2

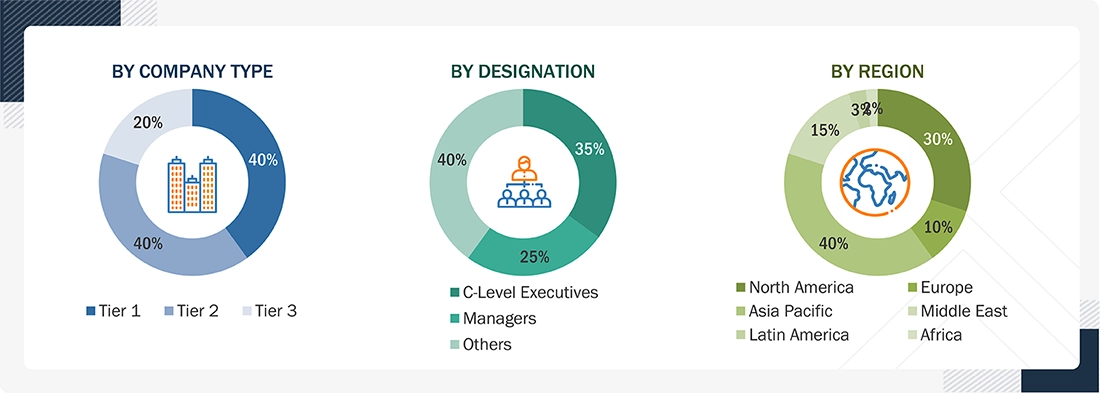

RESEARCH METHODOLOGY

37

5

MARKET OVERVIEW

Technological miniaturization and AI integration drive demand for advanced space sensors and actuators.

55

5.2.1.1

SURGE IN SATELLITE DEPLOYMENTS AND CONSTELLATIONS

5.2.1.2

TECHNOLOGICAL INNOVATION AND MINIATURIZATION

5.2.1.3

GROWING NEED FOR PRECISE SENSING, ACTUATION, AND ADAPTIVE CONTROL

5.2.2.1

STRINGENT REGULATORY AND CERTIFICATION REQUIREMENTS

5.2.2.2

LEGACY SYSTEM INTEGRATION COMPLEXITY

5.2.3.1

EXPANDING DEMAND FROM DEEP SPACE AND LUNAR EXPLORATION PROGRAMS

5.2.3.2

RISING ADOPTION OF SENSORS AND ACTUATORS IN SMALL SATELLITE PLATFORMS

5.2.3.3

INTEGRATION OF AI AND SENSOR FUSION FOR AUTONOMOUS SPACECRAFT

5.2.4.1

LONG DEVELOPMENT CYCLES AND TECHNOLOGY OBSOLESCENCE RISK

5.2.4.2

OVERCOMING INTEGRATION AND INTERFERENCE COMPLEXITIES

5.3

UNMET NEEDS AND WHITE SPACES IN SPACE SENSORS AND ACTUATORS MARKET

5.4

INTER-CONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

5.5

STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6

INDUSTRY TRENDS

Explore transformative trends reshaping the global space industry and impacting investment and pricing dynamics.

62

6.2

MACROECONOMIC INDICATORS

6.2.2

GDP TRENDS AND FORECAST

6.2.3

TRENDS IN GLOBAL SPACE INDUSTRY

6.4.1

PROMINENT COMPANIES

6.4.2

PRIVATE AND SMALL ENTERPRISES

6.5.1

IMPORT SCENARIO (HS CODE 880260)

6.5.2

EXPORT SCENARIO (HS CODE 880260)

6.6

KEY CONFERENCES AND EVENTS, 2025-2026

6.7

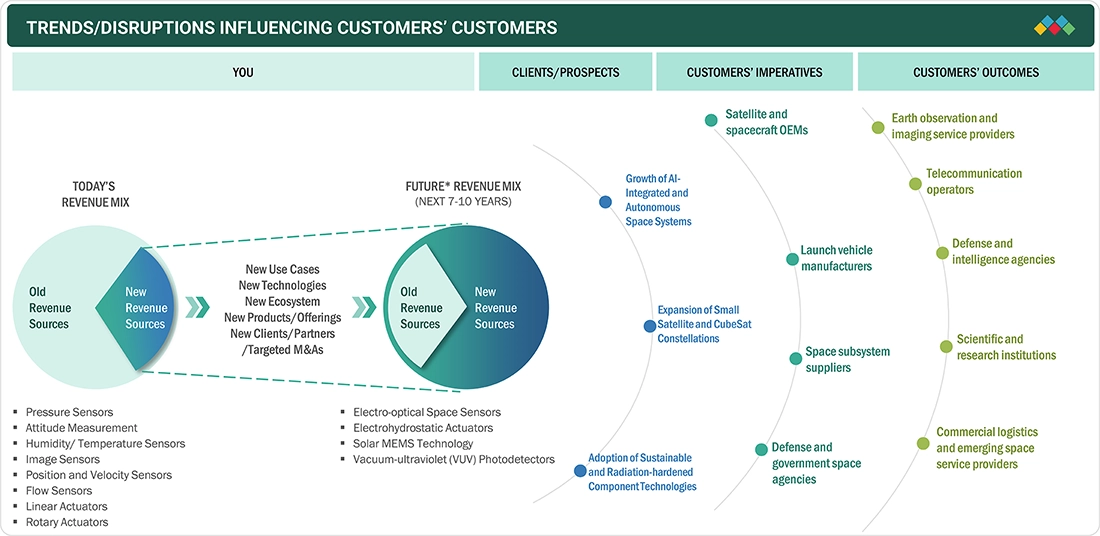

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.8

INVESTMENT AND FUNDING SCENARIO

6.9.1

INDICATIVE PRICING ANALYSIS, BY PRODUCT TYPE

6.9.2

AVERAGE SELLING PRICE TREND, BY REGION

6.10.1

SODERN DEVELOPED STAR TRACKER SENSORS FOR ULTRA-ACCURATE ATTITUDE DETERMINATION FOR SATELLITES

6.10.2

US AIR FORCE AND BALL AEROSPACE CONDUCTED RADIATION HARDNESS TEST ON ELECTRO-OPTICAL SENSORS

6.10.3

PHYSIK INSTRUMENTE SUPPLIED SPACE-QUALIFIED PIEZOELECTRIC ACTUATORS FOR NASA’S PERSEVERANCE ROVER SUPERCAM INSTRUMENT

7

STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

Harness emerging AI and quantum technologies to revolutionize space sensor autonomy and market leadership.

74

7.1

KEY EMERGING TECHNOLOGIES

7.1.1

MINIATURIZED MEMS-BASED SENSORS AND ACTUATORS

7.1.2

AI-ENABLED AUTONOMOUS SENSING SYSTEMS

7.1.3

QUANTUM AND PHOTONIC SENSOR PLATFORMS

7.2

COMPLEMENTARY TECHNOLOGIES

7.2.1

ADVANCED ONBOARD DATA PROCESSING (EDGE COMPUTING)

7.2.2

ADDITIVE MANUFACTURING OF SENSOR AND ACTUATOR COMPONENTS

7.2.3

RADIATION-HARDENED ELECTRONICS AND MATERIALS

7.4

EMERGING TECHNOLOGY TRENDS

7.7

IMPACT OF AI/ GENERATIVE AI ON SPACE SENSORS AND ACTUATORS MARKET

7.7.1

TOP USE CASES AND MARKET POTENTIAL

7.7.2

BEST PRACTICES IN SPACE SENSORS AND ACTUATORS MARKET

7.7.3

CASE STUDIES OF AI IMPLEMENTATION IN SPACE SENSORS AND ACTUATORS MARKET

7.7.4

INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

7.7.5

CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN SPACE SENSORS AND ACTUATORS MARKET

7.8

SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7.8.1

HONEYWELL AEROSPACE: ADVANCING AI-DRIVEN NAVIGATION AND ACTUATION SYSTEMS

7.8.2

LOCKHEED MARTIN: PIONEERING AUTONOMOUS SENSOR-ACTUATOR INTEGRATION

7.8.3

TELEDYNE TECHNOLOGIES: DELIVERING PRECISION IMAGING AND ACTUATION FOR DEEP SPACE MISSIONS

8

CUSTOMER LANDSCAPE & BUYER BEHAVIOR

Uncover how stakeholder dynamics and criteria shape space sensors and actuators purchasing decisions.

87

8.1

DECISION-MAKING PROCESS

8.2

KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

8.2.1

KEY STAKEHOLDERS IN BUYING PROCESS

8.3

ADOPTION BARRIERS AND INTERNAL CHALLENGES

9

SUSTAINABILITY AND REGULATORY LANDSCAPE

Navigate complex global regulations and sustainability initiatives shaping industry standards and eco-certifications.

92

9.1

TARIFF AND REGULATORY LANDSCAPE

9.1.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

9.2.5

LATIN AMERICA AND AFRICA

9.3

SUSTAINABILITY INITIATIVES

9.4

SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

9.5

CERTIFICATIONS, LABELING, AND ECO-STANDARDS

10

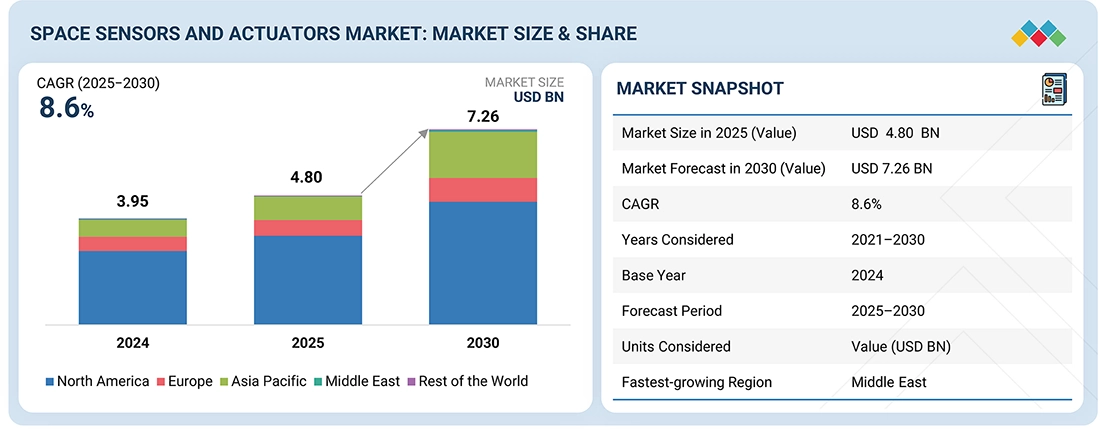

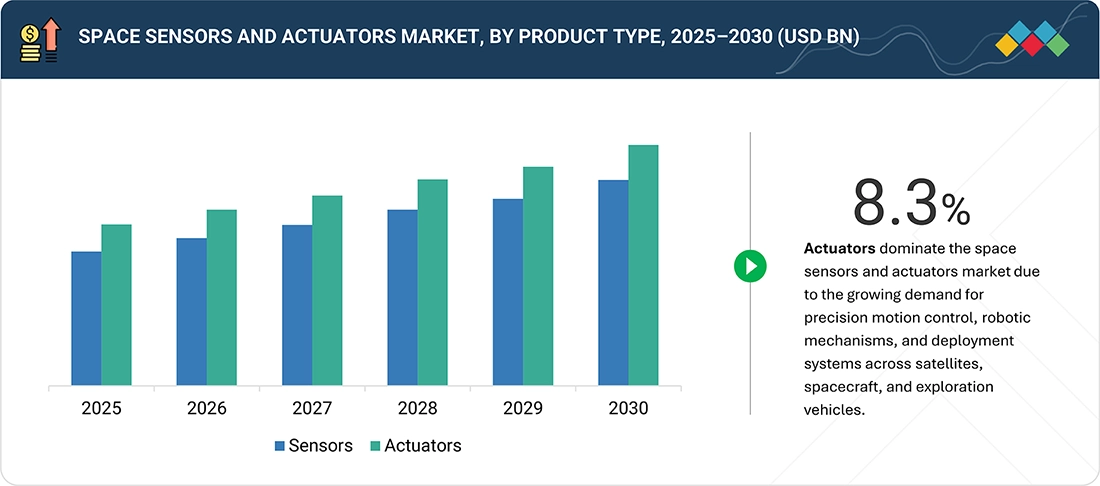

SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 18 Data Tables

100

10.2.1

EARTH OBSERVATION AND ENVIRONMENTAL MONITORING

10.2.2

ROBOTIC MANIPULATION AND SAMPLE HANDLING (NASA’S MARS PERSEVERANCE ROVER)

10.3.1

ATTITUDE & NAVIGATION SENSORS

10.3.1.1

NEED FOR PRECISE ORIENTATION, STABILIZATION, AND TRAJECTORY CONTROL IN SATELLITES AND SPACECRAFT TO DRIVE GROWTH

10.3.1.4

EARTH HORIZON SENSORS

10.3.2

ENVIRONMENTAL SENSORS

10.3.2.1

INCREASE IN LONG-DURATION MISSIONS TO DRIVE GROWTH

10.3.2.2

TEMPERATURE SENSORS

10.3.2.4

RADIATION DOSIMETERS

10.3.2.5

ELECTRICAL CURRENT/VOLTAGE SENSORS

10.3.2.6

ATMOSPHERIC/GAS SENSORS

10.3.2.7

PRESSURE SENSORS

10.3.3.1

SMALL SATELLITES AND EXPLORATION PROGRAMS TO DRIVE GROWTH

10.3.3.2

ELECTRO-OPTICAL SENSORS

10.3.3.3

THERMAL IMAGING SENSORS

10.3.3.4

RADAR IMAGING SENSORS

10.3.4

PROXIMITY, POSITION, AND RANGING SENSORS

10.3.4.1

INCREASING USE OF AUTONOMOUS AND COOPERATIVE SATELLITE MISSIONS TO DRIVE GROWTH

10.3.4.2

HALL-EFFECT SENSORS

10.3.4.3

INDUCTIVE NON-CONTACT POSITION SENSORS

10.3.4.4

LIMIT/PROXIMITY SWITCHES

10.3.4.7

RESOLVERS/LINEAR VARIABLE DIFFERENTIAL TRANSFORMERS (LVDTS)/ ROTARY VARIABLE DIFFERENTIAL TRANSFORMERS (RVDTS)

10.3.4.9

RENDEZVOUS/DOCKING RADAR SENSORS

10.3.5

SCIENTIFIC SENSORS

10.3.5.1

USE IN SATELLITES, PROBES, AND LANDERS TO OBTAIN DIRECT MEASUREMENTS FROM PLANETARY ENVIRONMENTS TO DRIVE GROWTH

10.3.5.2

SPECTROMETER SENSORS

10.3.5.3

VACUUM-ULTRAVIOLET (UV) PHOTODETECTORS

10.4.1.1

RISING NUMBER OF SMALL SATELLITES AND MODULAR SPACECRAFT TO DRIVE GROWTH

11

SPACE SENSORS AND ACTUATORS MARKET, BY PLATFORM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 22 Data Tables

117

11.2.1

PLANET DOVE CUBESAT CONSTELLATION

11.2.2

SENTINEL MEDIUM SATELLITE PLATFORM BY ESA

11.2.3

SKYNET SMALL SATELLITE PLATFORM BY AIRBUS DEFENCE AND SPACE

11.2.4

WORLDVIEW LARGE SATELLITE PLATFORM BY MAXAR TECHNOLOGIES

11.2.5

STARLINER CREWED SPACECRAFT PLATFORM BY BOEING

11.2.6

DRAGON UNCREWED SPACECRAFT PLATFORM BY SPACEX

11.2.7

JUICE INTERPLANETARY SPACECRAFT PLATFORM BY ESA

11.2.8

PHILAE LANDER PLATFORM BY DLR

11.2.9

ELECTRON SMALL LAUNCH VEHICLE BY ROCKET LAB

11.3.1

GROWING DEMAND FOR ACCURATE EARTH OBSERVATION, COMMUNICATION, AND SCIENTIFIC APPLICATIONS TO DRIVE GROWTH

11.3.2.1

SURGE IN USE FOR EARTH OBSERVATION, REMOTE SENSING, AND TECHNOLOGY DEMONSTRATIONS TO DRIVE GROWTH

11.3.3.1

GROWING USE FOR EARTH OBSERVATION, ENVIRONMENTAL MONITORING, AND DEFENSE APPLICATIONS TO DRIVE MARKET

11.3.3.4

MACRO SATELLITES

11.3.4.1

INCREASING REQUIREMENTS FOR REGIONAL CONNECTIVITY, SURVEILLANCE, AND DATA RELAY FUNCTIONS TO DRIVE GROWTH

11.3.5.1

ABILITY TO MANAGE MULTIPLE INSTRUMENTS AND COMPLEX MISSION PROFILES TO DRIVE GROWTH

11.3.6.1

INCREASING ORBITAL LOGISTICS TO DRIVE GROWTH

11.3.6.2

CREWED SPACECRAFT

11.3.6.3

UNCREWED SPACECRAFT

11.4

INTERPLANETARY SPACECRAFT AND PROBES

11.4.1

DEEP SPACE EXPLORATIONS TO DRIVE GROWTH

11.5

ROVERS/SPACECRAFT LANDERS

11.5.1

OPERATE AUTONOMOUSLY OR WITH LIMITED GROUND CONTROL, USING IMAGING, THERMAL, AND SPECTROSCOPIC INSTRUMENTS

11.6.1

INCREASE IN LAUNCH ACTIVITIES BY GOVERNMENT AND COMMERCIAL OPERATORS TO DRIVE GROWTH

11.6.2

SMALL LAUNCH VEHICLES (<350,000 KG)

11.6.3

MEDIUM-TO-HEAVY LAUNCH VEHICLES (>350,000 KG)

12

SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

132

12.2

ATTITUDE & ORBITAL CONTROL SYSTEMS

12.2.1

CONTROL ATTITUDE AND POSITION OF SATELLITES

12.3

COMMUNICATION POINTING & RF SWITCHING

12.3.1

RAPID DEPLOYMENT OF LEO CONSTELLATIONS AND INTER-SATELLITE LINK ARCHITECTURE TO DRIVE GROWTH

12.4

INSTRUMENT POINTING & OPTO-MECHANISMS

12.4.1

NEED FOR PRECISE ALIGNMENT AND STABILITY IN ADVANCED IMAGING AND SCIENTIFIC PAYLOADS TO DRIVE GROWTH

12.5

DEPLOYMENT & SEPARATION SYSTEMS

12.5.1

GROWING NUMBER OF RIDESHARE LAUNCHES AND CUBESAT MISSIONS TO DRIVE DEMAND

12.6

THERMAL CONTROL SYSTEMS

12.6.1

MAINTAIN TEMPERATURES OF SPACECRAFT, LAUNCH VEHICLES, AND ROVERS

12.7

PROPULSION & FLUID SYSTEMS

12.7.1

ENABLE PRECISE CONTROL OF SPACECRAFT THRUST AND FLUID FLOW

12.8

PROXIMITY, BERTHING, AND DOCKING SYSTEMS

12.8.1

GROWING FOCUS ON REUSABLE SPACECRAFT AND MODULAR STRUCTURES TO DRIVE GROWTH

12.9

SURFACE MOBILITY AND NAVIGATION SYSTEMS

12.9.1

PROVIDE NAVIGATIONAL SUPPORT

12.10

ROBOTIC ARMS/MANIPULATOR SYSTEMS

12.10.1

IN-ORBIT ASSEMBLY DRIVES ROBOTIC ARM AND MANIPULATOR INTEGRATION

12.11

THRUST VECTOR CONTROL SYSTEMS

12.11.1

CONTROL ATTITUDE OR ANGULAR VELOCITY

12.12

SOLAR ARRAY DRIVE MECHANISMS

12.12.1

DEVELOPMENT OF SOLAR ARRAY DRIVE ASSEMBLIES FOR CUBESATS TO DRIVE GROWTH

13

SPACE SENSORS AND ACTUATORS MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 6 Data Tables

140

13.2.1

INVESTMENT BY PRIVATE PLAYERS TO INCREASE EXPLORATION MISSIONS

13.2.2

SATELLITE AND LAUNCH VEHICLE MANUFACTURERS

13.2.3

IN-ORBIT SERVICE PROVIDERS

13.2.5

COMMERCIAL OPERATORS & OWNERS

13.3

GOVERNMENT & DEFENSE

13.3.1

EMPHASIS ON IMPROVING SPACECRAFT EFFICIENCY AND REDUCING MANUAL INTERVENTION TO DRIVE GROWTH

13.3.2

NATIONAL SPACE AGENCIES

13.3.3

DEPARTMENTS OF DEFENSE

13.3.4

ACADEMIA & RESEARCH

14

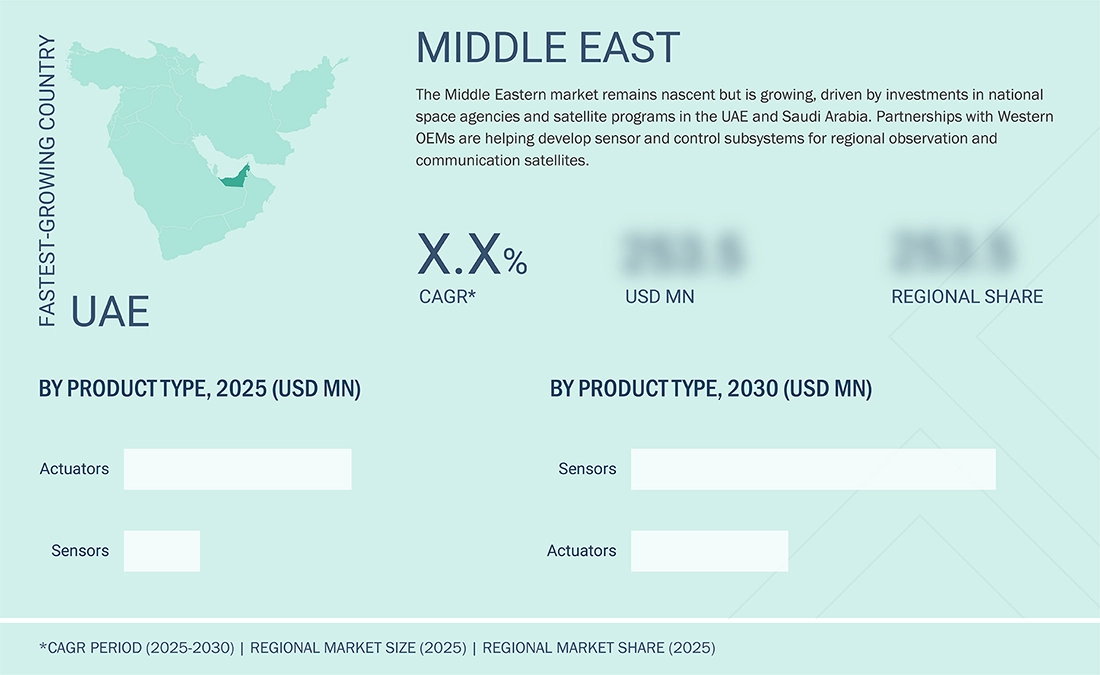

SPACE SENSORS AND ACTUATORS MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 14 Countries | 242 Data Tables.

146

14.2.1.1

INCREASING NUMBER OF SATELLITE LAUNCHES BY COMMERCIAL SPACE SECTOR TO DRIVE GROWTH

14.2.2.1

EXPANSION OF SATELLITE CONSTELLATIONS, IN-ORBIT SERVICING MISSIONS, AND ROBOTIC SYSTEMS TO DRIVE GROWTH

14.3.1.1

FOCUS ON DOMESTIC PRODUCTION OF SPACE-QUALIFIED COMPONENTS TO DRIVE GROWTH

14.3.2.1

SHIFT TOWARD SMALLER SATELLITE CONSTELLATIONS AND REUSABLE PLATFORMS TO DRIVE GROWTH

14.3.3.1

FOCUS ON DOMESTIC CAPABILITY IN SPACECRAFT COMPONENT PRODUCTION TO DRIVE GROWTH

14.3.4.1

INCREASE IN SMALL SATELLITES, COMMERCIAL LAUNCH PLATFORMS, AND IN-ORBIT SERVICE MISSIONS TO DRIVE GROWTH

14.3.5.1

PROGRAMS RELATED TO REUSABLE PROPULSION SYSTEMS, SMALL SATELLITE CONSTELLATIONS, AND LUNAR EXPLORATION TO DRIVE GROWTH

14.4.1.1

ADVANCEMENTS IN SPACE MISSIONS AND SPACE STATIONS TO DRIVE GROWTH

14.4.2.1

INDIGENIZATION OF TECHNOLOGIES AND PARTICIPATION OF PRIVATE SECTOR IN SPACE INDUSTRY TO DRIVE GROWTH

14.4.3.1

GROWING FOCUS OF PRIVATE COMPANIES ON DEVELOPING ADVANCED TECHNOLOGIES FOR SPACE SYSTEMS TO DRIVE GROWTH

14.4.4.1

DOMESTIC SATELLITE AND SPACE LAUNCH INDUSTRY DRIVEN BY PRIVATE SECTOR TO BOOST MARKET

14.4.5.1

INCREASING SMALL SATELLITE MANUFACTURING AND LAUNCH ACTIVITIES TO DRIVE GROWTH

14.5.1.1

EXPANSION OF EARTH OBSERVATION CAPABILITIES TO DRIVE GROWTH

14.5.2.1

PROGRESS IN SATELLITE MANUFACTURING TO DRIVE GROWTH

14.5.3

REST OF MIDDLE EAST

14.6.1.1

COLLABORATIONS WITH FOREIGN SPACE AGENCIES TO DRIVE GROWTH

14.6.2.1

LAUNCH OF NANOSATELLITES TO DRIVE GROWTH

15

COMPETITIVE LANDSCAPE

Uncover dominant strategies and market shifts shaping industry leaders and emerging players.

236

15.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

15.3

REVENUE ANALYSIS, 2021–2024

15.4

MARKET SHARE ANALYSIS, 2024

15.6

COMPANY VALUATION AND FINANCIAL METRICS

15.7

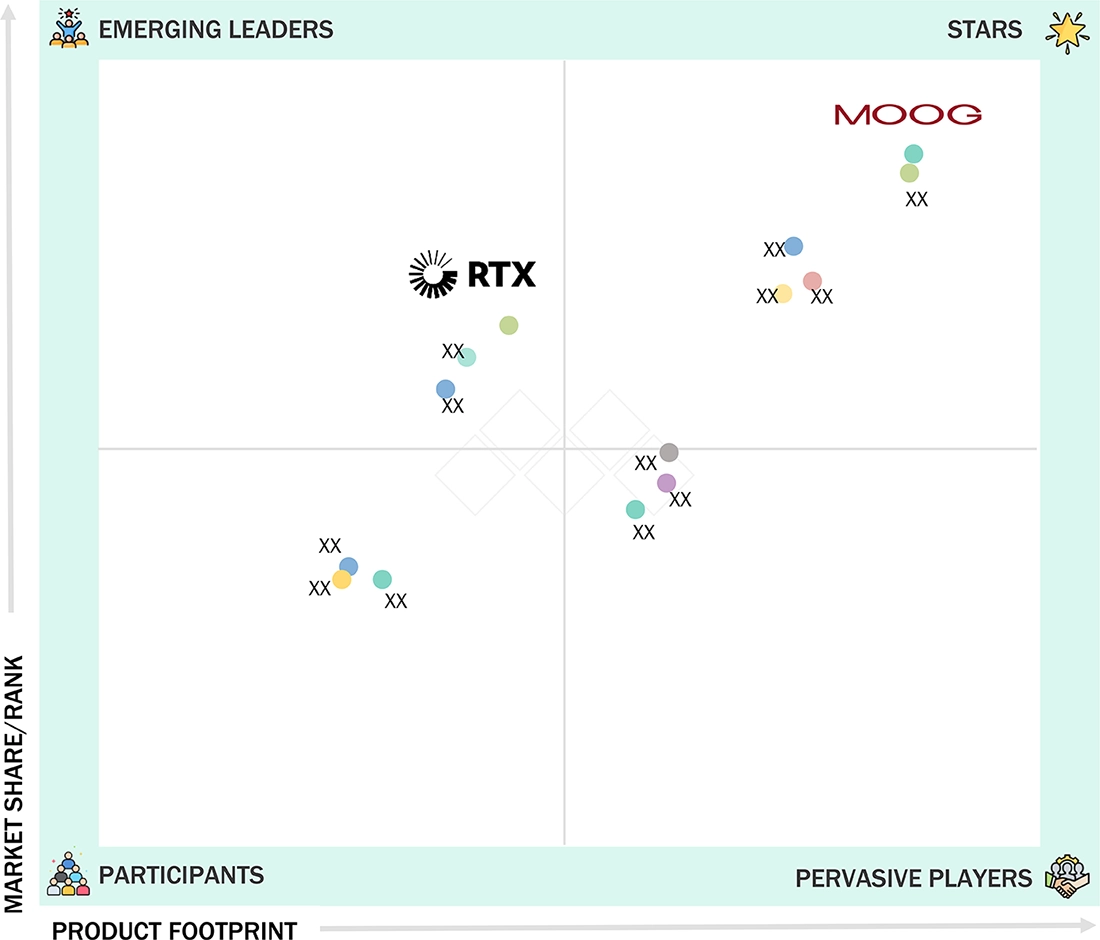

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

15.7.5.1

COMPANY FOOTPRINT

15.7.5.2

REGION FOOTPRINT

15.7.5.3

PRODUCT TYPE FOOTPRINT

15.7.5.4

END USER FOOTPRINT

15.7.5.5

PLATFORM FOOTPRINT

15.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

15.8.1

PROGRESSIVE COMPANIES

15.8.2

RESPONSIVE COMPANIES

15.8.5

COMPETITIVE BENCHMARKING

15.8.5.1

LIST OF STARTUPS/SMES

15.8.5.2

COMPETITIVE BENCHMARKING OF STARTUPS/SMES

15.9

COMPETITIVE SCENARIO

16

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

262

16.1.1

HONEYWELL INTERNATIONAL INC.

16.1.1.1

BUSINESS OVERVIEW

16.1.1.2

PRODUCTS OFFERED

16.1.1.3

RECENT DEVELOPMENTS

16.1.2

TELEDYNE TECHNOLOGIES INCORPORATED

16.1.6

L3HARRIS TECHNOLOGIES, INC.

16.1.9

TEXAS INSTRUMENTS INCORPORATED

16.1.12

ANALOG DEVICES, INC.

16.1.14

STMICROELECTRONICS

16.2.6

CEDRAT TECHNOLOGIES SA

16.2.7

CUBESPACE SATELLITE SYSTEMS

16.2.10

BARTINGTON INSTRUMENTS LTD

17.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3

CUSTOMIZATION OPTIONS

TABLE 1

SPACE SENSORS AND ACTUATORS MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 2

USD EXCHANGE RATES, 2020-2024

TABLE 3

COMPARISON BETWEEN BUSINESS MODELS

TABLE 4

STRATEGIC MOVES BY TIER 1, 2, AND 3 PLAYERS

TABLE 5

GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029

TABLE 6

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 7

IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 8

EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 9

KEY CONFERENCES AND EVENTS, 2025-2026

TABLE 10

INDICATIVE PRICING FOR SPACE SENSORS AND ACTUATORS, BY PRODUCT TYPE

TABLE 11

LIST OF MAJOR PATENTS FOR SPACE SENSORS AND ACTUATORS (2021-2024)

TABLE 12

SPACE SENSORS AND ACTUATORS: ENABLING NEXT-GENERATION SPACECRAFT AUTONOMY

TABLE 13

QUANTUM AND PHOTONIC SENSORS: NEXT-GENERATION NAVIGATION AND SCIENCE MISSIONS

TABLE 14

TOP USE CASES AND MARKET POTENTIAL

TABLE 15

BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

TABLE 16

SPACE SENSORS AND ACTUATORS MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

TABLE 17

INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

TABLE 18

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SPACE SENSORS AND ACTUATORS, BY END USER (%)

TABLE 19

KEY BUYING CRITERIA FOR SPACE SENSORS AND ACTUATORS MARKET, BY END USER

TABLE 20

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25

GLOBAL INDUSTRY STANDARDS IN SPACE SENSORS AND ACTUATORS MARKET

TABLE 26

CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN SPACE SENSORS AND ACTUATORS MARKET

TABLE 27

SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 28

SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 29

SPACE SENSORS AND ACTUATORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 30

SPACE SENSORS AND ACTUATORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 31

SPACE SENSORS AND ACTUATORS MARKET, BY ATTITUDE & NAVIGATION SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 32

SPACE SENSORS AND ACTUATORS MARKET, BY ATTITUDE & NAVIGATION SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 33

SPACE SENSORS AND ACTUATORS MARKET, BY ENVIRONMENTAL SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 34

SPACE SENSORS AND ACTUATORS MARKET, BY ENVIRONMENTAL SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 35

SPACE SENSORS AND ACTUATORS MARKET, BY IMAGE SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 36

SPACE SENSORS AND ACTUATORS MARKET, BY IMAGE SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 37

SPACE SENSORS AND ACTUATORS MARKET, BY PROXIMITY, POSITION, AND RANGING SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 38

SPACE SENSORS AND ACTUATORS MARKET, BY PROXIMITY, POSITION, AND RANGING SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 39

SPACE SENSORS AND ACTUATORS MARKET, BY ACTUATOR TYPE, 2021–2024 (USD MILLION)

TABLE 40

SPACE SENSORS AND ACTUATORS MARKET, BY ACTUATOR TYPE, 2025–2030 (USD MILLION)

TABLE 41

SPACE SENSORS AND ACTUATORS MARKET, BY LINEAR ACTUATOR TYPE, 2021–2024 (USD MILLION)

TABLE 42

SPACE SENSORS AND ACTUATORS MARKET, BY LINEAR ACTUATOR TYPE, 2025–2030 (USD MILLION)

TABLE 43

SPACE SENSORS AND ACTUATORS MARKET, BY ROTARY ACTUATOR TYPE, 2021–2024 (USD MILLION)

TABLE 44

SPACE SENSORS AND ACTUATORS MARKET, BY ROTARY ACTUATOR TYPE, 2025–2030 (USD MILLION)

TABLE 45

SPACE SENSORS AND ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 46

SPACE SENSORS AND ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 47

SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 48

SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 49

SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 50

SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 51

SPACE SENSORS MARKET, BY SATELLITE TYPE, 2021–2024 (USD MILLION)

TABLE 52

SPACE SENSORS MARKET, BY SATELLITE TYPE, 2025–2030 (USD MILLION)

TABLE 53

SPACE ACTUATORS MARKET, BY SATELLITE TYPE, 2021–2024 (USD MILLION)

TABLE 54

SPACE ACTUATORS MARKET, BY SATELLITE TYPE, 2025–2030 (USD MILLION)

TABLE 55

SPACE SENSORS MARKET, BY SMALL SATELLITE TYPE, 2021–2024 (USD MILLION)

TABLE 56

SPACE SENSORS MARKET, BY SMALL SATELLITE TYPE, 2025–2030 (USD MILLION)

TABLE 57

SPACE ACTUATORS MARKET, BY SMALL SATELLITE TYPE, 2021–2024 (USD MILLION)

TABLE 58

SPACE ACTUATORS MARKET, BY SMALL SATELLITE TYPE, 2025–2030 (USD MILLION)

TABLE 59

SPACE SENSORS MARKET, BY CAPSULE/CARGO TYPE, 2021–2024 (USD MILLION)

TABLE 60

SPACE SENSORS MARKET, BY CAPSULE/CARGO TYPE, 2025–2030 (USD MILLION)

TABLE 61

SPACE ACTUATORS MARKET, BY CAPSULE/CARGO TYPE, 2021–2024 (USD MILLION)

TABLE 62

SPACE ACTUATORS MARKET, BY CAPSULE/CARGO TYPE, 2025–2030 (USD MILLION)

TABLE 63

SPACE SENSORS MARKET, BY LAUNCH VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 64

SPACE SENSORS MARKET, BY LAUNCH VEHICLE TYPE, 2025–2030 (USD MILLION)

TABLE 65

SPACE ACTUATORS MARKET, BY LAUNCH VEHICLE TYPE, 2021–2024 (USD MILLION)

TABLE 66

SPACE ACTUATORS MARKET, BY LAUNCH VEHICLE TYPE, 2025–2030 (USD MILLION)

TABLE 67

SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 68

SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 69

SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 70

SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 71

SPACE SENSORS AND ACTUATORS MARKET, BY COMMERCIAL END USER, 2021–2024 (USD MILLION)

TABLE 72

SPACE SENSORS AND ACTUATORS MARKET, BY COMMERCIAL END USER, 2025–2030 (USD MILLION)

TABLE 73

SPACE SENSORS AND ACTUATORS MARKET, BY GOVERNMENT & DEFENSE END USER, 2021–2024 (USD MILLION)

TABLE 74

SPACE SENSORS AND ACTUATORS MARKET, BY GOVERNMENT & DEFENSE END USER, 2025–2030 (USD MILLION)

TABLE 75

SPACE SENSORS AND ACTUATORS MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 76

SPACE SENSORS AND ACTUATORS MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 77

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 78

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 79

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 80

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 81

NORTH AMERICA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 82

NORTH AMERICA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 83

NORTH AMERICA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 84

NORTH AMERICA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 85

NORTH AMERICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 86

NORTH AMERICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 87

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 88

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 89

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 90

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 91

US: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 92

US: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 93

US: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 94

US: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 95

US: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 96

US: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 97

US: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 98

US: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 99

US: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 100

US: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 101

CANADA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 102

CANADA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 103

CANADA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 104

CANADA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 105

CANADA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 106

CANADA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 107

CANADA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 108

CANADA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 109

CANADA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 110

CANADA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 111

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 112

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 113

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 114

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 115

EUROPE: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 116

EUROPE: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 117

EUROPE: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 118

EUROPE: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 119

EUROPE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 120

EUROPE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 121

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 122

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 123

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 124

EUROPE: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 125

RUSSIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 126

RUSSIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 127

RUSSIA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 128

RUSSIA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 129

RUSSIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 130

RUSSIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 131

RUSSIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 132

RUSSIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 133

RUSSIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 134

RUSSIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 135

GERMANY: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 136

GERMANY: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 137

GERMANY: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 138

GERMANY: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 139

GERMANY: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 140

GERMANY: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 141

GERMANY: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 142

GERMANY: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 143

GERMANY: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 144

GERMANY: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 145

FRANCE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 146

FRANCE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 147

FRANCE: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 148

FRANCE: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 149

FRANCE: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 150

FRANCE: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 151

FRANCE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 152

FRANCE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 153

FRANCE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 154

FRANCE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 155

UK: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 156

UK: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 157

UK: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 158

UK: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 159

UK: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 160

UK: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 161

UK: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 162

UK: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 163

UK: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 164

UK: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 165

ITALY: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 166

ITALY: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 167

ITALY: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 168

ITALY: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 169

ITALY: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 170

ITALY: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 171

ITALY: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 172

ITALY: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 173

ITALY: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 174

ITALY: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 175

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 176

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 177

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 178

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 179

ASIA PACIFIC: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 180

ASIA PACIFIC: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 181

ASIA PACIFIC: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 182

ASIA PACIFIC: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 183

ASIA PACIFIC: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 184

ASIA PACIFIC: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 185

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 186

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 187

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 188

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 189

CHINA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 190

CHINA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 191

CHINA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 192

CHINA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 193

CHINA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 194

CHINA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 195

CHINA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 196

CHINA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 197

CHINA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 198

CHINA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 199

INDIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 200

INDIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 201

INDIA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 202

INDIA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 203

INDIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 204

INDIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 205

INDIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 206

INDIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 207

INDIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 208

INDIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 209

JAPAN: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 210

JAPAN: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 211

JAPAN: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 212

JAPAN: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 213

JAPAN: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 214

JAPAN: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 215

JAPAN: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 216

JAPAN: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 217

JAPAN: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 218

JAPAN: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 219

SOUTH KOREA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 220

SOUTH KOREA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 221

SOUTH KOREA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 222

SOUTH KOREA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 223

SOUTH KOREA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 224

SOUTH KOREA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 225

SOUTH KOREA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 226

SOUTH KOREA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 227

SOUTH KOREA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 228

SOUTH KOREA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 229

AUSTRALIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 230

AUSTRALIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 231

AUSTRALIA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 232

AUSTRALIA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 233

AUSTRALIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 234

AUSTRALIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 235

AUSTRALIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 236

AUSTRALIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 237

AUSTRALIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 238

AUSTRALIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 239

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 240

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 241

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 242

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 243

MIDDLE EAST: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 244

MIDDLE EAST: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 245

MIDDLE EAST: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 246

MIDDLE EAST: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 247

MIDDLE EAST: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 248

MIDDLE EAST: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 249

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 250

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 251

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 252

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 253

SAUDI ARABIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 254

SAUDI ARABIA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 255

SAUDI ARABIA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 256

SAUDI ARABIA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 257

SAUDI ARABIA: SPACE ACTUATOR MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 258

SAUDI ARABIA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 259

SAUDI ARABIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 260

SAUDI ARABIA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 261

SAUDI ARABIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 262

SAUDI ARABIA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 263

UAE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 264

UAE: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 265

UAE: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 266

UAE: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 267

UAE: SPACE ACTUATOR MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 268

UAE: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 269

UAE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 270

UAE: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 271

UAE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 272

UAE: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 273

REST OF MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 274

REST OF MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 275

REST OF MIDDLE EAST: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 276

REST OF MIDDLE EAST: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 277

REST OF MIDDLE EAST: SPACE ACTUATOR MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 278

REST OF MIDDLE EAST: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 279

REST OF MIDDLE EAST: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 280

REST OF MIDDLE EAST: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 281

REST OF MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 282

REST OF MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 283

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 284

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 285

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 286

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 287

REST OF THE WORLD: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 288

REST OF THE WORLD: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 289

REST OF THE WORLD: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 290

REST OF THE WORLD: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 291

REST OF THE WORLD: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 292

REST OF THE WORLD: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 293

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 294

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 295

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 296

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 297

LATIN AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 298

LATIN AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 299

LATIN AMERICA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 300

LATIN AMERICA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 301

LATIN AMERICA: SPACE ACTUATOR MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 302

LATIN AMERICA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 303

LATIN AMERICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 304

LATIN AMERICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 305

LATIN AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 306

LATIN AMERICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 307

AFRICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION)

TABLE 308

AFRICA: SPACE SENSORS AND ACTUATORS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION)

TABLE 309

AFRICA: SPACE SENSORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 310

AFRICA: SPACE SENSORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 311

AFRICA: SPACE ACTUATORS MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 312

AFRICA: SPACE ACTUATORS MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 313

AFRICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION)

TABLE 314

AFRICA: SPACE SENSORS MARKET, BY SENSOR TYPE, 2025–2030 (USD MILLION)

TABLE 315

AFRICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 316

AFRICA: SPACE SENSORS AND ACTUATORS MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 317

KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020–OCTOBER 2025

TABLE 318

SPACE SENSORS AND ACTUATORS MARKET: DEGREE OF COMPETITION

TABLE 319

SPACE SENSORS AND ACTUATORS MARKET: REGION FOOTPRINT

TABLE 320

SPACE SENSORS AND ACTUATORS MARKET: PRODUCT TYPE FOOTPRINT

TABLE 321

SPACE SENSORS AND ACTUATORS MARKET: END USER FOOTPRINT

TABLE 322

SPACE SENSORS AND ACTUATORS MARKET: PLATFORM FOOTPRINT

TABLE 323

LIST OF KEY STARTUPS/SMES

TABLE 324

COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 325

SPACE SENSORS AND ACTUATORS MARKET: PRODUCT LAUNCHES, JANUARY 2020–OCTOBER 2025

TABLE 326

SPACE SENSORS AND ACTUATORS MARKET: DEALS, JANUARY 2020– OCTOBER 2025

TABLE 327

SPACE SENSORS AND ACTUATORS MARKET: OTHERS, JANUARY 2020– OCTOBER 2025

TABLE 328

HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 329

HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

TABLE 330

HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 331

HONEYWELL INTERNATIONAL INC.: DEALS

TABLE 332

HONEYWELL INTERNATIONAL INC.: OTHERS

TABLE 333

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

TABLE 334

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

TABLE 335

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

TABLE 336

TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

TABLE 337

TELEDYNE TECHNOLOGIES INCORPORATED: OTHERS

TABLE 338

MOOG INC.: COMPANY OVERVIEW

TABLE 339

MOOG INC.: PRODUCTS OFFERED

TABLE 340

MOOG INC.: EXPANSIONS

TABLE 341

MOOG INC.: OTHERS

TABLE 342

SAFRAN GROUP: COMPANY OVERVIEW

TABLE 343

SAFRAN GROUP: PRODUCTS OFFERED

TABLE 344

SAFRAN GROUP: DEALS

TABLE 345

SAFRAN GROUP: OTHERS

TABLE 346

AIRBUS: COMPANY OVERVIEW

TABLE 347

AIRBUS: PRODUCTS OFFERED

TABLE 348

L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

TABLE 349

L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

TABLE 350

L3HARRIS TECHNOLOGIES, INC.: OTHERS

TABLE 351

RTX: COMPANY OVERVIEW

TABLE 352

RTX: PRODUCTS OFFERED

TABLE 354

VANTOR: COMPANY OVERVIEW

TABLE 355

VANTOR: PRODUCTS OFFERED

TABLE 358

TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

TABLE 359

TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

TABLE 360

TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

TABLE 361

TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

TABLE 362

AMETEK.INC.: COMPANY OVERVIEW

TABLE 363

AMETEK.INC.: PRODUCTS OFFERED

TABLE 364

AMETEK.INC.: DEALS

TABLE 365

Beyond Gravity: COMPANY OVERVIEW

TABLE 366

Beyond Gravity: PRODUCTS OFFERED

TABLE 367

Beyond Gravity: OTHERS

TABLE 368

ANALOG DEVICES, INC.: COMPANY OVERVIEW

TABLE 369

ANALOG DEVICES, INC.: PRODUCTS OFFERED

TABLE 370

BAE SYSTEMS: COMPANY OVERVIEW

TABLE 371

BAE SYSTEMS: PRODUCTS OFFERED

TABLE 372

BAE SYSTEMS: PRODUCT LAUNCHES

TABLE 373

BAE SYSTEMS: DEALS

TABLE 374

BAE SYSTEMS: OTHERS

TABLE 375

STMICROELECTRONICS: COMPANY OVERVIEW

TABLE 376

STMICROELECTRONICS: PRODUCTS OFFERED

TABLE 377

BLUE ORIGIN: PRODUCTS OFFERED

TABLE 378

BLUE ORIGIN: DEALS

TABLE 379

BLUE ORIGIN: OTHERS

TABLE 380

TE CONNECTIVITY: COMPANY OVERVIEW

TABLE 381

TE CONNECTIVITY: PRODUCTS OFFERED

TABLE 382

TE CONNECTIVITY: DEALS

TABLE 383

INNALABS.: COMPANY OVERVIEW

TABLE 384

COMAT: COMPANY OVERVIEW

TABLE 385

SPACE-LOCK GMBH: COMPANY OVERVIEW

TABLE 386

NEWSPACE SYSTEMS: COMPANY OVERVIEW

TABLE 387

VEOWARE: COMPANY OVERVIEW

TABLE 388

CABRAT TECHNOLOGIES SA: COMPANY OVERVIEW

TABLE 389

CUBESPACE SATELLITE SYSTEMS: COMPANY OVERVIEW

TABLE 390

MAGSON GMBH: COMPANY OVERVIEW

TABLE 391

ISP SYSTEM: COMPANY OVERVIEW

TABLE 392

BARTINGTON INSTRUMENTS LTD: COMPANY OVERVIEW

FIGURE 1

SPACE SENSORS AND ACTUATORS MARKET SEGMENTATION

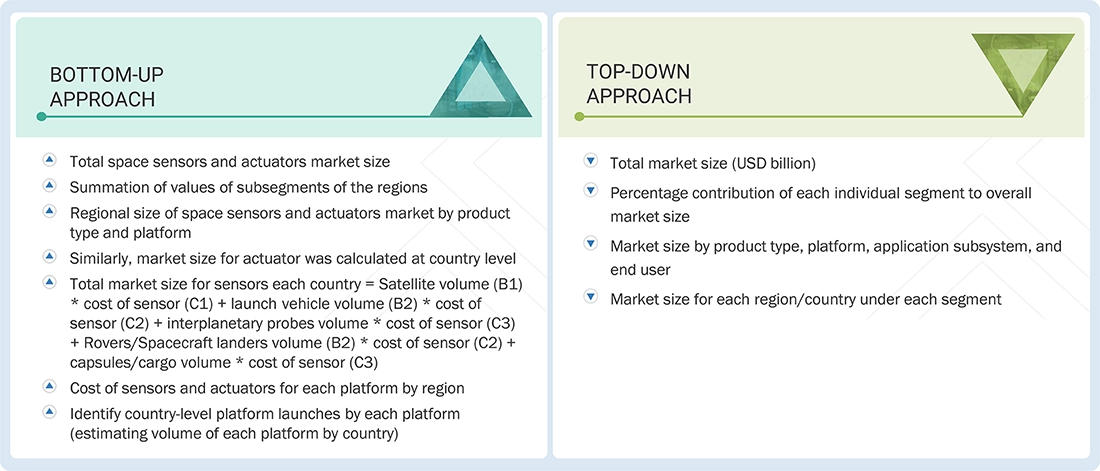

FIGURE 4

MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5

MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6

DATA TRIANGULATION METHODOLOGY

FIGURE 7

KEY INSIGHTS AND MARKET HIGHLIGHTS

FIGURE 8

MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN SPACE SENSORS AND ACTUATORS MARKET (2020-2025)

FIGURE 9

NORTH AMERICA TO ACCOUNT FOR LEADING MARKET SHARE IN 2025

FIGURE 10

NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 11

INCREASING DEMAND FOR SATELLITE-BASED SERVICES AND DEEP SPACE ACTIVITIES TO DRIVE MARKET

FIGURE 12

SENSORS SEGMENT TO REGISTER HIGHER CAGR IN 2025-2030

FIGURE 13

COMMERCIAL END USER SEGMENT TO ACCOUNT FOR DOMINANT MARKET SHARE IN 2025

FIGURE 14

INTERPLANETARY SPACECRAFT AND PROBES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 15

DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPACE SENSORS AND ACTUATORS MARKET

FIGURE 16

VALUE CHAIN ANALYSIS

FIGURE 17

ECOSYSTEM ANALYSIS OF SPACE SENSORS AND ACTUATORS MARKET

FIGURE 18

IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 19

EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 20

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 21

INVESTMENT AND FUNDING SCENARIO, 2021–2025

FIGURE 22

AVERAGE SELLING PRICE TREND OF SPACE SENSORS AND ACTUATORS, BY REGION, 2021-2024 (USD MILLION)

FIGURE 23

TECHNOLOGY ROADMAP (2020-2035)

FIGURE 24

EMERGING TECHNOLOGY TRENDS

FIGURE 25

PATENT ANALYSIS

FIGURE 26

FUTURE APPLICATIONS

FIGURE 27

SPACE SENSORS AND ACTUATORS MARKET: IMPACT OF AI/GEN AI

FIGURE 28

SPACE SENSORS AND ACTUATORS MARKET: DECISION-MAKING FACTORS

FIGURE 29

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

FIGURE 30

KEY BUYING CRITERIA FOR SPACE SENSORS AND ACTUATORS, BY END USER

FIGURE 31

ADOPTION BARRIERS AND INTERNAL CHALLENGES

FIGURE 32

SENSORS SEGMENT TO WITNESS HIGHER CAGR THAN ACTUATORS SEGMENT DURING FORECAST PERIOD

FIGURE 33

INTERPLANETARY SPACECRAFT AND PROBES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34

COMMUNICATION POINTING & RF SWITCHING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35

COMMERCIAL SEGMENT TO LEAD SPACE SENSORS AND ACTUATORS MARKET DURING FORECAST PERIOD

FIGURE 36

SPACE SENSORS AND ACTUATORS MARKET IN NORTH AMERICA TO CAPTURE LARGEST SHARE IN 2025

FIGURE 37

NORTH AMERICA: SPACE SENSORS AND ACTUATORS MARKET SNAPSHOT

FIGURE 38

EUROPE: SPACE SENSORS AND ACTUATORS MARKET SNAPSHOT

FIGURE 39

ASIA PACIFIC: SPACE SENSORS AND ACTUATORS MARKET SNAPSHOT

FIGURE 40

MIDDLE EAST: SPACE SENSORS AND ACTUATORS MARKET SNAPSHOT

FIGURE 41

REST OF THE WORLD: SPACE SENSORS AND ACTUATORS MARKET SNAPSHOT

FIGURE 42

REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021–2024

FIGURE 43

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 44

BRAND COMPARISON IN SPACE SENSORS AND ACTUATORS MARKET

FIGURE 45

FINANCIAL METRICS OF PROMINENT PLAYERS, 2025

FIGURE 46

VALUATION OF PROMINENT PLAYERS, 2025

FIGURE 47

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 48

SPACE SENSORS AND ACTUATORS MARKET: COMPANY FOOTPRINT

FIGURE 49

COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

FIGURE 50

HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 51

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

FIGURE 52

MOOG INC.: COMPANY SNAPSHOT

FIGURE 53

SAFRAN GROUP: COMPANY SNAPSHOT

FIGURE 54

AIRBUS: COMPANY SNAPSHOT

FIGURE 55

L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 56

RTX: COMPANY SNAPSHOT

FIGURE 57

TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FIGURE 58

AMETEK.INC.: COMPANY SNAPSHOT

FIGURE 59

Beyond Gravity: COMPANY SNAPSHOT

FIGURE 60

ANALOG DEVICES, INC.: COMPANY SNAPSHOT

FIGURE 61

BAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 62

STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 63

TE CONNECTIVITY: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Space Sensors and Actuators Market