Europe Mass Spectrometry Market Size, Growth, Share & Trends Analysis

Europe Mass Spectrometry Market by Component (Detector, Mass Analyzer, Ion Source, Vacuum System), Product (Triple Quad, Q-ToF, FTMS, Quad, ToF), Application (Omics, Environment, Pharma, Biopharma), Installed Base & Replacement Rate - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe mass spectrometry market, valued at USD 1.69 billion in 2024, stood at USD 1.83 billion in 2025 and is projected to advance at a resilient CAGR of 7.6% from 2025 to 2031, culminating in a forecasted valuation of USD 2.83 billion by the end of the period. The market is gaining strong forward momentum as laboratories increasingly adopt next-generation MS platforms that combine advanced ionization techniques with higher resolution and automation-ready workflows. Improvements in ESI, MALDI, and ambient ionization sources, along with real-time analysis approaches, are enabling more sensitive detection of trace analytes in complex matrices with shorter sample preparation times. At the same time, modern hybrid and tandem MS systems are being tightly integrated with AI-enabled data processing, automated peak identification, and cloud-based analytics, which together enhance throughput, reproducibility, and decision-making. As these capabilities are applied across proteomics, metabolomics, industrial and environmental testing, food safety, and precision medicine, MS is rapidly evolving from a specialist tool into a core technology for high-performance, compliance-ready analytical laboratories across Europe.

KEY TAKEAWAYS

-

By CountryBy country, Germany is estimated to dominate the market with more than 40% revenue share in 2025.

-

By ComponentBy component type, the vacuum system segment is set to register the highest CAGR of 10.5% during the forecast period.

-

By TechniqueBy technique, the GC-MS segment is projected to register the highest CAGR of 8.0%.

-

By ProductThe instruments segment is estimated to account for 74% revenue share in 2025.

-

By ApplicationBy application, the omics research segment registered the highest CAGR of 9.2%.

-

By End UserBy end user, the pharmaceutical companies segment registered the highest CAGR of 10.1%.

-

Competitive LandscapeCompanies such as Agilent Technologies, Inc. (US), Thermo Fisher Scientific Inc. (US), and Waters Corporation (US) were identified as some of the star players in the Europe mass spectrometry market, given their strong market share and product footprint.

-

Competitive LandscapeCompanies such as Analytik Jena GmbH+Co. KG (Germany), Hiden Analytical (UK), and Elementar Analysensysteme GmbH (Germany), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Europe mass spectrometry market is growing due to its expanding use across diverse applications, including proteomics, metabolomics, lipidomics, pharmacokinetics, environmental analysis, forensic toxicology, food safety, and single-cell analysis. Continued improvements in resolution, sensitivity, and analytical accuracy from technologies such as Orbitrap, FT-ICR, MR-TOF, and hybrid MS systems further drive adoption by enabling deeper and more reliable molecular characterization.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the Europe mass spectrometry market are driven by rising demand for high-resolution molecular analysis across proteomics, metabolomics, clinical diagnostics, and environmental testing. Advancements in Orbitrap, FT-ICR, MR-TOF, and hybrid MS systems, along with improved data processing capabilities, are reshaping laboratory workflows and expectations for speed, sensitivity, and accuracy. These shifts are accelerating the adoption of next-generation MS platforms, directly influencing operational efficiency and driving market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in Ionization Techniques

-

Rising Focus on Detection of Genotoxic Impurities (GTIs) & Nitrosamines in Pharmaceuticals

Level

-

Limited On-site/Portable Capabilities

-

High Cost of Instruments and Operational Requirements

Level

-

Emerging Applications in Environmental & Food Safety Testing

-

Growing Demand for Ultra-High-Resolution MS in Spatial Omics for Cancer and Cardiac Disease Research

Level

-

Technological Limitations in Sensitivity, Speed, and Matrix Effects

-

Integration Complexity with Other Analytical Techniques

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in Ionization Techniques

Advancements in ionization techniques have become a major driver for the mass spectrometry market, significantly enhancing analytical performance and expanding application capabilities across industries. Improvements in electrospray ionization (ESI) and nano-ESI have increased ionization efficiency for low-abundance and complex biomolecules while minimizing sample consumption and background noise, enabling higher sensitivity and more accurate quantification. Parallel innovations in MALDI, including optimized matrices and high-resolution analyzers, now provide superior spatial resolution for detailed molecular imaging of biological tissues. Additionally, the rise of ambient ionization methods such as DESI and DART allows rapid, direct analysis of samples with little to no preparation, supporting faster workflows in forensics, environmental monitoring, pharmaceutical quality control, and food testing. Together, these developments are driving broader adoption of MS technologies by enabling faster, more precise, and more versatile analytical outcomes.

Restraint: Limited On-site/Portable Capabilities

Although ambient ionization techniques like DESI and DART have enabled faster, real-time sample analysis, the broader mass spectrometry landscape still has limited capabilities for true on-site or portable use. Most MS systems continue to rely on laboratory-based setups with extensive instrumentation requirements, restricting their deployment in field environments such as environmental monitoring or food safety inspections. This limitation reduces MS accessibility for applications that demand rapid decision-making outside traditional laboratory settings, thereby constraining market expansion into emerging real-time testing scenarios.

Opportunity: Emerging Applications in Environmental & Food Safety Testing

Mass spectrometry is witnessing expanding applications in food and environmental safety driven by the need to detect contaminants, pollutants, and trace compounds with high specificity and sensitivity. Advanced MS techniques enable the analysis of pesticides, toxins, and chemical residues in water, soil, and food products without extensive sample preparation, making them highly suitable for complex real-world matrices. Recent developments in ambient ionization methods, such as DESI and DART, are further accelerating on-site and real-time assessments. These innovations allow rapid detection of environmental contamination and food safety hazards, supporting compliance with stringent regulatory standards and enhancing public health protection. As concerns around environmental pollution and food safety continue to rise, the use of MS in these sectors is expected to grow, driving advancements in detection methods and improving the ability to monitor and respond to potential hazards.

Challenge: Technological Limitations in Sensitivity, Speed, and Matrix Effects

Despite significant advancements, mass spectrometry continues to face technological limitations that impact both sensitivity and analytical speed. Sensitivity remains a core challenge, particularly for the analysis of trace components in complex matrices, where issues such as ion suppression, matrix effects, and calibration drift can reduce measurement precision. Additionally, high-throughput environments require rapid data acquisition and processing, yet the current pace of MS analysis still demands improvements in balancing speed with resolution and accuracy. Addressing these technological constraints is essential for expanding MS applicability across research, environmental, and industrial fields.

EUROPE MASS SPECTROMETRY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of ICP-MS (PlasmaQuant MS series) for trace metal detection in environmental, food, and clinical laboratories across Europe | Ultra-low detection limits, high matrix tolerance, and up to 50% reduced argon consumption |

|

Use of the SCIEX 7500+ triple quadrupole system for high-sensitivity quantitative LC-MS/MS workflows in pharmaceutical and environmental testing | Superior sensitivity, high robustness, and increased screening throughput |

|

Use of Orbitrap LC-MS platforms (Exploris/Astral series) for high-resolution qualitative and quantitative analysis in European pharma and omics research | Accuracy, high resolving power, and confident identification in complex samples |

|

Use of the isoprime precisION IRMS for stable isotope analysis in European food authenticity testing and environmental research | Highest isotope precision, good sensitivity, and a compact 50% smaller footprint |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe mass spectrometry market ecosystem consists of instrument manufacturers, including Hiden Analytical (UK), Scion Instruments (Scotland), Kore Technology (UK), Spacetek Technology AG (Switzerland), reagent and consumable suppliers such as Sigma-Aldrich (US), and end users across pharmaceuticals, biotechnology, environmental testing laboratories, food safety agencies, and academic research institutions. Instruments such as LC–MS, GC–MS, MALDI-TOF, and high-resolution MS systems are integrated into workflows for drug development, contamination detection, clinical diagnostics, and advanced omics research. End users drive demand for higher accuracy, regulatory compliance, and automation-ready solutions, while manufacturers deliver innovations in sensitivity, throughput, and data processing. Collaboration across this value chain is essential for enhancing analytical performance, meeting regulatory standards, and supporting continuous market growth in Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Mass Spectrometry Market, By Product

Based on the product, the Europe mass spectrometry is segmented into instruments and software & and services. Hybrid MS instruments hold the largest share of the Europe mass spectrometry market because their combined analyzer configurations directly support the most demanding applications highlighted, such as proteomics, metabolomics, structural biology, and high-precision pharmaceutical analysis. Systems like quadrupole-Orbitrap and quadrupole-TOF deliver both selective ion filtering and high-resolution detection, enabling precise identification of low-abundance molecules in complex biological mixtures. By offering high sensitivity, fast acquisition, and accurate qualitative and quantitative analysis in a single workflow, hybrid MS instruments align perfectly with Europe’s growing need for advanced molecular characterization, driving their dominant adoption across omics, pharma, and clinical research laboratories.

Europe Mass Spectrometry Market, By Application

Omics holds the largest share in the Europe mass spectrometry market because MS is essential for deep molecular profiling across proteomics, metabolomics, and lipidomics, which rely heavily on precise identification and quantification of complex biological molecules. In proteomics, MS enables detailed analysis of protein expression, modifications, and interactions, and in metabolomics, it provides sensitive detection of metabolic changes and disease-related biomarkers. When paired with separation techniques such as gas chromatography, ion chromatography, or liquid chromatography, MS can efficiently profile hundreds of compounds within a single sample run. The development of high-resolution, accurate-mass (HRAM) systems, along with more comprehensive metabolite databases and libraries, has further enhanced the accuracy and reliability of metabolite identification.

Europe Mass Spectrometry Market, By End User

Based on end users, the Europe mass spectrometry market is segmented into pharmaceutical companies, biotechnology companies, research labs & academic institutes, environmental testing Labs, the food and beverage industry, forensic labs, and the petrochemical industry. The Europe Mass spectrometry market holds the largest share in the pharmaceutical sector. Technologies such as MR-TOF (Multi-Reflecting Time-of-Flight) deliver the high-resolution, high-throughput performance essential for drug discovery and quality control. With superior mass accuracy and faster data acquisition enabled by its multi-reflection design, MR-TOF provides the precision and speed required for impurity profiling, complex compound analysis, and rapid decision-making, making MS the preferred analytical tool across pharmaceutical workflows.

REGION

Germany to lead growth in Europe mass spectrometry market

Germany is at the forefront of the mass spectrometry market in Europe, driven by its robust pharmaceutical and biotechnology sectors, the presence of key manufacturers, and significant demands from advanced research and strict regulatory testing. The adoption of high-resolution, high-throughput mass spectrometry systems is being propelled by research institutions and analytical laboratories, supporting initiatives in advanced proteomics, metabolomics, and precision medicine. Additionally, the growing emphasis on sustainability, the increasing demand for contamination-free food production, and the rapid rise of biotech startups across Europe are further contributing to the widespread implementation of mass spectrometry technologies in the region.

EUROPE MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX

In the Europe mass spectrometry market matrix, Thermo Fisher Scientific (Star) leads with a strong market share and an extensive product footprint, driven by its advanced Orbitrap platforms and high-resolution mass spectrometers widely adopted in proteomics, clinical research, environmental analysis, and pharmaceutical quality testing. Bruker (Emerging Leader) is gaining visibility with its MALDI-TOF and timsTOF portfolio, strengthening its position through innovation in spatial biology, ultra-high-sensitivity workflows, and targeted industrial applications. While Thermo Fisher dominates through scale, deep application coverage, and continuous technology upgrades, Bruker shows significant potential to move toward the leaders’ quadrant as demand increases for advanced, high-speed, and high-accuracy mass spectrometry solutions across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific, Inc. (US)

- Agilent Technologies, Inc. (US)

- Waters Corporation (US)

- Bruker (US)

- Danaher Corporation (US)

- Analytik Jena GmbH & Co. KG (Germany)

- Waters Corporation (US)

- Hiden Analytical (UK)

- Scion Instruments (Scotland)

- Kore Technology (UK)

- Spacetek Technology AG (Switzerland)

- Elementar Analysensysteme GMBH (Germany)

- Microsaic (UK)

- Pfeiffer Vacuum+ Fab Solutions (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.83 Billion |

| Market Forecast, 2031 (Value) | USD 2.83 Billion |

| Growth Rate | CAGR of 7.6% from 2025–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Units Sold) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries/Subregions Covered | Germany, UK, France, Italy, Spain, Nordic Region, Eastern Europe, Rest of Europe |

| Parent & Related Segment Reports |

Mass Spectrometry Market Pharma mass spectrometry market Environmental mass spectrometry market Drug discovery mass spectrometry market Clinical mass spectrometry market Asia-Pacific mass spectrometry market US mass spectrometry market |

WHAT IS IN IT FOR YOU: EUROPE MASS SPECTROMETRY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| MS Instrument Manufacturer |

|

|

| Pharmaceutical & Biotech Companies |

|

|

| Clinical & Diagnostic Laboratories |

|

|

RECENT DEVELOPMENTS

- December 2024 : F. Hoffmann-La Roche Ltd (Switzerland) launched the Cobas 601 analyzer, a mass spectrometer that automates and integrates clinical diagnostics workflows.

- May 2024 : Hiden Analytical Ltd introduced the new HPR-20 OEMS, an advanced online electrochemical mass spectrometry system designed for real-time reaction analysis and seamless integration with electrochemical test cells. Unveiled at the 245th ECS (The Electrochemical Society) Meeting, the system was designed to deliver precise, high-performance gas analysis to accelerate electrochemical research & development.

- June 2024 : SCIEX introduced the SCIEX 7500+, a next-generation quantitative mass spectrometer designed to deliver ultra-high sensitivity, faster MRM (Multiple Reaction Monitoring) performance, and greater resilience across complex sample types.

Table of Contents

Methodology

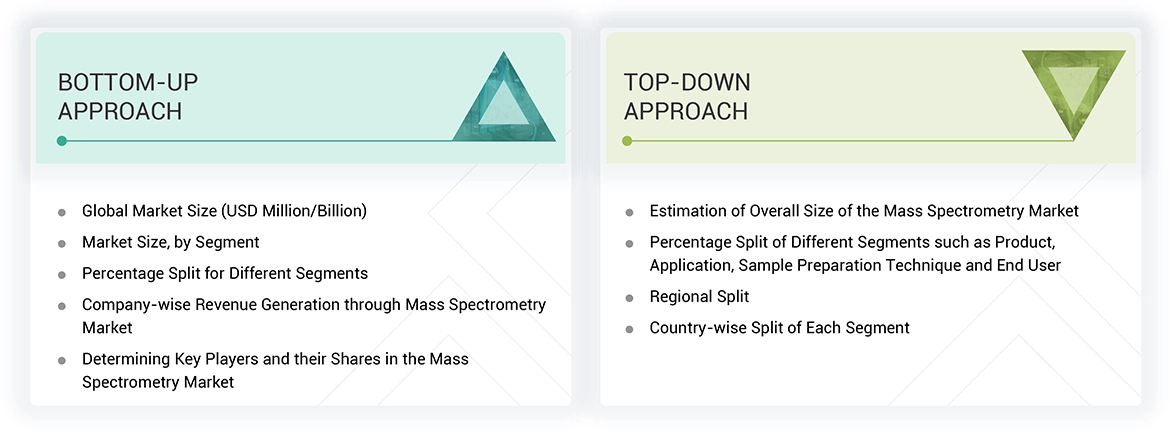

To make a balance between primary and secondary research for the Europe mass spectrometry market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the Europe mass spectrometry market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the Europe mass spectrometry market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their Europe mass spectrometry business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of key players that operate in the Europe mass spectrometry market on regional or on country level.

- Formation of product mapping of manufacturers of Europe mass spectrometry and related product lines at regional and country level

- Revenue mapping for listed players from Europe mass spectrometry and related product and services.

- Revenue mapping of major players to cover at least ~70% of the market share as of 2023. Revenue mapping for major players that cover nearly 70% of the market share for year 2023.

- Revenue mapping extrapolation for players will drive the market value for the respective segment.

- Summation for market value for all segments and subsegments to achieve the actual value of the value of the Europe mass spectrometry market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the Europe mass spectrometry market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the Europe mass spectrometry market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Stakeholders

- Pharmaceutical Industry

- Biotechnology Industry

- Manufacturers and suppliers of mass spectrometers.

- Product suppliers, distributors, and channel partners

- Food & beverage industry

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Report Objectives

- To define, describe, and forecast the Europe mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the Europe mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the Europe mass spectrometry market.

- To analyze key growth opportunities in the Europe mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key players in the Europe mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the Europe mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Mass Spectrometry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Mass Spectrometry Market