Clinical Mass Spectrometry Market Size, Growth, Share & Trends Analysis

Clinical Mass Spectrometry Market by Component (Detector, Mass Analyzer, Ion Source, Vacuum System), Technique (LC-MS, GC-MS, Standalone MS), Application (TDM, Newborn Screening, Hormonal Testing), Installed Base & Replacement Rate - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Clinical Mass Spectrometry market, valued at US$1.75 billion in 2024, stood at US$1.92 billion in 2025 and is projected to advance at a resilient CAGR of 9.5% from 2025 to 2031, culminating in a forecasted valuation of US$3.31 billion by the end of the period. Demand is underpinned by the shift from immunoassay-based methods to LC-MS platforms for therapeutic drug monitoring, endocrine testing, vitamin analysis, and newborn screening, where higher specificity and the ability to run multiplex panels on a single platform improve result reliability and workflow efficiency. On the demand side, rising chronic disease prevalence, wider implementation of stewardship programs, and gradual expansion of precision-medicine initiatives are increasing the number of patients monitored using mass spectrometry-based assays.

KEY TAKEAWAYS

-

BY REGIONThe North American clinical mass spectrometry market is estimated to account for a 45% revenue share in 2025.

-

BY COMPONENT TYPEBy component type, the vacuum pumps segments are expected to register the highest CAGR of 14.5%.

-

BY TECHNIQUEBy technique, the LC-MS is projected to register the highest CAGR of 9.5% through 2031.

-

BY END USERBy end user, the hospitals segment held a 55% share of the clinical mass spectrometry market in 2025.

-

BY APPLICATIONBy application, the therapeutic drug monitoring segment held a 44% share of the clinical mass spectrometry market in 2025.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSThermo Fisher Scientific (US), Agilent Technologies (US), and SCIEX (US) were identified as some of the key players in the clinical mass spectrometry market (global), given their broad clinical LC-MS/MS portfolios, sizeable installed bases, and strong application-support networks.

-

COMPETITIVE LANDSCAPE - STARTUPSAdvion Interchim Scientific (US), Kore Technologies (UK), and Systronics (India), among others, have established a presence in the clinical mass spectrometry space by supplying niche LC-MS platforms, front-end systems, or regionally focused solutions for hospital and diagnostic laboratories, indicating their potential as emerging participants for further competitive assessment.

The clinical mass spectrometry market is transitioning from a niche, specialist technology to a routine diagnostic platform embedded in hospital and reference laboratory workflows. Laboratories are prioritizing LC-MS/MS systems that deliver high analytical specificity, support multiplex panels for therapeutic drug monitoring, hormones, vitamins, and newborn screening, and can be integrated with existing laboratory information systems and automation tracks. As a result, capital allocation is shifting toward versatile instrument platforms and standardized kits that allow laboratories to consolidate multiple send-out assays onto a single analyzer and improve test economics at scale. Growth in chronic disease management, transplant medicine, and stewardship programs is increasing repeat testing volumes, while precision-medicine initiatives are gradually expanding the use of biomarker-based LC-MS assays in oncology and metabolic disease. Regional growth hotspots in Asia Pacific, particularly China, India, South Korea, and Japan, are driving new installations through hospital modernization and local reference-lab expansion. In contrast, North America and Europe focus more on menu expansion, workflow automation, and replacement of legacy immunoassay methods. Overall, the market is consolidating around vendors that can offer clinically validated LC-MS/MS platforms, application support, and service coverage that meet regulatory requirements and operational constraints across multi-site laboratory networks

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The clinical mass spectrometry market is evolving from a specialist technology to a routine clinical platform that shapes how hospitals and diagnostic networks organize their testing portfolios. Laboratories face pressure to internalize outsourced assays for therapeutic drug monitoring, endocrine disorders, vitamins, and newborn screening, making “internalized outsourcing” a key strategic theme as they seek to reduce dependence on external reference labs and stabilize turnaround times. At the same time, concerns about analytical variability with some immunoassays are encouraging a shift toward LC-MS as a confirmatory or primary method in high-impact areas such as transplant medicine, oncology, and infectious disease, placing analytical reliability and result comparability at the center of procurement decisions. This transition is redefining performance expectations for vendors. Customers now emphasize workflow integration, automation, and ease of use over standalone instrument specifications, driving interest in benchtop clinical LC-MS/MS platforms, standardized sample-prep kits, and middleware that connect seamlessly with LIS and existing automation tracks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift from immunoassays to high-specificity LC-MS/MS testing

-

Expansion of TDM, endocrine, and toxicology test menus in core labs

Level

-

High upfront capital and operating costs of clinical MS systems

-

Shortage of trained MS specialists in routine laboratories

Level

-

Decentralizing MS into mid-sized hospitals and regional labs

-

Leveraging AI and cloud analytics for automated data interpretation and QC

Level

-

Integrating MS workflows seamlessly with LIS, middleware, and automation

-

Standardizing methods and reference ranges across sites and platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift from immunoassays to high-specificity LC-MS/MS testing

Clinical labs are steadily moving away from single-analyte immunoassays in areas where cross-reactivity, interferences, and narrow measuring ranges compromise clinical decisions. LC-MS platforms offer far higher analytical specificity and sensitivity, enabling accurate quantitation of structurally similar drugs, metabolites, steroids, and vitamins in one run. This allows labs to collapse multiple immunoassays into a few multiplexed LC-MS panels, improving turnaround time and reducing per-result cost at medium–high volumes. Guideline updates in areas such as TDM, endocrinology, and toxicology increasingly reference or prefer MS-based methods, further legitimizing this shift. Together, these factors are pushing core and reference laboratories to treat LC-MS as a strategic replacement and complement to immunoassays rather than a niche technology.

Restraint: Shortage of trained MS specialists in routine laboratories

Clinical LC-MS/MS systems require trained technologists and supervisory scientists to operate, troubleshoot, validate new assays, and maintain regulatory compliance. Unlike routine chemistry analyzers that can run on generalist staff, most clinical labs report that MS programs depend on a core team of specialists. In many regions, especially mid-sized hospitals and smaller diagnostic networks, there is a shortage of qualified LC-MS/MS technicians and method-development scientists. Training programs take 12–24 months, and staff turnover or poaching by larger labs can disrupt testing continuity. This labor constraint particularly affects adoption in secondary and tertiary hospitals outside major metropolitan areas and in emerging markets where MS expertise is concentrated in a few large reference centers. Hospitals weighing the decision to invest in LC-MS/MS often hesitate because they cannot guarantee sustained staffing, making this a real (not theoretical) barrier to expansion of the installed base.

Opportunity: Decentralizing MS into mid-sized hospitals and regional labs

Historically, mass spectrometry was confined to large academic centers and national reference labs, but improving usability and footprint is opening a sizeable opportunity in mid-sized hospitals and regional laboratory hubs. Newer benchtop LC-MS systems, preconfigured clinical methods, simplified user interfaces, and vendor-provided validation packages are lowering the expertise barrier for smaller labs. As health systems push to reduce send-out testing, shorten turnaround times, and keep complex cases within their own network, these mid-tier facilities become prime candidates for first-time MS adoption. Vendors that can bundle instruments, reagents, remote training, and service into predictable commercial models (leasing, reagent-rental, managed service) are well-positioned to unlock this next wave of growth. Over time, this decentralization will significantly expand the installed base and recurring consumables revenue beyond today’s highly concentrated top-tier customers.

Challenge: Method Validation Complexity and Regional Fragmentation

Despite strong clinical value, mass spectrometry still sits awkwardly in many lab IT and automation environments. Each system generates complex raw data and derived results that must be mapped correctly into LIS fields, quality flags, and audit trails, often via custom interfaces that are expensive to build and maintain. Lack of standardized data formats, differing middleware capabilities, and fragmented automation (pre-analytics, sample tracking, barcoding) can lead to manual steps, transcription risk, and bottlenecks that erode the efficiency gains of MS. Validation of every interface change against regulatory and accreditation requirements further adds time and cost. Solving this challenge requires instrument vendors, LIS/middleware providers, and lab automation companies to co-develop plug-and-play, standards-based integrations so that MS workflows behave like any other high-throughput analyzer in the lab.

CLINICAL MASS SPECTROMETRY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Some transplant centers use TSQ Altis MD for same-day measurement of tacrolimus and cyclosporine levels in patients on immunosuppressive therapy, replacing multi-day send-out assays. TraceFinder software enables automated result verification and direct LIS reporting with compliance flags. | Enables faster dose optimization within 24 hours post-transplant | Reduces graft rejection risk from delayed therapeutic adjustments | Eliminates send-out logistics and cost burden |

|

Hospital clinical chemistry labs deploy the K6460S Clinical Edition for routine 25-hydroxyvitamin D and cortisol testing across pediatric and adult populations, supporting endocrinology clinics and bone health programs. MassHunter Clinical Edition handles simultaneous multi-patient sample batches. | Stabilizes vitamin D deficiency assessment across patient populations | Reduces turnaround from 5–7 days to 24 hours; improves compliance with endocrine guideline recommendations |

|

Use of triple-quadrupole systems from SCIEX for expanded dried blood spot panels in newborn screening is playing a crucial role, especially in reducing turnaround time | Early detection of treatable metabolic diseases prevents severe developmental disability and death | Reduces the need to send samples to distant reference centers | Supports public health screening mandates |

|

Standalone diagnostic laboratories implement cobas MS to offer hormone panels (testosterone, estradiol, cortisol) without hiring specialized technicians or investing in separate MS systems. Ionify reagent packs come pre-validated for clinical use. | Enables labs to compete with larger reference centers by offering advanced testing in-house | Eliminates multi-week method validation | Plug-and-play model reduces startup risk for entering the MS market |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The clinical mass spectrometry ecosystem spans instrument manufacturers (Thermo Fisher Scientific, SCIEX, Agilent Technologies, Bruker, Waters, Roche), raw material and subsystem suppliers (MKS Instruments, Matsusada Precision, Labnics, EquipNet, and detector and ion-source vendors), distributors, and end users such as hospital-based diagnostic laboratories, contract testing labs, and large academic medical centers like the NIH, Cleveland Clinic, and Charité. Manufacturers differentiate through clinically validated LC-MS/MS platforms, automation, and assay menus, while component suppliers provide detectors, ion sources, power supplies, and precision modules that underpin instrument performance and reliability. Distributors and channel partners (for example, Analytik Jena, Axelsemrau, SpectraLab, and regional Fisher Scientific entities) extend geographic reach, manage installation and service, and support localized regulatory and procurement needs, especially in Europe and emerging Asian markets. On the demand side, hospital networks, reference laboratories, and specialized centers adopt clinical mass spectrometers to internalize outsourced tests.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Clinical Mass Spectrometry Market, by Technique

By technique, the market for clinical mass spectrometry is categorized into LC-MS, GC-MS, and standalone MS. LC-MS dominates the market owing to its ability to quantify a wide range of small molecules and peptides with high sensitivity and selectivity, while supporting reimbursed routine tests across multiple clinical disciplines. Modern triple-quadrupole and hybrid LC-MS systems combine compact footprints with front-end automation, standardized methods, and LIS connectivity, making them suitable for high-throughput core labs rather than only specialist research centers. Hospitals and independent laboratories are prioritizing LC-MS investments to internalize high-value assays—particularly immunosuppressant drugs, steroid hormones, vitamins, and pain-management panels—reducing reliance on external reference labs and improving control over turnaround times and quality.

Clinical Mass Spectrometry Market, by Application

By application, the clinical mass spectrometry market is categorized into therapeutic drug monitoring, hemoglobin testing, hormonal testing, newborn screening, biomarker screening, and other applications. The therapeutic drug monitoring (TDM) and related drug/toxicology testing account for the largest share of the clinical mass spectrometry market by application, reflecting their central role in routine care for patients on complex medication regimens. LC MS/MS has become the reference method for many small molecule drugs and metabolites because it offers higher specificity, lower detection limits, and the ability to quantify multiple analytes in a single run, which improves dose adjustment and reduces adverse events.

Clinical Mass Spectrometry Market, by End User

By end user, the clinical mass spectrometry market is categorized into hospitals, clinical labs, and other end users. The hospitals account for the largest share of the clinical mass spectrometry market by end user, reflecting their central role in managing complex, high-acuity patients who require frequent or repeated therapeutic drug monitoring, endocrine testing, and toxicology assessments. These laboratories are embedded within tertiary and academic medical centers, where clinicians demand short turnaround times and high analytical reliability, prompting hospitals to install in-house LC-MS/MS platforms rather than relying solely on send-out testing. In parallel, many hospital systems are consolidating laboratory services into core hubs that standardize on a limited set of mass spectrometry platforms and roll them out across satellite sites, which concentrates instrument purchases and service contracts in this end-user segment.

REGION

Asia Pacific to be fastest-growing region in global clinical mass spectrometry market during forecast period

The clinical mass spectrometry market is segmented across five prominent regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is experiencing significant growth in the market. Asia-Pacific, as a region, is scaling up pharmaceutical manufacturing, clinical research, and hospital diagnostic infrastructure. Rising investment in drug development, biologics production, and clinical trials in countries such as China, India, Japan, and South Korea is translating into strong demand for LC-MS/MS systems to support bioanalysis, therapeutic drug monitoring, and biomarker-driven studies. In parallel, government-led healthcare modernization programs and precision-medicine initiatives are encouraging tertiary and academic hospitals to adopt advanced analytical platforms, including clinical LC-MS, as part of upgraded oncology, endocrinology, and infectious-disease services. Some of the large hospital chains with high patient volume are internalising previously outsourced assays—such as complex hormone panels, vitamin D testing, and specialised TDM—by installing in-house LC-MS/MS, thereby reducing turnaround times and strengthening clinical decision-making. These factors have positioned the Asia Pacific to show significant growth in the forecast period.

CLINICAL MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX

In the clinical mass spectrometry market matrix, Thermo Fisher Scientific and Agilent Technologies dominate the "stars" cluster, anchored by comprehensive clinical LC-MS/MS portfolios, strong regulatory positioning, and deep integration with hospital and reference-lab workflows. A second tier of pervasive players, including SCIEX, Waters, and Shimadzu, maintains extensive installed bases in therapeutic drug monitoring, endocrinology, and newborn screening, combining robust instrument performance with mature application libraries and established service networks. The competitive landscape is intensifying as multinational leaders expand multi-site standardization projects and long-term service contracts, while emerging suppliers focus on workflow automation, cost optimization, and regional penetration to challenge incumbent market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific (US)

- Agilent Technologies (US)

- SCIEX (US)

- Waters Corporation (US)

- Bruker (US)

- Rosche (Switzerland)

- Shimadzu Corporation (Japan)

- PerkinElmer (US)

- Knauer Wissenschaftliche Geräte (Germany)

- MKS Instruments (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | USD 1.92 Billion |

| Market Forecast, 2031 (Value) | USD 3.31 Billion |

| Growth Rate | CAGR of 9.5% from 2025–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Billion), Volume (Unit Sold) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, Latin America |

| Parent & Related Segment Reports |

Mass Spectrometry Market Pharma mass spectrometry market Environmental mass spectrometry market Drug discovery mass spectrometry market Asia-Pacific mass spectrometry market US mass spectrometry market European mass spectrometry market |

WHAT IS IN IT FOR YOU: CLINICAL MASS SPECTROMETRY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- December 2024 : Roche received CE mark approval for the cobas Mass Spec solution, including the cobas i 601 analyzer and the first Ionify reagent pack with four IVDR-compliant steroid hormone assays, positioning this fully automated and integrated LC-MS/MS platform for routine clinical laboratories worldwide.

- June 2024 : Thermo Fisher announced the Thermo Scientific Stellar mass spectrometer, a new MS platform combining high sensitivity and fast throughput to support translational omics research and biomarker verification for precision medicine applications.

- May 2024 : Agilent issued a press release ahead of ASMS 2024 stating that it would showcase new high-performance MS innovations, highlighting the Agilent 6495D LC/TQ and Agilent Revident LC/Q-TOF systems, which deliver very low detection limits and high-resolution data for large-batch analysis in pharma and life-science testing labs, including clinical and biopharma research workflows.

Table of Contents

Methodology

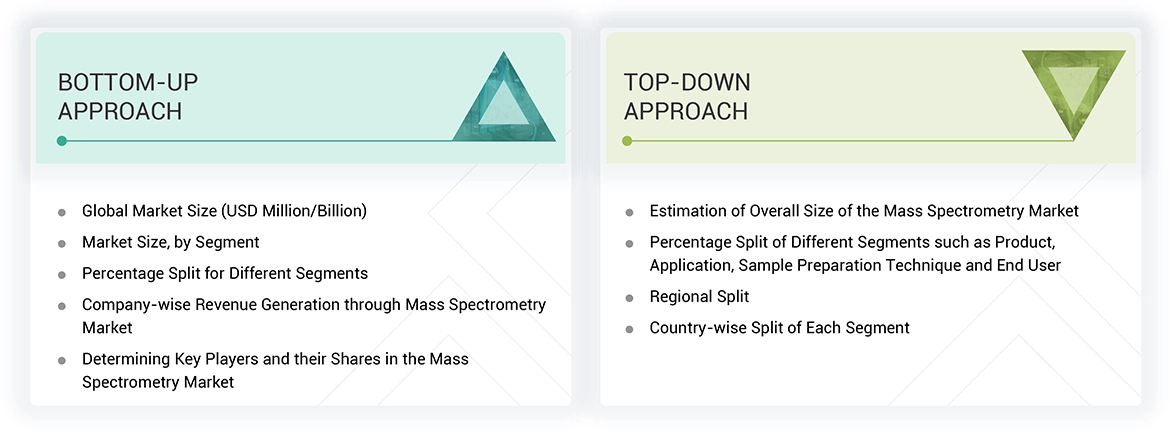

To make a balance between primary and secondary research for the clinical mass spectrometry market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the clinical mass spectrometry market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the global clinical mass spectrometry market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their clinical mass spectrometry business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of global market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of key players that operate in the clinical mass spectrometry market on regional or on country level.

- Formation of product mapping of manufacturers of clinical mass spectrometry and related product lines at regional and country level

- Revenue mapping for listed players from clinical mass spectrometry and related product and services.

- Revenue mapping of major players to cover at least ~70% of the global market share as of 2023. Revenue mapping for major players that cover nearly 70% of the global market share for year 2023.

- Revenue mapping extrapolation for players will drive the global market value for the respective segment.

- Summation for market value for all segments and subsegments to achieve the actual value of the global value of the clinical mass spectrometry market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the Drug discovery clinical mass spectrometry market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the Drug discovery clinical mass spectrometry market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Drug discovery clinical mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Stakeholders

- Pharmaceutical Industry

- Biotechnology Industry

- Manufacturers and suppliers of mass spectrometers.

- Product suppliers, distributors, and channel partners

- Food & beverage industry

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Report Objectives

- To define, describe, and forecast the clinical mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global clinical mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global clinical mass spectrometry market.

- To analyze key growth opportunities in the global clinical mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and rest of the world.

- To profile the key players in the global clinical mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global clinical mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Clinical Mass Spectrometry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Clinical Mass Spectrometry Market