US Mass Spectrometry Market Size, Growth, Share & Trends Analysis

US Mass Spectrometry Market by Component (Detector, Mass Analyzer, Ion Source, Vacuum System), Product (Triple Quad, Q-ToF, FTMS, Quad, ToF), Application (Omics, Clinical, Environment, F&B, Pharma), Installed Base & Replacement Rate - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US Mass Spectrometry market, valued at USD 2.29 billion in 2024, stood at USD 2.42 billion in 2025 and is projected to advance at a resilient CAGR of 6.7% from 2025 to 2031, culminating in a forecasted valuation of USD 3.55 billion by the end of the period. The US mass spectrometry market is projected to expand strongly, supported by pharmaceutical and biotech companies across the US that continue to allocate significant capital to development programs. This capital intensity directly translates to demand for advanced bioanalytical infrastructure, particularly LC-MS/MS systems required for FDA-compliant method validation, biomarker quantification, and batch release testing. The FDA's adoption of ICH M10 bioanalytical guidance has made LC-MS/MS the de facto standard for preclinical and clinical bioanalysis, creating a compliance-driven capital expenditure cycle that spans every drug development phase from discovery through commercialization. Such developments are projected to grow the demand for new models of mass spectrometers.

KEY TAKEAWAYS

-

BY PRODUCTBy product, the software & services are projected to register the highest CAGR of 11.5%.

-

BY COMPONENTBy component, the mass analyzers segment is estimated to account for the largest share of 45% as of 2025.

-

BY TECHNIQUEBy technique, the LC-MS segment is estimated to account for the largest share of 52% in the US mass spectrometry market in 2025.

-

BY END USERBy end user, the pharmaceutical companies is estimated to hold a 25% share of the US mass spectrometry market in 2025.

-

BY APPLICATIONBy application, the environmental testing segment is projected to register the highest CAGR of 12.2%.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThermo Fisher Scientific (US), Agilent Technologies (US), and Waters Corporation (US) were identified as some of the key players in the US mass spectrometry market, given their broad LC-MS/MS portfolios, sizable installed bases, and strong application-support networks.

-

COMPETITIVE LANDSCAPE - STARTUPSAdvion Interchim Scientific (US) and Analytic-Jena GmbH (Germany), among others, have established a presence in the US mass spectrometry space by supplying niche LC-MS platforms, front-end systems, or regionally focused solutions for hospital and diagnostic laboratories, indicating their potential as emerging participants for further competitive assessment.

The mass spectrometry market in US is undergoing a fundamental structural shift as pharmaceutical and biotech companies increasingly outsource bioanalytical testing services, including LC-MS/MS analysis, biomarker quantification, method development, and batch release testing, to specialized Contract Research Organizations (CROs). This transition is fundamentally reshaping demand patterns and creating a multiplier effect that expands the total addressable market for MS instrumentation and services. Within the bioanalytical testing outsourcing segment, the majority of pharmaceutical companies now outsource their bioanalytical testing to third-party laboratories, and this penetration is accelerating the adoption of mass spectrometry in the US. This trend reflects a strategic reallocation of capital: pharmaceutical and biotech sponsors are shifting resources away from fixed internal laboratory infrastructure and toward flexible partnerships with CROs that offer specialized MS capabilities, faster turnaround times, and regulatory expertise.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The US mass spectrometry market is shifting from a specialized analytical tool to a core technology for pharmaceutical, biotech, and clinical networks. Laboratories are under increasing pressure to adopt advanced bioanalytical capabilities, particularly for method validation and batch release acceleration. This transition emphasizes "integrated analytics" as a competitive advantage, especially as companies seek faster FDA approvals. Emerging regulatory demands, such as ultra-trace PFAS detection and accelerated batch testing workflows, are reshaping vendor performance expectations, with clients requiring standardized assays compatible with laboratory information systems. As a result, vendors are focusing on workflow automation, data integration, and instrument interoperability, driving interest in benchtop clinical LC-MS/MS platforms that combine analytical rigor with operational efficiency. Pharmaceutical and biotech companies specifically seek solutions that enable faster batch releases while ensuring method integrity. Contract research organizations and diagnostic centers are adopting LC-MS/MS to enhance their service offerings and maintain a competitive edge. This move towards integrated, standardized analytical infrastructure is reshaping vendor expectations around scalability, regulatory readiness, and total cost of ownership, while promoting solutions that merge bioanalytical precision with operational speed.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Precision Medicine & Biomarker-driven Healthcare System to Drive Adoption

-

Updates in the FDA Regulatory Framework & Bioanalytical Mandates to Support growth

Level

-

Capital Intensity and High Initial Investment Barriers

-

Skilled Workforce Shortage and Analytical Expertise Gap

Level

-

Biosecure Act Catalyzing Domestic Analytical Capacity Consolidation

-

Artificial Intelligence and Machine Learning Integration in MS Data Analysis

Level

-

Regulatory Complexity and Method Validation Burden

-

Software Interoperability and Data Management Fragmentation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Precision Medicine & Biomarker-driven Healthcare Adoption

The US has prioritized precision medicine as a national healthcare imperative, supported by government funding, extensive genomic research infrastructure, and widespread hospital system adoption. This commitment to personalized, data-driven healthcare, distinct from traditional one-size-fits-all medicine, fundamentally drives demand for biomarker discovery, validation, and clinical implementation, all of which rely on advanced mass spectrometry capabilities. Precision medicine requires identifying and quantifying disease biomarkers (protein signatures, metabolite patterns, genetic variants) in patient samples. LC-MS/MS is the analytical platform of choice for this work because it enables high-resolution proteomic and metabolomic profiling, multi-analyte quantification, and definitive molecular identification. American hospitals and diagnostic networks are increasingly adopting LC-MS/MS platforms for newborn screening, therapeutic drug monitoring, cancer biomarker profiling, and rare disease diagnostics, applications that are clinical necessities in the US healthcare system but remain aspirational in many other countries. The US healthcare system's emphasis on precision oncology (cancer therapy tailored to individual tumor genomics), expanded newborn screening (covering 30+ metabolic disorders), and precision dosing (individualized medication adjustments based on biomarkers) creates sustained institutional demand for MS infrastructure. Government funding through NIH grants and supportive FDA policies further accelerate this adoption.

Restraint: Capital Intensity and High Initial Investment Barriers

Mass spectrometry instruments represent substantial capital expenditures that create structural barriers to market adoption, particularly for smaller laboratories, emerging biotech companies, and academic institutions. A comprehensive LC-MS/MS system, including the instrument, liquid chromatography component, sample preparation infrastructure, and facility modifications, can exceed USD 200,000 to USD 500,000 in total installed cost. This capital intensity restricts market penetration to well-funded organizations and limits expansion in price-sensitive segments such as small diagnostic centers, teaching hospitals, and early-stage biotech firms. Additionally, significant ongoing operational expenses—including maintenance contracts, calibration, quality control consumables, and reagent costs—create recurring financial burdens that constrain adoption among budget-constrained institutions. Academic research institutions, despite their scientific importance, frequently lack the sustained capital budgets to acquire and maintain state-of-the-art MS platforms, restricting market growth in the research segment.

Opportunity: Biosecure Act Catalyzing Domestic Analytical Capacity Consolidation

The US BIOSECURE Act (Prohibition on Contracting with Certain Biotechnology Providers) represents a significant policy shift that is redirecting bioanalytical testing and pharmaceutical manufacturing capacity from offshore providers to domestic US-based CROs and manufacturers. The Act, passed by the House of Representatives in September 2024 and reintroduced in July 2025 as part of the National Defense Authorization Act, prohibits federal agencies and federally funded entities from contracting with biotechnology companies associated with certain foreign nations, particularly China. This regulatory mandate creates a direct, structural opportunity for MS instrumentation demand growth. CROs and biotech manufacturers are rapidly expanding domestic laboratory capacity to replace offshore testing relationships. North American CROs are investing hundreds of millions of dollars in new bioanalytical testing centers and manufacturing facilities over the 2025–2027 period. Each new facility requires significant MS infrastructure investment: advanced LC-MS/MS systems, high-resolution platforms for complex molecule analysis, and redundant capacity. The technical transfer process itself, transitioning testing methods and manufacturing processes from offshore to onshore facilities, requires extensive method validation using MS, further amplifying MS instrumentation demand.

Challenge: Software Interoperability and Data Management Fragmentation

The mass spectrometry ecosystem suffers from a persistent lack of software integration and data interoperability across platforms. LC-MS/MS instruments generate proprietary data formats that often do not seamlessly integrate with laboratory information systems (LIS), electronic health records (EHR), or enterprise data management platforms. Clinical laboratories frequently must develop custom interfaces or deploy third-party data management solutions to connect MS instrumentation to their LIS, incurring significant IT costs and requiring specialized programming expertise. This fragmentation creates several downstream problems: manual data transcription errors, workflow inefficiencies, delayed result reporting, and compliance risks. The lack of standardized, vendor-agnostic data interchange standards forces organizations into "software lock-in" relationships with equipment manufacturers, reducing flexibility and increasing total cost of ownership. Furthermore, the absence of robust, easy-to-use data analysis and interpretation tools has been explicitly identified as the primary bottleneck in clinical proteomics, limiting the ability of laboratories to extract actionable insights from complex MS datasets. These interoperability challenges reduce return on investment for MS systems and slow clinical adoption.

US MASS SPECTROMETRY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of Orbitrap Exploris/Orbitrap Astral platforms for high-throughput biomarker discovery and verification in pharma and food safety—e.g., Nestlé’s wide-scope pesticide & natural toxin workflows developed on Orbitrap Exploris instruments | Ultra-high resolution for confident compound ID, improved mass accuracy for non-target screening, and high throughput that accelerates R&D → faster biomarker discovery to clinical research translation |

|

Implementation of the 6495D Triple Quadrupole LC/MS in food, environmental, and clinical testing labs for trace-level quantitation (PFAS, pesticides, clinical small molecule panels) | Labs use the 6495D for PPQ–PPT sensitivity workflows and high sample throughput | Sub-ppt detection limits in difficult matrices, fast dwell times for large panels (higher sample throughput), and robustness for routine regulatory testing → reliable compliance testing and improved lab productivity |

|

Clinical and regulated-testing labs deploying SCIEX Triple Quadrupole and TripleTOF platforms for routine clinical LC-MS/MS assays (therapeutic drug monitoring, endocrinology, toxicology) and targeted quantitation in biopharma QA/QC | SCIEX also provides implementation guides to support lab adoption | High sensitivity and selectivity for clinical assays, validated workflows, and implementation support reduce time-to-operational readiness, enabling labs to bring complex LC-MS tests into routine diagnostics |

|

Use of Xevo MRT and UNIFI software for large-cohort metabolomics, lipidomics, and non-targeted environmental screens (including PFAS) | Waters positions the Xevo MRT for studies requiring high mass resolution and sub-ppm accuracy across hundreds of injections | High-resolution, stable mass accuracy for confident non-target identification, scalable throughput for cohort studies, and integrated software for pattern analysis → more reliable discovery datasets and faster time from data to decision |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US mass spectrometry ecosystem spans instrument manufacturers (Thermo Fisher Scientific, SCIEX, Agilent Technologies, Bruker, Waters Corporation), raw material and subsystem suppliers (MKS Instruments, Matsusada Precision, Labnics, EquipNet, detector and ion-source vendors), distributors, and end users such as pharma-biotech companies, environmental testing labs, contract testing labs, and large academic medical centers like the NIH, Cleveland Clinic, and Charité. Manufacturers differentiate through clinically validated LC-MS/MS platforms, automation, and assay menus, while component suppliers provide detectors, ion sources, power supplies, and precision modules that underpin instrument performance and reliability. Distributors and channel partners (for example, Labcompare, Avantor, Thomas Scientific, regional Fisher Scientific entities) extend, manage installation and service, and support localized regulatory and procurement needs in the US.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Mass Spectrometry Market, by Product

By product, the US mass spectrometry market is categorized into instruments and software & services. Mass spectrometry instruments represent substantial capital expenditures, with prices starting from USD 90,000 (basic configuration). The advanced are capital-intensive investments in the US pharma & biopharma landscape. The upfront hardware investment masks recurring software/service spending, naturally skewing revenue toward instruments. As drug development becomes more complex—requiring high-resolution MS for biologics, ADCs, and multi-omics—companies prioritize instrument acquisition to stay competitive. This creates a direct correlation between the increase in R&D spending and the procurement of mass spectrometry instruments. Due to strong research, healthcare, and pharma infrastructure, the instrument replacement cycle is also short when compared to other regions.

US Mass Spectrometry Market, by Technique

By technique, the market for US mass spectrometry is categorized into GC-MS, LC-MS, ICP-MS, and others. During the forecast period, LC-MS as a technique is expected to dominate the US mass spectrometry market. LC-MS is one of the most commonly used analytical techniques in various sectors for the quantitation and identification of unknowns from a variety of complex samples. As FDA has adopted ICH M10 guidance on bioanalytical method validation, explicitly recognizing LC-MS/MS as the gold-standard platform for quantifying drugs. This regulatory endorsement creates a compliance-driven capex cycle: sponsors must validate methods using LC-MS/MS to secure IND approvals, and deviations risk regulatory rejection. The guidance standardizes validation parameters (accuracy, precision, selectivity, matrix effects) in ways that favor LC-MS/MS.

US Mass Spectrometry Market, by End User

By end user, the US mass spectrometry market is segmented into pharmaceutical companies, biotechnology companies, research labs & academic institutes, environmental testing Labs, food and beverage industry, hospital clinical labs & forensic labs, petrochemical industry, and other end users. The Pharmaceutical companies as a segment registered the fastest growth during the forecast period. The pharmaceutical industry has facilitated the advancement of diagnostics & biomarker identification in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years. Also, the anticipated revenue growth of this segment during the forecast period is attributed to the rapid expansion of the pharmaceutical industry worldwide and the technological advancements in the pharmaceutical sector. While pharma companies have downsized internal bioanalytical headcount, they retain core internal MS labs for proprietary work and manage strategic outsourcing to CROs. The dominant model is Model II (hybrid insourcing/outsourcing), where pharma owns high-end instruments for method development and transfers assays to CROs for scale-up. This creates dual demand: pharma directly purchases instruments for internal labs, and CROs purchase additional instruments to serve pharma clients, both counted under pharmaceutical-driven revenue. All these conditions have helped pharmaceutical companies acquire a significant share.

US MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX

In the US mass spectrometry market matrix, Thermo Fisher Scientific and Agilent Technologies dominate the "stars" cluster, anchored by comprehensive clinical LC-MS/MS portfolios, strong regulatory positioning, and deep integration with hospital and reference-lab workflows. A second tier of pervasive players, including SCIEX, Waters, and Shimadzu, maintains extensive installed bases in pharma, biopharma manufacturing, OMICS research, drug discovery, and environmental testing, combining robust instrument performance with mature application libraries and established service networks. The competitive landscape is intensifying as multinational leaders expand multi-site standardization projects and long-term service contracts, while emerging suppliers focus on workflow automation, cost optimization, and regional penetration to challenge incumbent market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Agilent Technologies, Inc (US)

- Thermo Fisher Scientific, Inc (US)

- Danaher Corporation (US)

- Waters Corporation (US)

- Bruker Corporation (US)

- Shimadzu Corporation (Japan)

- PerkinElmer, Inc (US)

- Jeol, Ltd (Japan)

- Jasco (Japan)

- Teledyne Technologies Incorporated (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 2.29 Billion |

| Market Forecast, 2031 (Value) | USD 3.55 Billion |

| Growth Rate | CAGR of 6.7% |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Unit Sold) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Parent & Related Segment Reports |

Mass Spectrometry Market Pharma mass spectrometry market Environmental mass spectrometry market Drug discovery mass spectrometry market Clinical mass spectrometry market Asia-Pacific mass spectrometry market European mass spectrometry market |

WHAT IS IN IT FOR YOU: US MASS SPECTROMETRY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- October 2024 : Danaher Corporation (US) entered into a partnership with IonOpticks (Australia) to co-market IonOptiks‘s chromatography system with SCIEX’s Zeno TOF product line.

- August 2024 : Agilent Technologies, Inc. (US) entered into a partnership agreement with Newomics Inc. (US) that aims to develop an LC-MS platform, especially for identifying druggable targets for drug discovery.

- June 2024 : Thermo Fisher Scientific, Inc. (US) opened a new facility aiming to increase production capability for analytical services and clinical research. The facility has dedicated space for LC-MS.

Table of Contents

Methodology

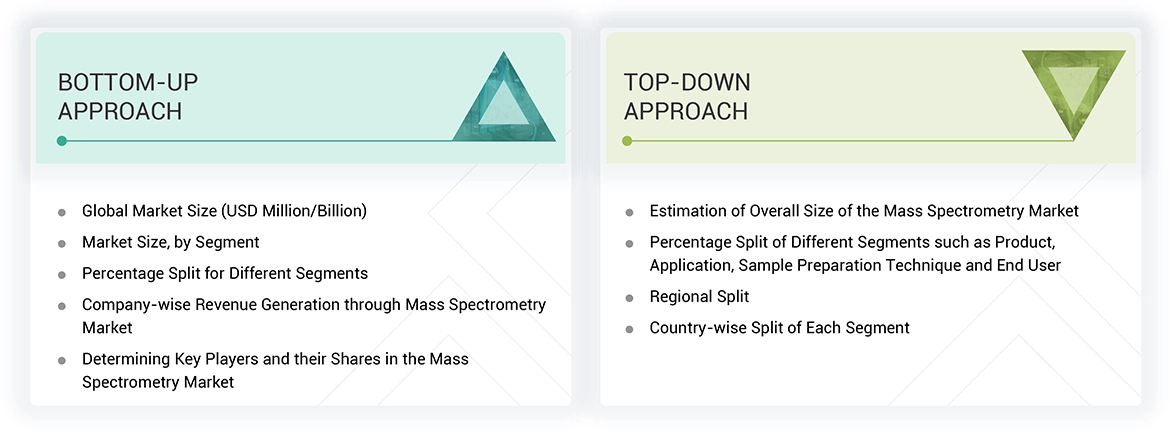

To make a balance between primary and secondary research for the US mass spectrometry market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the US mass spectrometry market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the US mass spectrometry market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their US mass spectrometry business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of key players that operate in the US mass spectrometry market on regional or on country level.

- Formation of product mapping of manufacturers of US mass spectrometry and related product lines at regional and country level

- Revenue mapping for listed players from US mass spectrometry and related product and services.

- Revenue mapping of major players to cover at least ~70% of the market share as of 2023. Revenue mapping for major players that cover nearly 70% of the market share for year 2023.

- Revenue mapping extrapolation for players will drive the market value for the respective segment.

- Summation for market value for all segments and subsegments to achieve the actual value of the global value of the US mass spectrometry market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the US mass spectrometry market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the US mass spectrometry market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Stakeholders

- Pharmaceutical Industry

- Biotechnology Industry

- Manufacturers and suppliers of mass spectrometers.

- Product suppliers, distributors, and channel partners

- Food & beverage industry

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Report Objectives

- To define, describe, and forecast the US mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the US mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the US mass spectrometry market.

- To analyze key growth opportunities in the US mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key players in the US mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the US mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Mass Spectrometry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Mass Spectrometry Market