This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global cloud ERP market. A few other market-related reports and analyses published by various industry associations and consortiums, such as the National Security Agency (NSA) and SC Magazine, were considered while doing the extensive secondary research. The primary sources were mainly the industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the prospects. The market has been estimated by analyzing various driving factors, such as improving organizational compliance requirements, enhancing operational efficiency, and requiring simplified workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering cloud ERP was arrived at based on secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain essential information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the cloud ERP market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various technologies-related trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using cloud ERP and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall cloud ERP market.

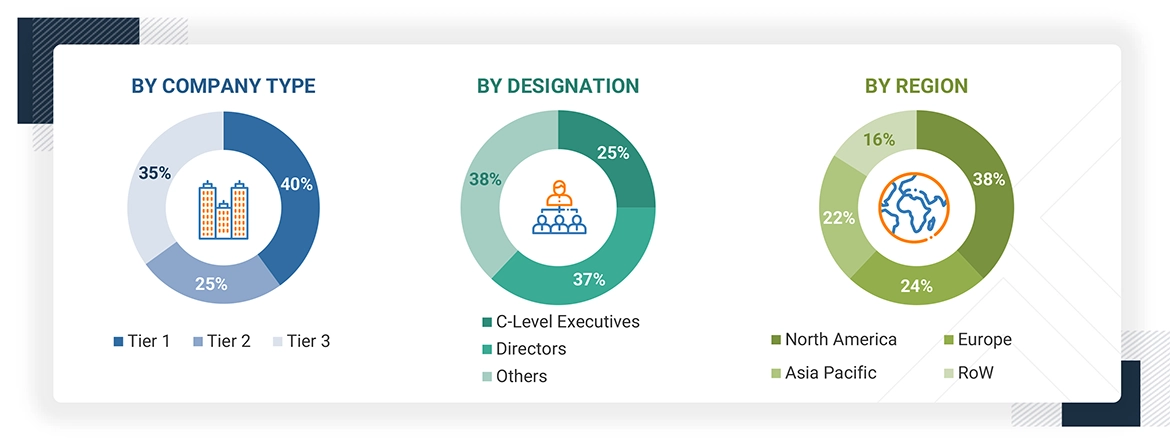

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The cloud ERP and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

-

We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

-

Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

-

We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Cloud ERP Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines a Cloud ERP (Enterprise Resource Planning) as a software solution that enables businesses to manage core operations such as finance, supply chain, manufacturing, human resources, and customer relationships through a cloud-based platform. Unlike traditional on-premises ERP systems, cloud ERP is hosted on remote servers and accessed via the Internet, reducing the need for costly hardware and IT maintenance. It offers real-time data access, scalability, and seamless integration with other cloud applications, improving operational efficiency and decision-making. Businesses benefit from automatic updates, enhanced security, and lower upfront costs, making it ideal for companies of all sizes.

Stakeholders

-

Cloud ERP provider

-

Implementation Partners & System Integrators

-

Enterprise Customers

-

Technology Infrastructure Providers

-

Regulatory Bodies & Compliance Organizations

-

Consulting & Advisory Firms

-

Investors & Venture Capitalists

-

End Users & Employees

-

Open-source & Niche ERP Developers

-

Cloud service providers

Report Objectives

-

To define, describe, and forecast the global cloud ERP market based on offering (software and professional services), deployment type (private cloud, public cloud, and hybrid cloud), and applications (financial management, project management, human resource management, inventory management, sales & order management, business intelligence & analytics, supply chain management and other application, vertical (IT & ITES, telecommunications, BFSI, healthcare & life science, manufacturing, retail & e-commerce, government & public sector, education and other verticals) and region.

-

To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

-

To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

-

To analyze industry trends, patents and innovations, and pricing data related to the cloud ERP market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

-

To analyze the impact of AI/GenAI on the global cloud ERP market.

-

To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

-

To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis as per Feasibility

-

Further breakup of the cloud ERP market

Company Information

-

Detailed analysis and profiling of five additional market players

Growth opportunities and latent adjacency in Cloud ERP Market