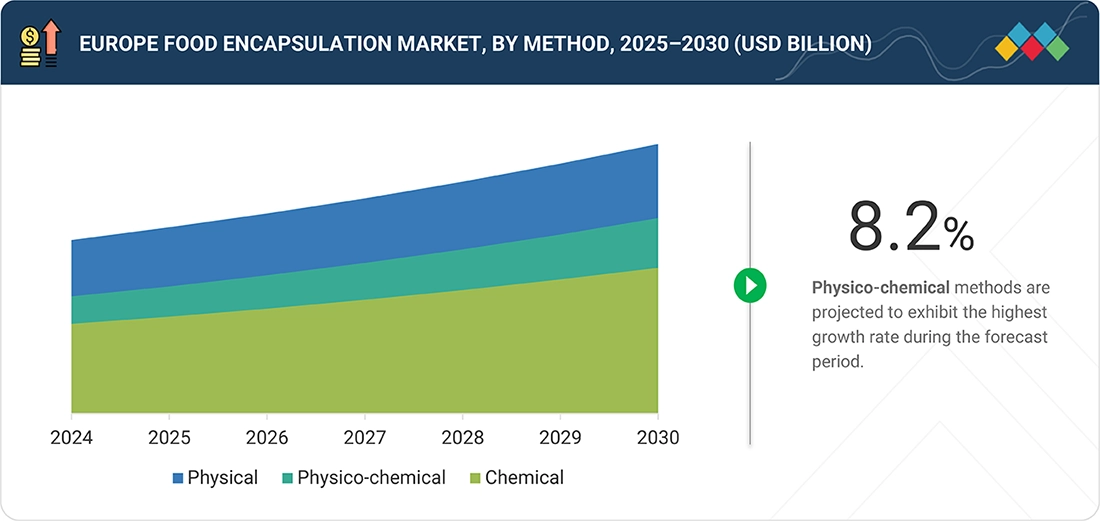

BY METHODBy method, physico-chemical is expected to be the fastest-growing segment in the market at 8.2%.

-

BY APPLICATIONThe dietary supplements segment is projected to dominate the Europe food encapsulation market during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSKey players in the Europe food encapsulation market include BASF SE, Kerry Group plc, DSM-Firmenich, Givaudan, and Symrise, supported by strong encapsulation expertise and established relationships with food and beverage manufacturers across Europe.

-

COMPETITIVE LANDSCAPE - STARTUPSEmerging companies in the Europe food encapsulation market include TasteTech and VitaBlend, which are gaining visibility through specialized encapsulation solutions for food and nutrition applications.

The Europe food encapsulation market is estimated to be valued at USD 4.38 billion in 2025 and is projected to reach USD 6.58 billion by 2030, growing at a CAGR of 8.5% during the forecast period. The market is poised for steady growth, supported by rising demand for stable, protected, and controlled-release food ingredients. Food manufacturers use encapsulation to improve shelf life, taste, and nutrient delivery in functional foods, beverages, and dietary products. Growing focus on clean label, functional nutrition, and product quality supports market adoption. Wider use across bakery, dairy, beverages, and supplements is strengthening demand. Ongoing investment in process improvement and scalable encapsulation technologies is expected to support long-term market growth in Europe.

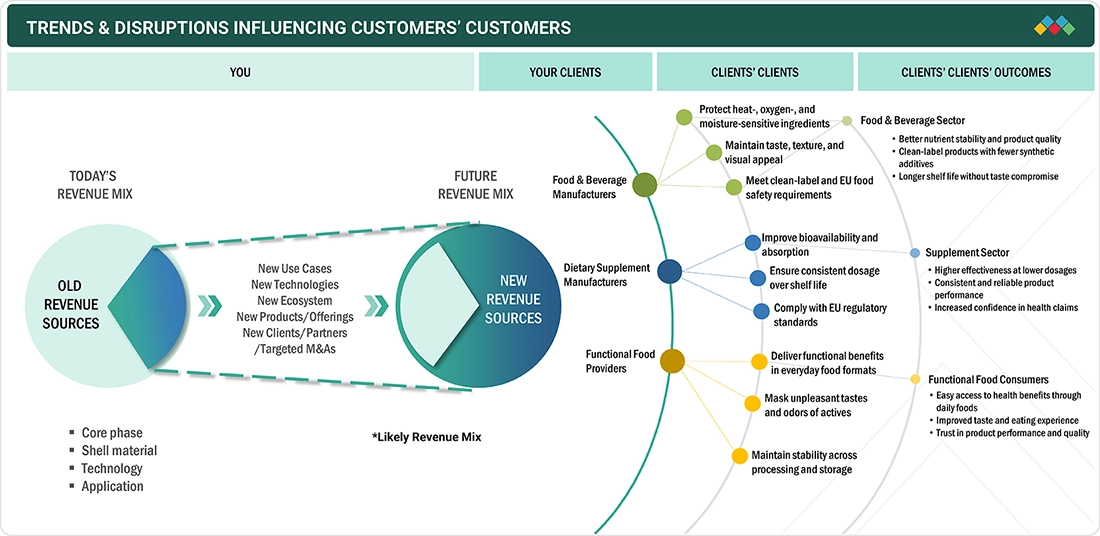

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Today’s revenue mix is centered on a set of core applications, mainly traditional food and beverage formats. Going forward, revenue growth will come from new use cases, improved encapsulation technologies, product upgrades, partnerships, and focused expansion. Emerging applications will take a higher share of revenue, showing a clear structural shift. This shift is driven by changes in encapsulation type, materials, processing methods, routes to market, and end-use needs. Across food and beverage brands, dietary supplement players, animal nutrition companies, and wellness-focused users, customer needs now focus on clean labels, food safety, freshness, ingredient protection, stability, waste reduction, sustainable processing, better bioavailability, cost control, scale-up, and regulatory fit. These trends lead to longer shelf life and fewer synthetic additives in food and beverages, steady performance and dose control in supplements, better gut health and feed efficiency in animal nutrition, and improved product compatibility in wellness uses. Together, these trends are reshaping demand across the Europe food encapsulation value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong demand for functional and fortified foods across European consumers

-

Strict food quality and shelf-life standards in the European food industry

Level

-

Limited flexibility in ingredient claims and labelling

-

Stringent EFSA and EU regulatory approval processes

Level

-

Growing demand for non-dairy and plant-based encapsulated ingredients

-

Innovation in sustainable and biodegradable encapsulation materials

Level

-

Scaling production while keeping costs competitive

-

Balancing clean-label expectations with technical performance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong demand for functional and fortified foods across European consumers

The strong consumption of functional and fortified foods across Europe is the primary driver of the food encapsulation market in Europe. Consumers are looking for foods that offer immunity, aid in digestion, give energy, and enhance overall health. This encourages the manufacturers to add active nutrients, probiotics, vitamins, minerals, and enzymes altogether. However, many of these nutrients lose potency when they come in contact with heat, light, oxygen, or moisture. Encapsulation is a method that allows the nutrients to be protected during the whole process of manufacturing, shipping, and storage. Besides, it also prevents bitterness and minimizes taste issues. Encapsulation controls how nutrients are released in the body. This helps companies to keep the product quality uniform and to meet the label claims. The rise of interest in health and preventive nutrition has led the food companies in Europe to increasingly adopt food encapsulation.

Restraint: Limited flexibility in ingredient claims and labelling

A major limiting factor in the Europe food encapsulation market is the lack of flexibility in ingredient claims and labeling. The region applies stringent regulations regarding food safety and labeling for functional and fortified foods. The range of health claims, dosage levels, and the scientific proof for such claims has to be very precise for the companies that wish to communicate the benefits of their products through labels. The larger the difference between the performance of the encapsulation and the claims allowed, the higher the risks of noncompliance. The whole process of getting the claims approved is also very time-consuming and costly. Hence, some producers either delay the launch of new products or restrict the use of advanced encapsulated ingredients, which in turn hampers the widespread use of food encapsulation solutions in the European market.

Opportunity: Growing demand for non-dairy and plant-based encapsulated ingredients

One of the key opportunities is the increasing demand for encapsulated ingredients that are non-dairy and plant-based. The switch in consumer diet from dairy to vegan, lactose-free, and plant-based is the main factor for the use of plant proteins, plant oils, vitamins, and bioactives to increase. However, these ingredients often have stability and taste issues. Encapsulation, on the other hand, helps in protecting the sensitive compounds during the process, thus improving the shelf life and sensory performance as well. Moreover, it also aids in the controlled release of the component in the plant-based food format. Thus, as the food brands widen their range of non-dairy and plant-based products, the need for encapsulation solutions in Europe will continue to grow.

Challenge: Balancing clean-label expectations with technical performance

A key challenge in the market is balancing clean-label expectations with technical performance. Consumers prefer short, familiar ingredient lists and avoid artificial additives. Many encapsulation systems rely on carriers, coatings, or stabilizers that may not align with clean-label demands. Reducing these inputs can affect stability, protection, and controlled release. This creates trade-offs between product simplicity and functional performance. Food manufacturers must invest in new materials and processes to meet clean-label needs without losing encapsulation efficiency, which increases development time and cost across Europe.

EUROPE FOOD ENCAPSULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Encapsulated vitamins, minerals, and omega-3 ingredients used in functional foods and nutrition products | Protects sensitive nutrients, improves shelf life, and ensures controlled release during consumption |

|

Flavor encapsulation for bakery, dairy, and convenience food applications | Protects flavors during heat processing and enables gradual flavor release |

|

Uses encapsulated probiotics, vitamins, and minerals in yogurts and fermented dairy products to protect actives during processing and shelf life | Maintains probiotic viability, improves nutrient stability, and supports functional health positioning |

|

Probiotic drops, tablets, and oral health products | Provides digestive relief, supports infant gut health, and improves overall wellness |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe food encapsulation market ecosystem includes companies that supply encapsulation materials, systems, and processing solutions. These players help protect sensitive food ingredients and support their controlled release. Food and functional nutrition manufacturers use encapsulation to improve shelf life, product stability, and taste control. The market follows a strong regulatory structure led by EFSA, which oversees food safety, additives, and novel food approvals across Europe. Established distributors and retail channels help bring encapsulated ingredients and finished food products to market across the region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Food Encapsulation Market, By Core Phase

In the core phase, vitamins and minerals play a key role in the Europe food encapsulation market, and hold the largest share. These nutrients are found extensively in functional foods, supplements, and fortified daily intake foods. The major drawback with these nutrients is that they can easily break down when exposed to heat, light, air, or moisture. To counter this, encapsulation is used to keep them safe through the whole process of manufacturing, storage, and transport. It also aids in absorption and provides support for controlled release in the organism, which is essential for products that make nutrition claims. The restrictive regulations on nutrient levels in Europe, combined with the high demand for fortified foods, make the use of encapsulated vitamins and minerals a necessity for manufacturers. They are present in dairy, beverages, bakery, infant nutrition, and meal replacements, among other sectors. With encapsulation, the nutrients are evenly mixed, and the taste is no longer a problem. This is why vitamins and minerals are still the most common core phases used in food encapsulation throughout the region.

Europe Food Encapsulation Market, By Technology

By technology, microencapsulation dominates the Europe food encapsulation market. Food and ingredient companies rely on it for vitamins, minerals, flavors, probiotics, and fatty acids. It helps protect these ingredients during heat processing and long storage. It also helps manage release and reduce strong or bitter taste. Spray drying and spray cooling are the main methods used. These methods are well known and easy to run at scale. Most European food plants already use them. Owing to this wide use and proven results, microencapsulation accounts for the largest share among food encapsulation technologies in Europe.

Europe Food Encapsulation Market, By Application

By application, dietary supplements hold a significant share in the Europe food encapsulation market. Companies use encapsulation to protect vitamins, minerals, probiotics, and fatty acids in supplement products. It helps keep these ingredients stable during storage and shipping. It also helps control release and improve uptake. Powders, capsules, and sachets depend on encapsulated inputs. European supplement brands focus on shelf life, clear dosing, and steady quality. Due to these needs, dietary supplements represent a strong share of food encapsulation use in the European market.

REGION

Germany to be fastest-growing country in Europe food encapsulation market during forecast period

Germany is projected to be the fastest-growing country in the Europe food encapsulation market during the forecast period. Germany is seeing rising use of food encapsulation across nutrition products. The country has a strong base of food and ingredient makers. Many of them use encapsulation for supplements and fortified foods. The process helps keep vitamins and other actives stable for longer periods. It also supports consistent quality in finished products. German companies give high importance to food safety and clean labels. Encapsulation fits well with these requirements. Most production plants already run modern processing lines. This reduces changeover effort. Ongoing product launches and steady investment continue to support demand. As a result, Germany is expected to grow faster than other European markets over the forecast period.

EUROPE FOOD ENCAPSULATION MARKET: COMPANY EVALUATION MATRIX

A competitive landscape framework for the Europe food encapsulation market groups companies as Stars, Emerging Players, Participants, and Pervasive Players based on technology strength, market reach, and growth focus. BASF SE is positioned as a Star player. This is supported by its strong R&D base, wide portfolio of encapsulation solutions for food and nutrition, and deep ties with food and beverage manufacturers across Europe. The company continues to invest in advanced encapsulation technologies that improve stability, shelf life, and controlled release of active ingredients. TasteTech is positioned as an Emerging Player, due to its growing focus on flavor and ingredient encapsulation for food applications, especially in fats, oils, and functional ingredients. The company is expanding its customer base among European food producers looking for targeted release and taste-masking solutions. Participants mainly include small or regional firms with a narrow application focus or limited scale. Pervasive Players have a steady presence in the market but show slower progress in innovation and new encapsulation formats compared with leading players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF SE (Germany)

- Kerry Group plc (Ireland)

- DSM-Firmenich (Switzerland)

- Givaudan (Switzerland)

- Symrise (Germany)

- Lonza (Switzerland)

- Evonik (Germany)

- Lallemand Inc. (Canada)

- Firmenich SA (Switzerland)

- Sensient Technologies Corporation (US)

- Tate & Lyle (UK)

- Lycored (UK)

- TasteTech (UK)

- FrieslandCampina (Netherlands)

- Vitablend (Netherlands)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 4.04 Billion |

| Market Forecast, 2030 (Value) | USD 6.58 Billion |

| Growth Rate | CAGR of 8.5% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Covered | Germany, UK, France, Italy, Spain, Rest of Europe |

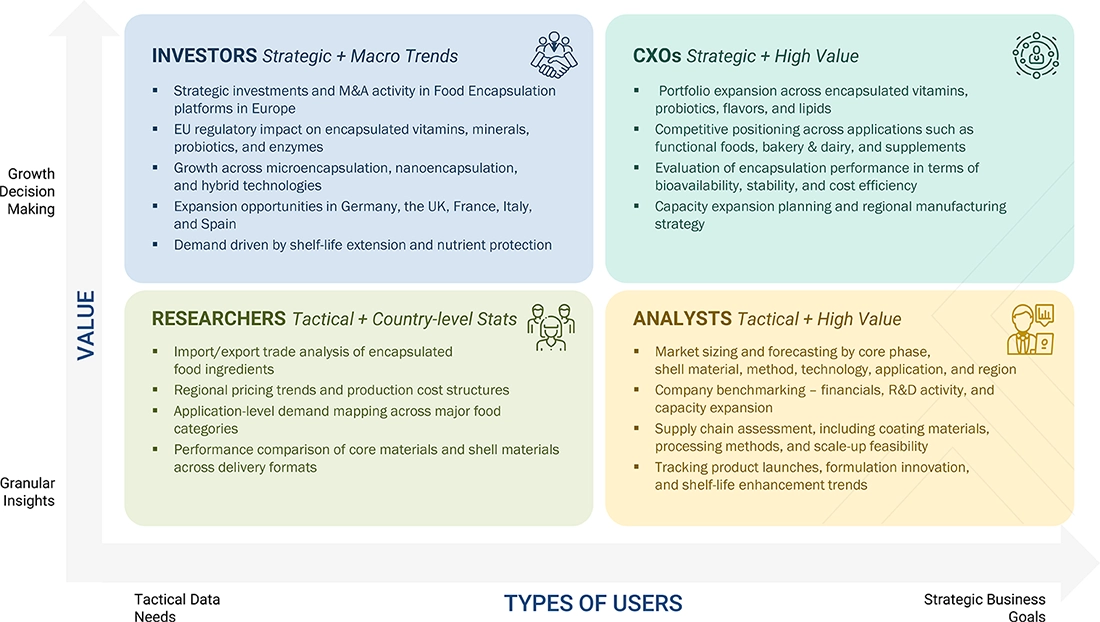

WHAT IS IN IT FOR YOU: EUROPE FOOD ENCAPSULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Functional Food Ingredients Market |

|

|

| Flavors & Fragrances Market |

|

|

| Nutraceuticals & Dietary Supplements Market |

|

|

RECENT DEVELOPMENTS

- September 2025 : BASF SE completed the sale of its Food & Health Performance Ingredients business to Louis Dreyfus Company, transferring European assets producing emulsifiers and food-grade functional ingredients used in encapsulation systems.

- January 2025 : DSM-Firmenich broke ground on a new production facility in Parma, Italy, expanding European capacity for flavors and functional blends, including encapsulated ingredient systems for food applications.

- September 2021 : TasteTech continued the expansion of its lipid-based food encapsulation technologies in Europe, supporting controlled-release flavors and nutrients for bakery, dairy, and nutrition products.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the Europe Food Encapsulation Market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the Europe Food Encapsulation Market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Europe Food Encapsulation Market.

Europe Food Encapsulation Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Europe Food Encapsulation Market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the Europe Food Encapsulation Market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the Europe market for food encapsulation on the basis of core phase, application, shell material, method, technology and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyse the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyse the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyse their market position and core competencies.

- To analyse the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the Europe Food Encapsulation Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Food Encapsulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Food Encapsulation Market