Network Slicing Market

Network Slicing Market by Offering (Solution, Service (Professional Services, Managed Services)), End User (Telecom Operators, Enterprises (Manufacturing, Automotive, Government & Public Sector, Healthcare & Life Sciences)) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Network Slicing market is projected to reach USD 2.81 billion by 2030 from USD 1.30 billion in 2025, at a CAGR of 16.6% from 2025 to 2030. The growth of the aerospace materials market is driven by the rising demand for advanced materials that deliver superior performance, efficiency, and sustainability in modern aircraft.

KEY TAKEAWAYS

-

By RegionThe North America XYZ market accounted for a 37.2% revenue share in 2024.

-

By OfferingBy offering, the Services segment is expected to register the highest CAGR of 19.3%.

-

By End UserBy end user, the Telecom Operators segment is projected to grow at the fastest rate from 2025 to 2030.

The network slicing market is witnessing robust growth, with North America accounting for a significant 37.2% revenue share in 2024. Among offerings, the services segment is projected to record the highest CAGR of 19.3%, driven by increasing demand for managed and orchestration services. By end user, telecom operators are expected to grow at the fastest pace from 2025 to 2030 as they leverage network slicing for enhanced service delivery and monetization. Leading players such as Broadcom, Nokia, and Ericsson dominate the global landscape with strong market presence and advanced product portfolios, while emerging firms like Parallel Wireless, Affirmed Networks, and Celona are gaining traction in niche areas, positioning themselves as potential future leaders.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The network slicing market is experiencing a major shift from traditional connectivity services to advanced, high-value solutions driven by new technologies, use cases, and ecosystems. Companies such as Ericsson, Huawei, Nokia, Cisco, and ZTE are focusing on enabling network slicing-as-a-service, AI-based slice management, and multi-cloud orchestration to support industry-specific applications. This evolution is helping telecom operators and enterprises unlock new revenue streams through 5G platform monetization and partner ecosystem integration. As a result, clients are achieving outcomes such as real-time automation, ultra-low latency connectivity, secure data flows, and new digital service models tailored to diverse industry needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Ultra-low latency slicing for real-time use cases

-

Rising enterprise demand for network customization

Level

-

Lack of unified standards across ecosystems

-

High cost of network transformation for smaller players

Level

-

AI-powered orchestration for zero-touch slicing

-

Edge computing integration with slicing

Level

-

SLA enforcement remains difficult in live deployments

-

Shortage of slicing-skilled workforce

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Ultra-low latency slicing for real-time use cases

Network slicing provides a solution to URLLC (Ultra-Reliable Low-Latency Communication) by allowing mobile networks to build virtual networks intended for highly sensitive applications. For industries such as autonomous vehicles, industrial automation, and telemedicine services, being timely is crucial and makes this capability very valuable. A consistent quality of service is achieved because network slicing can assign resources as needed and improve their performance. Robotic systems and similar applications require a very fast reaction time of under 10 milliseconds in all-latency networks. Deutsche Telekom and Siemens collaborated in January 2025 to carry out network slicing in a German factory and prove that specific procedures in machinery were finished within a set time frame.

Restraint: Lack of unified standards across ecosystems

While the concept of network slicing is clearly defined by 3GPP, how it is practiced varies greatly among operators and vendors. The absence of standard practices for all ecosystems makes operating in multiple-vendor or cross-operator situations very hard. Consequently, difficulties occur in handling orchestration, ensuring service quality, and managing the lifecycle. Despite repeating the need for standardized APIs and interfaces, progress in the industry has not been swift. Standardized northbound APIs are important for consistent slicing, yet there has been little adoption according to the GSMA’s report in December 2024, and this is hindering European telecom network deployment.

Opportunity: AI-powered orchestration for zero-touch slicing

Telecom operators can use artificial intelligence to quickly and efficiently set up, watch over, and automate network slice management. Utilizing AI in closed-loop orchestration, operators can make operations more efficient and immediately deliver tailored slices as needed. Implementing this approach saves money, allows services to launch faster, and supports meeting service-level expectations. AI plays a role in allocating resources wisely and managing faults, which helps the network respond quickly and stay resilient. Ericsson and Singtel demonstrated an AI-powered system in February 2025 that was able to provide slices for applications such as e-sports and remote surgery, providing proof of intelligent automation’s use in telecom networks.

Challenge: SLA enforcement remains difficult in live deployments

Providing stable service in several different network slices at the same time is very hard to achieve. As more slices are created, it gets harder to ensure that each slice achieves the required values for latency, bandwidth, and jitter. Due to this complexity, fixing any issues can be difficult and opens operators to the risk of late SLAs, unhappy customers, and harm to their image. Conventional systems do not provide quick and detailed insights for each slice, pushing the market to develop advanced and predictive tools. For instance, there was a problem at a major sporting event in Paris in January 2025 when a premium video slice was unable to keep up with the latency needed, which greatly affected broadcasters’ experience.

Network Slicing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ericsson enables dynamic 5G network slicing for telecom operators, supporting enterprise-specific applications such as smart manufacturing, connected healthcare, and mission-critical communication. | Delivers ultra-reliable, low-latency connectivity, faster service provisioning, and improved monetization for operators through differentiated network performance. |

|

Huawei provides end-to-end network slicing solutions with AI-driven orchestration and intelligent slice lifecycle management for industries like automotive, energy, and public safety. | Enhances operational efficiency and service quality while reducing OPEX through automation and real-time resource optimization. |

|

Nokia’s slicing platform enables multi-domain network slicing across RAN, transport, and core networks, allowing CSPs to deliver customizable connectivity for enterprise and IoT services. | Enables rapid deployment of tailored 5G services, greater scalability, and new revenue opportunities through on-demand, SLA-based connectivity. |

|

Cisco offers a cloud-native 5G network slicing solution integrated with its Service Orchestrator and Crosswork Automation Suite, enabling operators to dynamically create, manage, and assure network slices across RAN, transport, and core domains. | Delivers end-to-end visibility, automated slice lifecycle management, and assured QoS, helping operators accelerate time-to-market for enterprise 5G services and reduce network complexity. |

|

ZTE provides a full-stack network slicing solution leveraging AI-based orchestration and intelligent service assurance. It supports multi-scenario slicing for industries like manufacturing, transportation, and public safety through its Common Network Resource Pool (CNRP) framework. | Improves network agility and reliability with on-demand slice creation, ensures efficient resource utilization, and enables differentiated services for diverse verticals through intelligent automation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The network slicing market ecosystem consists of solution providers, service providers, and regulatory bodies working together to enable scalable 5G connectivity. Solution providers such as Ericsson, Huawei, Nokia, Cisco, ZTE, Ciena, and Samsung develop core technologies like orchestration platforms, virtualization tools, and AI-based management systems, supported by innovators like Celona, Parallel Wireless, and Affirmed Networks. Service providers including BT Group, NTT, Türk Telekom, and T-Mobile deploy these solutions to deliver industry-specific 5G services with enhanced performance and reliability. Regulatory bodies such as the ITU and ETSI ensure standardization, interoperability, and security compliance, creating a unified framework that drives the adoption and commercialization of network slicing globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aerospace Materials Market, By Offering

The network slicing market is projected to grow significantly from 2025 to 2030, with the services segment expected to lead the market at a CAGR of 19.3%. This growth is primarily driven by the increasing demand for managed and professional services that support network deployment, orchestration, and lifecycle management, as telecom operators and enterprises focus on optimizing 5G network performance and delivering customized connectivity solutions across industries.

REGION

Asia Pacific to be fastest-growing region in global Network Slicing market during forecast period

The network slicing market in the Asia Pacific region is expected to witness strong growth, registering a CAGR of 18.1% from 2025 to 2030. This growth is driven by rapid 5G rollouts, increasing digital transformation initiatives, and rising adoption of smart city and industrial automation projects across countries such as India, China, Japan, and South Korea. India, in particular, is emerging as the fastest-growing market, supported by government-led 5G initiatives and expanding enterprise demand for customized connectivity. The telecom operators segment dominates the market by end user, while the services segment leads by offering, as enterprises increasingly rely on managed network slicing solutions to enable reliable, low-latency, and scalable 5G applications.

Network Slicing Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the network slicing market categorizes players based on their market share and product footprint. Companies positioned in the “Stars” quadrant, including Broadcom, Nokia, Ericsson, Cisco, Huawei, ZTE, Ciena, and Amdocs, are recognized as market leaders with strong technological capabilities, extensive product portfolios, and significant market presence. Emerging Leaders like Juniper Networks and T-Mobile are gaining momentum through innovative solutions and expanding partnerships, positioning themselves for future growth. Pervasive Players such as Samsung, NTT, HPE, and Türk Telekom have established operational footprints but are focusing on broadening their product offerings to strengthen competitiveness. Meanwhile, Participants like Mavenir and BT are active in specific niches or early stages of adoption, with potential to move upward through targeted innovation and ecosystem collaboration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.03 Billion |

| Market Forecast in 2030 (Value) | USD 2.80 Billion |

| Growth Rate | CAGR of 16.6% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Network Slicing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- April 2025 : In April 2025, OPPO and Ericsson collaborated to explore 5G network slicing, aiming to enhance mobile experiences through tailored connectivity solutions.

- March 2025 : In March 2025, U Mobile teamed up with Huawei and ZTE to roll out Malaysia's Next Gen 5G network. The plan is to incorporate network slicing for enterprise-grade services and achieve 80% coverage in the first year.

- September 2024 : In September 2024, Ericsson and Concordia University partnered to explore innovative solutions in 5G and beyond, focusing on R&D in advanced wireless technologies.

Table of Contents

Methodology

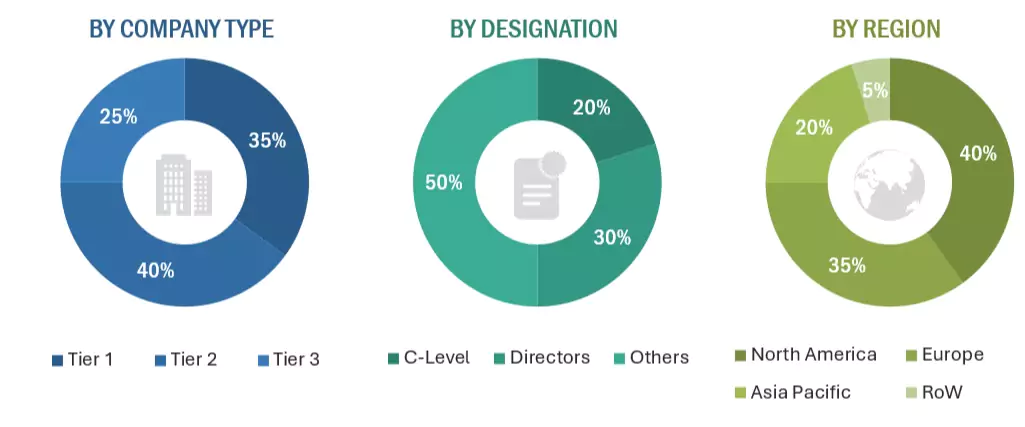

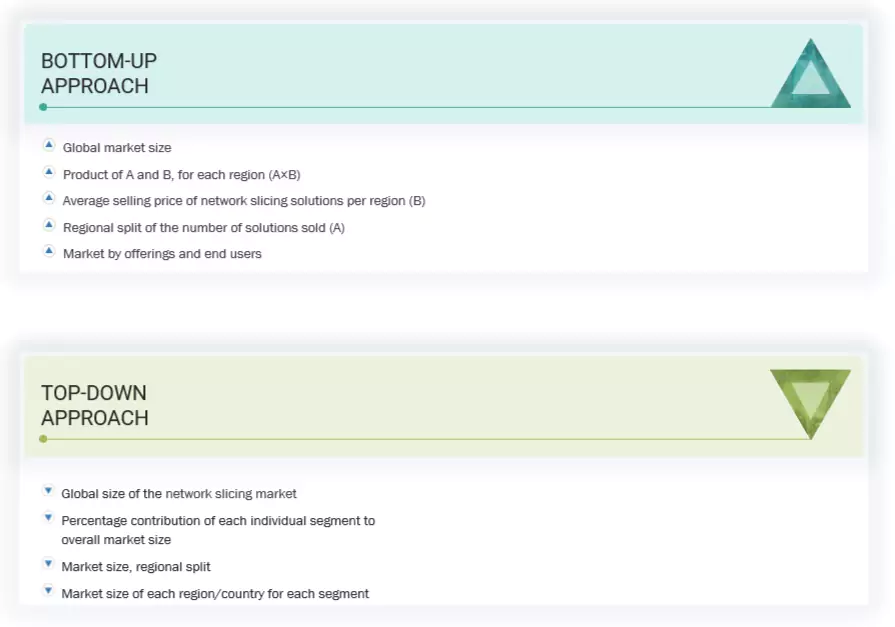

The research study involved four major activities in estimating the network slicing market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering network slicing solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from network slicing solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use network slicing solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current use of network slicing solutions which is expected to affect the overall network slicing market growth.

Notes: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies have revenues between USD

500 million and 1 billion, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Network slicing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Network Slicing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the network slicing market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The network slicing market size has been validated using top-down and bottom-up approaches.

Market Definition

According to Ericsson, network slicing enables multiple logical networks to operate on a shared physical network infrastructure by creating “slices” that are logically separated, self-contained, independent, and secured. These sliced networks can be independently configured to target specific services or users with distinct speed, latency, and reliability needs. It provides an opportunity to monetize 5G network investments and unleash the power of differentiated connectivity.

As per Celona, network slicing is a type of functionality that enables multiple independent networks to exist on the same physical network, using different “slices” of the same spectrum band. This allows organizations to accommodate different application requirements for security, reliability, and performance on the same network. It leverages Software-defined Networking (SDN), Network Function Virtualization (NFV), and automation to quickly segment the network and its resources to support specific applications, devices, domains, and groups.

Stakeholders

- System Integrators

- Network Infrastructure Enablers

- Technology Vendors

- Resellers

- Value-added Resellers (VARs)

- Independent Software Vendors (ISVs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

- Investment Firms

- Network Slicing Alliances/Groups

- Enterprises/Businesses

Report Objectives

- To determine, segment, and forecast the network slicing market based on offering, end user, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments, and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and research & development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the definition of network slicing?

According to Ericsson, network slicing enables multiple logical networks to operate on a shared physical network infrastructure by creating “slices” that are logically separated, self-contained, independent, and secured. These sliced networks can be independently configured to target specific services or users with distinct speed, latency, and reliability needs. It provides an opportunity to monetize 5G network investments and unleash the power of differentiated connectivity.

What is the size of the network slicing market?

The network slicing market is projected to grow from USD 1.30 billion in 2025 to USD 2.81 billion by 2030, at a CAGR of 16.6% during the forecast period.

What are the major drivers of the network slicing market?

Major drivers of the network slicing market include the ultra-low latency slicing for real-time use cases, rising enterprise demand for network customization, and private 5G adoption fueling slicing deployment.

Who are the key players operating in the network slicing market?

The major players in the network slicing market include Ericsson (Sweden), Huawei (China), Nokia (Finland), Cisco (US), ZTE (China), Ciena Corporation (US), Amdocs (US), Turk Telekom (Turkey), Samsung (South Korea), HPE (US), NTT (Japan), BT Group (UK), and Broadcom (US), Juniper Networks (US), T-Mobile (US), Mavenir (US), Parallel Wireless (US), Affirmed Networks (US), Celona (US), Argela Technologies (Turkey), Tambora Systems (Singapore), Firecell (France), Druid Software (Ireland), Niral Networks (New York), and SLICEFINITY (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches/enhancements, and acquisitions to expand their footprint in the network slicing market.

What are the opportunities for new entrants in the network slicing market?

New organizations entering the network slicing space can find success by supplying cloud-native, AI-powered orchestration tools that help operators deploy slices more easily. Companies can help underserved sectors like healthcare or utilities by providing specialized slicing services. Making managed slice lifecycle services accessible to companies who do not have 5G expertise can help telecoms quickly build a business in this outsourced area.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Network Slicing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Network Slicing Market