Drug Discovery Mass Spectrometry Market Size, Growth, Share & Trends Analysis

Drug Discovery Mass Spectrometry Market by Component (Detector, Mass Analyzer, Ion Source, Vacuum System), Product (Triple Quad, Q-ToF, FTMS, Quad, ToF), Application (Biomarker, HTS, Proteomics), Installed Base & Replacement Rate - Global Forecasts to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The drug discovery mass spectrometry market is experiencing strong upward momentum, driven by increasing reliance on high-resolution analytical platforms across pharmaceutical companies, biotechnology firms, and CROs. The drug discovery mass spectrometry market, valued at US$0.89 billion in 2024, stood at US$1.05 billion in 2025 and is projected to advance at a resilient CAGR of 8.5% from 2025 to 2031, culminating in a forecasted valuation of US$1.69 billion by the end of the period. Growth is anchored in the expanding adoption of MS-based proteomics, metabolomics, and structural biology, which enable deeper biological characterization for target identification, mechanism-of-action studies, pathway analysis, and biomarker validation. Market demand is further strengthened by rising global R&D investment, the rapid expansion of biologics and precision medicine pipelines, and the increasing use of targeted proteomics and high-throughput MS workflows. Applications such as LC-MS/MS–based lead optimization, ADME profiling, impurity and metabolite identification, and safety assessment are driving the adoption of instruments across discovery programs. In parallel, advancements in resolution, acquisition speed, automation, miniaturization, and AI-driven data processing are improving workflow throughput and reducing time-to-insight. Collectively, these trends are expanding the number of research programs relying on MS-enabled platforms, positioning mass spectrometry as a strategic enabler in modern drug discovery.

KEY TAKEAWAYS

-

BY REGIONThe North American market accounted for a 45.0% revenue share in 2025.

-

BY PRODUCTBy product, the instruments segment held 75.0% of the market in 2025.

-

BY INLET TYPEBy inlet type, the GC-MS segment expected to register the highest CAGR of 6.5%.

-

BY END USERBy end user, the CROs segment is expected to witness the highest CAGR in the market.

-

BY APPLICATIONBy application, the pharmacokinetics segment is expected to register the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSThermo Fisher Scientific (US), Agilent Technologies (US), and Danaher (US) are identified as key players in the global market, due to their extensive portfolios of high-resolution LC-MS/MS systems, global installed bases, and strong R&D investments.

-

COMPETITIVE LANDSCAPE- STARTUPSAdvion Interchim Scientific (US), Scion Instruments (UK), and Hitachi High-Tech Corporation (Japan) are promising startups/SMEs/emerging players. They have established a foothold in the market through their presence in the pharmaceutical, contract research, and diagnostic laboratory sectors, supported by region-focused product portfolios and expanding distribution networks.

The drug discovery mass spectrometry market is rapidly becoming a core component of early-stage research, driven by rising adoption of LC-MS/MS and high-resolution systems for target identification, hit-to-lead optimization, and biomarker discovery. Multi-omics integration, especially proteomics and metabolomics, is boosting demand for platforms that deliver higher sensitivity, accurate structural analysis, and reliable quantitation. Growth in biologics, gene and cell therapies, and precision-medicine programs is further accelerating MS use for ADME, PK/PD, and impurity profiling. Asia Pacific is emerging as a strong growth hub with expanding CRO activity and modernized R&D infrastructure, while North America and Europe continue to lead innovation in high-throughput and automation-ready MS systems. Vendors offering end-to-end workflows, advanced software, and application support are gaining preference as laboratories prioritize reproducibility, efficiency, and scalable discovery operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Proteomics and metabolomics investigations are becoming more accurate due to the rapid adoption of high-resolution and hybrid MS platforms in the global drug discovery mass spectrometry market. Biomarker discovery and therapeutic target identification are being accelerated by the increasing integration of automation and AI-driven data analysis. Point-of-need testing is being made possible by small and portable MS instruments, altering conventional centralized laboratory paradigms. Precise and high-throughput MS treatments are becoming more and more necessary as the need for targeted therapy and customized medicine increases. Innovations in software and cloud-based management of MS data are revolutionizing data accessibility and teamwork. Workflow standardization and instrument design are being impacted by regulatory emphasis on data integrity and repeatability. Adoption in developing nations may be temporarily slowed by supply chain issues and expensive instruments. Overall, these developments are changing the landscape of drug discovery, cutting down on time, and improving the effectiveness of pharmaceutical R&D worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of proteomics accelerates MS integration in drug discovery

-

Growth of personalized medicine

Level

-

Limited accessibility in developing regions & infrastructure constraints

-

Shortage of skilled workforce & expertise gap

Level

-

Growing adoption of high-resolution MS in biopharmaceuticals

-

Increasing outsourcing to CROs

Level

-

Lack of standardization and reproducibility across labs

-

Challenges analyzing complex biologics or novel therapeutics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of proteomics accelerates MS integration in drug discovery

The accelerating growth of proteomics and targeted proteomics has become a pivotal driver for the mass spectrometry market in drug discovery, as R&D teams increasingly depend on protein-level insights for target identification, mechanistic studies, and biomarker development. Proteomics offers a direct view of functional biology, making high-resolution MS indispensable for identifying and quantifying proteins, post-translational modifications, and pathway changes. By providing accurate, quantitative, and high-throughput assessments of specific biomarkers and drug-response signatures, the development of tailored proteomics techniques, such as SRM/MRM, PRM, and DIA, is further enhancing the adoption of MS. To enhance decision-making and lower early-stage failures, these procedures are increasingly incorporated into translational research, lead optimization, and target validation. Accurate and scalable protein quantification is becoming increasingly necessary as pipelines move toward complex biologics, precision medicine, and multi-omics approaches. As proteomics and focused proteomics continue to gain traction, mass spectrometry remains a key tool in drug discovery, leading to improvements in data analysis capabilities, workflow automation, and instrument performance.

Restraint: Limited accessibility in developing regions & infrastructure constraints

Limited access to advanced laboratory infrastructure in developing regions significantly restricts the adoption of mass spectrometry in drug discovery. Many laboratories lack the high-quality power supply, controlled environments, and specialized facilities required to install and operate MS systems. In addition, budget limitations and inadequate technical expertise hinder the ability of institutions to maintain and calibrate these highly sensitive instruments. These infrastructure and accessibility gaps slow the expansion of MS-based research capabilities, reducing the overall pace of drug discovery activities in emerging markets and limiting the global penetration of mass spectrometry technologies.

Opportunity: Growing adoption of high-resolution MS in biopharmaceuticals

Pharmaceutical and biotechnology companies are increasingly adopting high-resolution and accurate mass spectrometry (MS) platforms. These platforms enable precise analysis of complex molecules in proteomics, metabolomics, and lipidomics studies. The demand is driven by the need for deeper molecular insights in drug discovery and development. High-resolution MS improves data accuracy, sensitivity, and reproducibility, which is critical for regulatory compliance. Companies investing in advanced MS technologies can accelerate R&D timelines and reduce experimental variability. This trend opens avenues for MS manufacturers to expand their market presence. Overall, the adoption of high-resolution MS is transforming biopharma research and creating significant growth opportunities.

Challenge: Lack of standardization and reproducibility across labs

The global drug discovery mass spectrometry market faces significant hurdles due to the lack of standardized protocols across laboratories. Variations in sample preparation techniques, choice of MS platforms, and chromatographic methods lead to inconsistent results, reducing reproducibility and limiting cross-study comparability. This challenge impacts pharmaceutical and biotechnology companies engaged in multi-site drug development, where harmonized data is crucial for regulatory submissions and accelerated timelines. Additionally, the lack of standardization can increase operational costs, as laboratories may need to reanalyze or validate data, slowing down drug discovery workflows. Market growth is also affected because new entrants may face difficulties in meeting regulatory expectations and ensuring reliable, comparable results across regions, which can limit the adoption of advanced mass spectrometry technologies.

DRUG DISCOVERY MASS SPECTROMETRY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Orbitrap Exploris 480 and Orbitrap Exploris 240 are high-resolution, accurate-mass (HRAM) mass spectrometry systems designed to support small-molecule and biotherapeutic drug discovery workflows. | Provides consistent, high-quality HRAM data; reduces analysis time with simplified workflows; enhances accuracy in routine impurity and metabolite profiling, accelerates lead optimization with faster throughput; delivers high reproducibility for large-scale discovery programs. |

|

Nexera-i UHPLC system and the LCMS-2020 single-quadrupole mass spectrometer are designed to support high-throughput, reliable analytical workflows in pharmaceutical R&D. | High-resolution separations and sensitive mass detection for routine drug discovery applications such as impurity profiling, compound confirmation, metabolite screening, and stability testing |

|

The SYNAPT HDMS system supports structural elucidation, metabolite profiling, impurity identification, and analysis of complex mixtures, providing deep insights into molecular shape, size, and conformational changes. | Improves detection of low-abundance compounds and isomers; increases confidence in impurity and metabolite identification; accelerates complex mixture analysis in discovery programs; delivers high-quality, multidimensional data for more informed decision-making |

|

SCIEX OS software is used to manage, process, and interpret mass spectrometry data generated across drug discovery workflows | Automated data processing and reporting, simplified workflow management, and advanced quantification algorithms |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drug discovery mass spectrometry ecosystem is supported by manufacturers, refurbishers, distributors, and end users that collectively drive adoption across global R&D workflows. Leading manufacturers such as Agilent Technologies and Thermo Fisher Scientific supply high-performance LC-MS/MS and high-resolution systems essential for screening, metabolite identification, and ADME studies. Refurbishers like Conquer Scientific and GenTech Scientific expand accessibility by providing cost-effective, validated mass spectrometers for emerging labs and academic centers. Distributors including HTI and Thomas Scientific strengthen market reach through equipment procurement, installation, and technical support. End users—such as major pharmaceutical companies and research institutes—rely on these systems to accelerate drug discovery through deeper molecular analysis, faster workflows, and high analytical precision. Together, this ecosystem ensures continuous innovation, availability, and adoption of mass spectrometry technologies across drug discovery programs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drug Discovery Spectrometry Market, By Product

By product, the market for is categorized into instruments and software & services. Instruments dominate the market primarily because complex analytical systems require substantial capital investments, and there is a constant demand for technologically advanced equipment that performs more efficiently. High-precision, high-resolution instruments, such as hybrid mass spectrometers (e.g., Q-TOF and triple quadrupole), are important for drug discovery, enabling activities like metabolite profiling, biomarker identification, and pharmacokinetics studies with the required sensitivity and accuracy. The segment's dominant revenue share is further strengthened by the ongoing R&D and product launches by major players, which are motivated by the need for increased throughput and automation in pharmaceutical and biopharmaceutical workflows, requiring frequent upgrades and purchases of new, expensive instrumentation.

Drug Discovery Spectrometry Market, By Inlet Type

Liquid Chromatography-Mass Spectrometry (LC-MS) holds the major market share in the drug discovery mass spectrometry inlet segment primarily because of separation power and detection specificity, making it the gold standard for analyzing complex biological matrices. LC-MS couples the physical separation capabilities of liquid chromatography, which can effectively separate a vast array of chemically diverse and non-volatile compounds (including small molecules, metabolites, and large biomolecules such as peptides) commonly encountered in drug development and research, with the highly sensitive and selective detection of a mass spectrometer. This synergy allows for the simultaneous identification and precise quantification of analytes at trace levels, which is crucial for pharmacokinetics (PK), drug metabolism and pharmacokinetics (DMPK) studies, and metabolite profiling

Drug Discovery Spectrometry Market, By Application

Proteomics and metabolomics hold the major share of the applications market because they provide the most immediate and dynamic functional readouts of a biological system in response to a disease or drug candidate. Mass spectrometry is the indispensable core technology for both 'omics fields due to its ability to offer high-resolution, highly sensitive, and quantitative analysis of proteins, peptides, and small-molecule metabolites, which are the direct executors of cellular function. The growing need for precision medicine and biomarker discovery, where proteomics finds drug targets, tracks therapeutic engagement, and evaluates toxicity (toxicoproteomics), and metabolomics profiles metabolic changes for early disease indicators, treatment response prediction, and clarification of drug mechanism of action, are the key factors driving their market dominance. Additionally, the throughput and accuracy required to accelerate preclinical and clinical drug development pipelines have been significantly enhanced by ongoing advancements in MS instrumentation, including high-resolution Orbitrap and Q-TOF systems, as well as the integration of AI and Machine Learning for complex data analysis.

Drug Discovery Spectrometry Market, By End User

CROs dominate the end-user segment primarily due to the increasing trend of outsourcing R&D activities by pharmaceutical and biopharmaceutical companies, driven by the desire for cost-efficiency and the need to accelerate drug development timelines. CROs offer ready access to specialized expertise and high-end, technologically advanced mass spectrometry instrumentation (such as LC-MS/MS and HRMS), which would be a significant capital expenditure and require a highly skilled workforce for individual drug developers. CROs are essential partners in navigating complex global regulatory environments and ensuring the safety and efficacy of novel drug candidates because they uphold strict regulatory compliance and standardized protocols for bioanalytical testing, pharmacokinetics, and toxicological studies.

REGION

Asia Pacific to be fastest-growing region in global drug discovery mass spectrometry market during forecast period

The drug discovery mass spectrometry market is segmented across five prominent regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific is the fastest-growing region in the drug-discovery mass spectrometry market because of high-throughput MS workflows used in target identification, proteomics/metabolomics, PK/PD, and bioanalysis, which are in high demand due to the rapid expansion of pharmaceutical, biotech, and CRO R&D in China, India, and Southeast Asia. This expansion includes onshoring analytical labs and outsourcing to regional CRDMOs/CROs. Strong public and private R&D funding and national bio/biotech initiatives (plus growing industry–academic collaborations) are boosting proteomics and multi-omics programs that depend on high-resolution MS for biomarker discovery and lead optimization.

DRUG DISCOVERY MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX

In the drug discovery mass spectrometry market matrix, Thermo Fisher Scientific stands out in the “Stars” quadrant, supported by a broad portfolio of high-resolution LC-MS/MS systems, deep integration across pharma R&D workflows, and strong global service capabilities. JEOL (emerging leader) is strengthening its position through advanced TOF and multi-omics-ready platforms that appeal to specialized discovery laboratories. A wider group of vendors occupies the pervasive players segment, offering dependable LC-MS systems, expanding application libraries, and growing installed bases across ADME, metabolomics, and structural elucidation workflows. Meanwhile, several participant-level companies continue to gain traction by targeting niche applications, cost-effective systems, or region-focused solutions aimed at academic centers and early-stage biotech firms. Together, these dynamics reflect a market where established leaders leverage scale and workflow standardization, while emerging suppliers compete through innovation, agility, and specialized R&D-oriented features.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific (US)

- Agilent Technologies (US)

- Waters Corporation (US)

- Bruker (US)

- Shimadzu Corporation (Japan)

- PerkinElmer (US)

- Danaher (US)

- MKS Instruments (US)

- Joel LTD (Japan)

- Leco (Denmark)

- Advion Interchim Scientific (US)

- Jasco Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.05 Billion |

| Market Forecast in 2031 (value) | USD 1.69 Billion |

| Growth Rate | CAGR of 8.5% from 2025–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Units Installed) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

| Parent & Related Segment Reports |

Mass Spectrometry Market Pharma mass spectrometry market Environmental mass spectrometry market Clinical mass spectrometry market Asia-Pacific mass spectrometry market US mass spectrometry market European mass spectrometry market |

WHAT IS IN IT FOR YOU: DRUG DISCOVERY MASS SPECTROMETRY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- June 2025 : Thermo Fisher Scientific unveiled its Next-Generation Mass Spectrometers at ASMS 2025, aiming to revolutionize biopharma applications and support the advancement of omics research.

- May 2025 : Bruker Corporation introduced the timsOmni system, an innovative timsTOF-based mass spectrometer designed for scientific research, drug discovery, clinical studies, and advanced biologics quality control.

- June 2023 : Thermo Fisher Scientific Inc. and Seer Technology have partnered to deliver Proteograph XT Assay Kit services on Orbitrap Astral MS, addressing the needs of researchers who lack access to mass spectrometry but wish to undertake a deep, unbiased proteomics study.

Table of Contents

Methodology

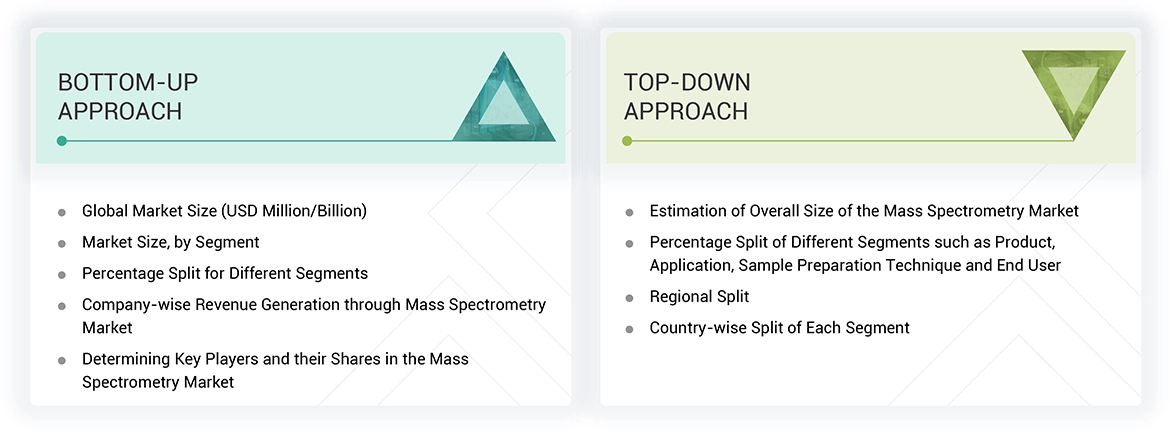

To make a balance between primary and secondary research for the drug discovery mass spectrometry market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the drug discovery mass spectrometry market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the global drug discovery mass spectrometry market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their drug discovery mass spectrometry business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of global market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of key players that operate in the drug discovery mass spectrometry market on regional or on country level.

- Formation of product mapping of manufacturers of drug discovery mass spectrometry and related product lines at regional and country level

- Revenue mapping for listed players from drug discovery mass spectrometry and related product and services.

- Revenue mapping of major players to cover at least ~70% of the global market share as of 2023. Revenue mapping for major players that cover nearly 70% of the global market share for year 2023.

- Revenue mapping extrapolation for players will drive the global market value for the respective segment.

- Summation for market value for all segments and subsegments to achieve the actual value of the global value of the drug discovery mass spectrometry market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the Drug discovery drug discovery mass spectrometry market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the Drug discovery drug discovery mass spectrometry market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Drug discovery drug discovery mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Stakeholders

- Pharmaceutical Industry

- Biotechnology Industry

- Manufacturers and suppliers of mass spectrometers.

- Product suppliers, distributors, and channel partners

- Food & beverage industry

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Report Objectives

- To define, describe, and forecast the drug discovery mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global drug discovery mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global drug discovery mass spectrometry market.

- To analyze key growth opportunities in the global drug discovery mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and rest of the world.

- To profile the key players in the global drug discovery mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global drug discovery mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drug Discovery Mass Spectrometry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drug Discovery Mass Spectrometry Market