Terahertz Technology Market Size, Share & Trends

Terahertz Technology Market by Terahertz Imaging, Terahertz Spectroscopy, Terahertz Communication Systems, Laboratory Research, Medical & Healthcare, Industrial NDT, Outdoor/Indoor Wireless Communications - Global Forecast to 2030

OVERVIEW

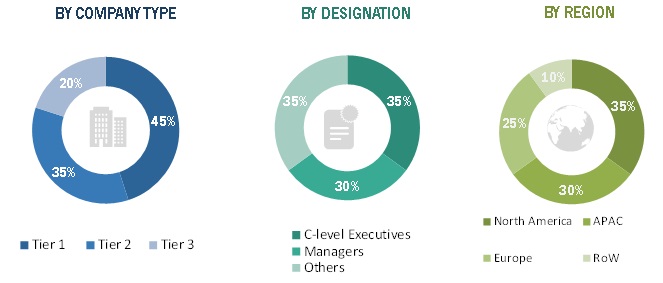

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The terahertz technology market worldwide is set to grow from USD 0.82 billion in 2025 to USD 1.71 billion by 2030 at a CAGR of 15.8%. The rising adoption of terahertz technology in medical imaging, material characterization, and security screening is a key growth-inducing factor in the market. Healthcare institutions are increasingly deploying terahertz-based systems for non-invasive diagnostics and early disease detection, while industries rely on them for precise material inspection and quality control. In parallel, governments and defense organizations are leveraging terahertz scanners for advanced security screening and threat detection. This steady demand is further supported by ongoing advancements in compact sources & detectors, and imaging systems, which are enhancing usability, accuracy, and cost efficiency.

KEY TAKEAWAYS

-

BY TYPEThe terahertz technology market is segmented by type, with terahertz imaging, terahertz spectroscopy, and terahertz communication systems growing the fastest. This is driven by demand for ultra-high-speed wireless data, 6G networks, and high-capacity connectivity for data centers, autonomous vehicles, and IoT applications.

-

BY APPLICATIONThe terahertz technology market is segmented by application into laboratory research, medical & healthcare, military & homeland security, industrial NDT, satellite communications, tactical/military communications, and outdoor/indoor communications. Laboratory research is estimated to account for the largest share by 2030, driven by growing investments from universities, research institutions, and tech companies to develop new terahertz applications in spectroscopy, imaging, and high-speed communication.

-

BY REGIONAsia Pacific is projected to grow the fastest in the terahertz technology market due to the presence of key technology manufacturers, increasing government and private investments in research & development, and rising adoption of advanced applications such as high-speed wireless communications, medical imaging, and industrial inspection. Rapid industrialization, growing demand for next-generation 6G networks, and expanding smart city and IoT initiatives further accelerate market growth in the region.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic growth strategies, including partnerships, product launches, and collaborations. The leading market players are ADVANTEST Corporation, Luna Innovations, and Teraview Limited, leading with broad product portfolios, while niche companies such as Sciencetech Inc. and Batop GmbH bring innovation in high-reliability designs.

The terahertz technology market is expected to grow steadily over the next decade, driven by advancements in terahertz generation, detection, and imaging technologies. Terahertz systems are increasingly used in telecommunications, medical imaging, security screening, and industrial inspection due to their high resolution, non-ionizing nature, and material penetration capabilities. Expanding applications in high-speed wireless communications, spectroscopy, and quality control, along with growing investments from governments and tech companies, are supporting the market’s global growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The terahertz technology market is poised for a significant transformation, driven by emerging applications and new revenue sources. Traditional areas are being complemented by advancements in 6G and next-generation wireless communication, automotive safety, autonomous navigation sensors, medical imaging and diagnostics, industrial automation, smart manufacturing, and security screening. Key clients, including laboratory research, medical & healthcare, military and homeland security, industrial NDT, satellite communication, and tactical/communication sectors, are experiencing a shift in their revenue mix. This evolution is enabling enhanced capabilities in concealed weapon detection, explosives and hazardous material identification, surveillance and perimeter security, and counterterrorism operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing use in security screening and surveillance applications

-

Rising application in medical imaging and diagnostics

Level

-

Limited awareness and expertise across end-user industries

-

Complex integration with existing systems

Level

-

Role in 6G and ultra-high-speed communications

-

Expansion into the automotive sector for ADAS (Advanced Driver Assistance Systems)

Level

-

Technical barriers to generating and detecting stable THz signals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising application in medical imaging and diagnostics

The increasing focus on public safety and security has elevated the importance of terahertz technology in screening and surveillance systems. Unlike ionizing methods, terahertz waves are non-harmful and can safely penetrate fabrics and plastics to detect concealed items such as weapons or explosives. This trend is driving the adoption, with both government agencies and private organizations recognizing terahertz systems as effective, non-invasive alternatives to traditional X-ray and millimeter-wave scanners. For instance, in June 2025, Cambridge Terahertz Inc. (US) received a USD 1.25 million SBIR (Small Business Innovation Research) Phase II award from the U.S. National Science Foundation to develop a terahertz imaging radar for real-time, contactless weapon detection in public transit and educational facilities. Additionally, in 2023, the NSF granted USD 274,927 (Phase I) to the company for creating a portable terahertz radar system for law enforcement, capable of detecting non-metallic threats like 3D-printed firearms and ceramic knives, offering a compact, cost-effective alternative to conventional airport scanners.

Restraint: Complex integration with existing systems

A key restraint limiting the broader adoption of terahertz technology is the complexity of integrating terahertz systems into existing industrial, communication, medical, and security infrastructures. Unlike established technologies with standardized protocols and interfaces, terahertz systems often demand custom components, specialized calibration, and tailored software, increasing both technical challenges and costs for end-users. Many legacy systems cannot operate at the high frequencies or bandwidths required by terahertz devices, necessitating significant retrofitting or system upgrades. This integration challenge is especially critical in sectors like telecommunications, where reliability is essential. Consequently, organizations may delay or avoid adoption of terahertz despite its advantages, slowing market penetration and creating a gap between research innovation and commercial deployment.

Opportunity: Role in 6G and ultra-high-speed communications

The shift toward 6G wireless networks presents a significant growth opportunity for the terahertz technology market. 6G aims to deliver data rates exceeding 1 terabit per second, ultra-low latency, and massive device connectivity, requiring frequencies well beyond the millimeter-wave spectrum used in 5G. With their ultra-wide bandwidth and short wavelengths, terahertz waves are ideally suited to meet these demands, enabling faster data transmission and advanced applications such as real-time holographic communication and immersive extended reality (XR). As global 6G standardization efforts advance, terahertz technology is becoming a key enabler for prototype development, spectrum research, and field trials. This transition offers substantial growth potential for the terahertz technology market, as telecommunications firms, semiconductor manufacturers, and network equipment providers increasingly adopt terahertz technology components, test systems, and integrated solutions to support next-generation wireless connectivity.

Challenge: Technical barriers to generating and detecting stable terahertz signals

A key challenge limiting the growth of the terahertz technology market is the technical difficulty in generating and detecting stable terahertz signals. Positioned between the microwave and infrared regions of the electromagnetic spectrum, terahertz frequencies require highly specialized components for effective generation and detection. Current systems often face low output power, signal instability, and restricted operational range, especially in compact or portable designs. These limitations impede real-world deployment, where reliable, high-quality signals are crucial for accurate imaging, spectroscopy, and communication. Additionally, developing advanced terahertz sources and detectors involves complex engineering and material challenges, resulting in higher costs and extended development timelines, which constrain the technology’s scalability and broader adoption.

Terahertz Technology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

NVIDIA faced difficulties in chip-level failure analysis (FA) for advanced packaging technologies such as CoWOS, 2.5D, and 3D ICs, as traditional methods lacked sufficient resolution and depth. To address this, NVIDIA adopted TeraView Limited’s Electro-Optical Terahertz Pulse Reflectometry (EOTPR) system, which uses terahertz pulses to accurately detect impedance discontinuities and localize faults like open circuits and grounding issues. | EOTPR enabled precise, non-destructive fault localization with higher resolution, improving speed and efficiency in FA. It also provided valuable feedback to OSAT and foundry partners, enhancing collaboration and throughput across complex semiconductor packaging workflows. |

|

In collaboration with Bridgestone Tire (Japan), Luna Innovations deployed its single-sided T-Gauge terahertz (THz) sensor to address challenges in the calendaring process of tire manufacturing. The sensor enables rapid, high-frequency thickness measurements, delivering precise control of sheet gauge and material balance, which conventional mass-based methods could not achieve. | The THz-based solution optimized material usage by allowing operation near minimum thickness limits, generating significant cost savings (e.g., USD 1.2 million annually from a 0.025 mm reduction). It improved product quality, minimized scrap, enhanced safety by eliminating hazardous radiation sources, and supported sustainability by reducing material waste, while ensuring reliable performance in demanding industrial environments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The terahertz technology ecosystem market comprises major players such as ADVANTEST CORPORATION (Japan), HÜBNER GmbH & Co. KG (Germany), TOPTICA Photonics AG (Germany), Menlo Systems (Germany), and Luna Innovations (US). These leading companies have a global presence and are pursuing strategic collaborations, acquisitions, and technological enhancements to increase their strength. Through continuous efforts, the companies provide better services, support for environmentally friendly initiatives, and innovative solutions for meeting evolving market demands.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Terahertz Technology Market, by Type

The terahertz technology market is segmented by type, which includes terahertz imaging, terahertz spectroscopy, and terahertz communication systems. The terahertz imaging is estimated to have held the largest share of the terahertz technology market in 2024. Terahertz imaging remains the most widely adopted application because it enables non-destructive and non-ionizing visualization, which is increasingly valued across diverse industries such as healthcare, defense, security, and manufacturing. Terahertz imaging systems are vital tools that deliver high-resolution, real-time images capable of identifying concealed objects, detecting material defects, and capturing biomedical details without damaging the subject under analysis. This unique capability has positioned terahertz imaging as the most commercially viable and impactful application of terahertz technology. Organizations across sectors are investing heavily in terahertz imaging hardware to strengthen security screening at airports, optimize industrial quality assurance, and support advanced medical diagnostics.

Terahertz Technology Market, by Application

The terahertz technology market is segmented by application into laboratory research, medical & healthcare, military & homeland security, industrial NDT, satellite communications, tactical/military communications, and outdoor/indoor communications. The satellite communication segment is expected to record the fastest growth rate in the terahertz technology market during the forecast period. Terahertz frequencies offer unique advantages for satellite networks, including extremely high bandwidth, faster data transmission, and enhanced reliability for secure long-distance communication. These capabilities make THz-based systems particularly suited for next-generation satellite constellations, inter-satellite links, and high-capacity ground-to-satellite connections. A major factor driving this growth is the increasing global demand for high-speed and low-latency connectivity. Industries such as aerospace, defense, and commercial broadband providers rapidly adopt advanced satellite solutions to meet requirements for real-time imaging, high-definition broadcasting, and reliable communication in remote or underserved regions.

REGION

Asia Pacific to be the fastest-growing region in the global terahertz technology market during the forecast period

Asia Pacific is projected to witness the highest CAGR in the terahertz technology market during the forecast period, driven by the region’s expanding industrial base, rising healthcare needs, and growing security requirements. Countries such as China, Japan, South Korea, and India are leading the adoption of terahertz-based solutions, supported by both government initiatives and private sector investments. Healthcare is emerging as one of the key growth drivers, with terahertz imaging being actively explored for advanced diagnostics, including early-stage cancer detection and real-time medical imaging.

Terahertz Technology Market: COMPANY EVALUATION MATRIX

In the terahertz technology market matrix, ADVANTEST Corporation (Japan) (Star) emerges as the leader with a strong global presence and a comprehensive portfolio of terahertz testing and measurement solutions, particularly for semiconductor and high-speed communication applications. The company's extensive expertise in precision instrumentation and continuous innovation enables it to support advanced research, high-speed wireless networks, and industrial inspection, positioning it at the forefront of market adoption. Menlo Systems GmbH (Germany) (Emerging Leader) is rapidly gaining recognition with its cutting-edge terahertz generation and detection technologies, catering to growing demand in spectroscopy, imaging, and communication systems. While ADVANTEST benefits from scale, brand strength, and established market leadership, Menlo Systems demonstrates strong growth potential to move into the leaders’ quadrant by focusing on technological innovation and expanding its global reach.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.64 Billion |

| Market Forecast, 2030 (Value) | USD 1.71 Billion |

| Growth Rate | 15.8% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Terahertz Technology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Security & Defense Contractor |

|

|

| European Research Institute (R&D Focus) |

|

|

| Medical Device Manufacturer |

|

|

| Asian Semiconductor Company (Entering Terahertz Market) |

|

|

RECENT DEVELOPMENTS

- July 2025 : Teraview Limited (UK) partnered with DOOLIM-YASKAWA (South Korea) to deploy its TeraCota 2000 sensor for real-time automotive paint inspection. The deal coincided with Teraview securing a US patent for film coating measurement.

- August 2024 : Teraview Limited (UK) launched the TeraCota 3500 terahertz sensor for EV battery anode manufacturing. It enabled real-time, non-contact coating measurement with less than 1% accuracy in lab and in-line settings.

- June 2024 : HÜBNER GmbH & Co. KG (Germany) launched the VALO Tidal femtosecond laser for terahertz applications. It delivered sub-40 fs pulses with 3W power, enabling broadband terahertz generation and advanced imaging.

- April 2024 : TeraSense Inc. (US) expanded its tunable terahertz wave source product line with eight new models (50–500 GHz). The launch supported advanced imaging and spectroscopy applications, strengthening its position in terahertz technology.

- August 2023 : Luna Innovations (US) secured a major contract for its Model 5600 "T-Ray" terahertz system for EV battery inspection. The company scaled production at its Atlanta facility, increasing capacity fourfold.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the terahertz technology market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering terahertz technologies have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the terahertz technology market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of terahertz technology to identify key players based on their products and prevailing industry trends in the terahertz technology market by type, application, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the terahertz technology market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the terahertz technology market.

- Identifying the number of terahertz technology shipped at the global level

- Identifying average selling prices of terahertz technology shipped globally

- Conducting multiple discussion sessions with key opinion leaders to understand different terahertz technology and their deployment in multiple products and applications; analysing the break-up of the work conducted by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases of the company- and region-specific developments undertaken in the terahertz technology market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the terahertz technology market.

- Focusing initially on the top-line investments and expenditures made in the terahertz technology ecosystem, splitting further into product, technology, application, and listing key developments in key market areas

- Identifying all major players offering a variety of terahertz technology products and technology, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which all identified players offer terahertz technology to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the terahertz technology market.

Report Objectives

- To describe and forecast the overall terahertz technology market, by type and application, in terms of value

- To provide the size for the overall market in terms of volume

- To describe operational frequencies of the terahertz technology market

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the terahertz technology ecosystem, along with the average selling prices of device type

- To strategically analyze the ecosystem, Porter’s five forces, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as partnerships, expansion, investments, and acquisitions in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

What are the opportunities in the global terahertz technology market?

The global terahertz technology market presents significant opportunities, driven by rising demand for non-invasive, high-resolution imaging across healthcare, security, and industrial quality control. Moreover, expanding applications in ultrafast wireless communications, including next-generation 6G and IoT connectivity.

Which region is expected to have the largest share in the terahertz technology market?

North America currently holds the largest share in the terahertz technology market, accounting for around 35–41% of total revenue in 2024. The region’s leadership is supported by well-established sectors such as defense, healthcare, telecommunications, and aerospace, along with significant R&D investments, early adoption of emerging technologies, and the strong presence of key terahertz solution providers. However, by 2030, the Asia Pacific is expected to surpass North America and lead the market, driven by rapid industrialization, expanding healthcare infrastructure, growing defense modernization programs, and increasing investments in advanced communication technologies. The shift highlights the transition of terahertz adoption from early mature markets toward high-growth economies.

What are the prominent strategies adopted by the market players?

The key players have adopted product launches, product enhancements, acquisitions, expansions, partnerships, investments, and contracts to strengthen their position in the terahertz technology market.

How big is the global terahertz technology market today?

The global terahertz technology market is projected to grow from USD 818.7 million in 2025 to USD 1,706.5 million by 2030, at a CAGR of 15.8% during the forecast period.

What is the impact of Gen Al/Al on the terahertz technology market on a scale of 1 to 10 (1- least impactful and 10-most impactful)?

The impact is as follows:

|

Use Cases |

Rating |

|

Predictive Maintenance |

7 |

|

Optimized Wireless Communication |

9 |

|

Automated Defect Detection |

8 |

|

Advanced Signal Processing |

9 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Terahertz Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Terahertz Technology Market

Richard

Jan, 2019

Compare THz spectroscopy technologies and the companies that sell them. Pricing information on the different instruments Who is currently building ASOPS systems (Advantest, Menlo) Compare and contrast specs and capabilities of frequency domain systems..

Muhammed

Apr, 2019

I already contributed market researches of MnM. I am working on micromachined THz components, give invited talks, have a featured article on waveguide modeling, in PCB tech. at microwaves. I would be pleased, if you could send me a free sample, and we could discuss about THz market when you are available..