Textured Vegetable Protein Market

Textured Vegetable Protein Market Report by Type (Slices, Chunks, Flakes, Granules), Source (Soy, Pea, Wheat), Application (Meat Analogues, Bars & Snacks, Ready-to-Eat Meals), Nature (Organic, Conventional), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The textured vegetable protein (TVP) market is projected to reach USD 2.65 billion by 2030 from USD 1.88 billion by 2025, at a CAGR of 7.1% during the forecast period in terms of value. The current TVP market is competitive and rapidly evolving due to the presence of immense research and development.

KEY TAKEAWAYS

- The North America textured vegetable protein market accounted for a 43.1% revenue share in 2024.

- By source, the pea segment is expected to register the highest CAGR of 7.4% during the forecast period.

- By nature, the organic segment is projected to grow at the fastest rate from 2025 to 2030.

- By application, the meat analogues segment is expected to dominate the market, growing at the highest CAGR of 7.4%.

- ADM, Cargill Incorporated, International Flavors & Fragrances, and DSM were identified as some of the star players in the textured vegetable protein market, given their strong market share and product footprint.

- Sotexpro, LIVING FOODS, and Blattmann Schweiz AG have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The market is experiencing substantial growth in the current alternative protein landscape driven by shifting consumer preferences toward vegetable protein sources, nutritional benefits, a focus on clean eating, and increasing concerns about health, the environment, and animal welfare. Plant-based meat and ingredients, including textured vegetable proteins derived from soy, wheat, and peas, are gaining popularity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The textured vegetable protein (TVP) market is leveraging new sources to enhance product diversity and meet growing consumer demand for innovative plant-based proteins. Traditional soy-based textured vegetable protein is being complemented by proteins derived from peas, lentils, chickpeas, and other legumes, offering a broader nutritional profile and catering to those with soy allergies. Additionally, novel sources such as fava beans, quinoa, and hemp are on the rise, driven by their unique health benefits and sustainability credentials. These new sources provide varied textures and flavors and align with the clean-label and non-GMO trends, appealing to health-conscious and environmentally aware consumers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for meat alternatives

-

Breakthroughs in food science and processing technologies

Level

-

Allergies associated with vegetable protein sources

-

Complexities in processing textured vegetable proteins

Level

-

Economical solutions using plant-based ingredients

-

Shift from traditional extraction sources of textured vegetable protein to new sources

Level

-

Stringent government regulations

-

High cost of production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for meat alternatives

Textured vegetable protein, derived from soy, wheat, and pea, has been widely adopted by food manufacturers due to its functional and nutritional characteristics, making it an effective meat alternative. Consumers have embraced TVP for its ability to replicate the texture and flavor of meat products, such as sausages, burger patties, nuggets, and crumbles. As plant proteins become more popular among non-meat consumers, flexitarians, who are actively reducing meat consumption in their diets, are emerging as a significant potential consumer segment. This shift has resulted in increased production of meat alternatives that closely mimic the eating experience of beef, chicken, and other animal-based products.

Restraint: Complexities in processing textured vegetable proteins

Processing complexities of textured vegetable protein arise because its fiber texture, length, and strength must match conventional meat. Bulk density, shape, and extrudate surface are crucial to textured vegetable protein quality. The texturization process by extrusion involves changes in the conformation and quality of vegetable protein. Controlling extrusion is a significant challenge due to the combined effects of temperature, shear force, and pressure, which complicate the conformational aspects of textured vegetable protein and affect its quality.

Opportunity: Shift from traditional extraction sources of textured vegetable protein to new sources

The traditional sources for extracting textured vegetable protein are soy, wheat, and pea, with soy being the primary source. However, manufacturers are now exploring other sources, such as lentils, fava beans, oats, rice, and chia seeds. Fava beans are a rich source of plant-based protein, vitamins, and minerals. They are also high in soluble fiber, which aids digestion and lowers cholesterol levels. Fava beans can provide over 46% of proteins as essential macronutrients during extraction, making them a crucial alternative source for TVP. Ingredion offers a range of textured vegetable proteins made from fava beans, including products such as NUTRALYS T Pea-Fava 570C Organic, NUTRALYS T Pea-Fava 572C Organic, and NUTRALYS T Pea-Fava 570S Organic, whereas DSM offers Vertis TVP F70.01m TVP, which is manufactured from fava bean and pea protein.

Challenge: Stringent government regulations

The market for textured vegetable protein faces significant regulatory challenges that pose major obstacles for companies in the sector. One major issue is the restrictive labeling rules implemented in some countries in response to the growing customer demand for plant-based alternatives. These rules often restrict the use of traditional meat and dairy terms on plant-based goods, forcing textured vegetable protein manufacturers to constantly modify their labeling and marketing techniques. These laws are frequently inconsistent and can lead to legal conflicts, making compliance efforts and associated costs extensive and complicated. This regulatory environment hampers the potential for market growth and expansion.

textured vegetable protein market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces soy-based textured vegetable protein for meat alternatives, ready-to-eat meals, and snacks | Expanding into pea protein TVP with clean-label offerings | High protein content, versatile texturization, cost-effective meat replacement, supports plant-based innovation |

|

Offers soy and pea-based TVP solutions integrated into plant-based burgers, nuggets, and hybrid meat products | Collaborates with foodservice and retail brands | Improved mouthfeel and juiciness, scalable supply chain, sustainability through reduced carbon footprint, and broad B2B reach |

|

Develops wheat and faba bean-based textured proteins for clean-label, allergen-free applications in meat substitutes and bakery products | Allergen-friendly, non-GMO options, improved digestibility, supports "clean label" and regional consumer preferences |

|

Provides pea and chickpea-based TVP through its food innovation platforms, focusing on specialty ingredients for alternative proteins and pet food | Gluten-free, diverse plant protein portfolio, strong sustainability profile, catering to human and companion animal nutrition |

|

Manufactures pea-based TVP (Nutralys® range) for burgers, sausages, and dairy-alternative products, with emphasis on sensory quality and nutrition | High digestibility, excellent texture and binding, sustainable sourcing, and aligning with flexitarian and vegan consumer demand |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Key players in this market include well-established and financially strong manufacturers of textured vegetable protein. These companies have extensive industry experience, providing a diverse range of products, advanced technologies, and strong global sales and marketing networks. Prominent companies in this market include ADM (US), Roquette Frères (France), Ingredion (US), DSM (Netherlands), The Scoular Company (US), Beneo (Germany), International Flavors & Fragrances, Inc. (US), Cargill, Incorporated (US), MGP (US), PURIS (US), Shandong Yuxin Bio-Tech Co., Ltd. (China), Gushen Biological Technology Group, Co., Ltd. (China), Axiom Foods, Inc. (US), Foodchem International Corporation (China), and Dacsa Group (Spain).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Textured Vegetable Protein Market, by Source

Soy is the leading ingredient for TVP due to its high protein concentration, cost-effectiveness, and versatility. The global movement to plant-based diets is increasing due to health awareness and environmental concerns, leading to significant growth in the demand for soy TVP. The USDA reported that global soy production was 360 million metric tons in 2024. Its cost is usually cheaper than animal proteins, which appeals to growing markets, particularly price-sensitive markets such as China and India, that are witnessing increased demand for soy-based meat alternatives. Additionally, soy TVP benefits from technology improvements in extrusion processes that can create a meat-like texture in products such as burgers and sausages, which contributes to the driving demand.

Textured Vegetable Protein Market, by Type

Flakes are increasingly gaining popularity in the market due to their versatility and their effectiveness in absorbing marinades. Consumers prefer meat-like textures and flakes. The vegan population in Europe and other countries worldwide is increasing, which leads to greater demand for flakes, as they are used in plant-based pulled meats and burgers. Wheat is found worldwide and is available at approximately 780 million metric tons each year, providing a measure of stability for supply, thereby sustaining market growth. Regulations regarding labeling for allergens require thorough supply chain checks to ensure compliance and may increase costs. Additionally, limited regional awareness can be a barrier to the adoption of this product.

Textured Vegetable Protein Market, by Application

TVP finds its largest and most impactful application in meat analogs—burgers, sausages, nuggets, and fillets designed for vegetarian or flexitarian consumers. By leveraging extrusion technology, companies transform soy, pea, wheat, and even fava proteins into fibrous, meat-like textures and juiciness. Industry leaders such as Archer Daniels Midland (ADM) and Cargill offer TVP chunks and granules that scale to match industrial production needs; ADM recently invested USD 300?million to double extrusion capacity in Illinois, supplying large-scale plant-based manufacturers.

Textured Vegetable Protein Market, by Nature

The market for conventional textured protein is predicted to rise due to the benefits of conventional farming, such as using fertilizers in crop cultivation. Although organic farming is becoming more popular, most farmers are unaware of the practices to be followed. Furthermore, conventional textured vegetable protein is produced on a larger scale, benefiting from economies of scale that reduce per-unit costs and increase availability. The supply chain for conventional textured vegetable protein is well-established and more developed, making it easier to source and distribute compared to the more niche organic textured vegetable protein.

REGION

Asia Pacific to be fastest-growing region in global textured vegetable protein market during forecast period

The Asia Pacific textured vegetable protein market is estimated to register the highest CAGR during the forecast period. The region has a robust agricultural production base, which is essential for producing vegetable-sourced proteins. Growing consumer awareness of the functional benefits of these proteins has increased the demand for alternative meat products compared to conventional protein sources. The changing lifestyles of consumers have inclined them toward a vegan diet. The rise in the consumption of meat alternatives has been driven by increased awareness among affluent millennial consumers about the functional benefits and sustainability concerns. The purchasing power of this demographic is augmenting the vegan trend and encouraging food manufacturers to launch more vegan products in the region.

textured vegetable protein market: COMPANY EVALUATION MATRIX

In the textured vegetable protein market matrix, ADM (Star) is one of the global leaders in the nutrition segment. The company has pioneered textured vegetable protein innovation for over 75 years. It is termed as one of the largest soybean processors in the world. The Scoular Company (Emerging Leader) is gaining traction because it has strategically expanded into pea- and chickpea-based textured proteins, meeting the growing demand for allergen-free and gluten-free alternatives to soy.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.76 BN |

| Market Forecast in 2030 (Value) | USD 2.65 BN |

| Growth Rate | CAGR of 7.1% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: textured vegetable protein market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market sizing of TVP by type (soy, pea, wheat, chickpea) across regions | Provided global and regional breakdown (North America, Europe, Asia-Pacific, South America, RoW) with CAGR forecasts | Clear understanding of demand hotspots and investment opportunities |

| Competitive landscape of key players (ADM, Cargill, Roquette, Beneo, Scoular) | Delivered benchmarking on production capacity, sourcing strategies, patents, and product portfolios | Identifies leaders, niche players, and partnership/M&A opportunities |

| Application analysis of TVP in food and non-food industries | Segmentation by meat alternatives, bakery, snacks, ready meals, beverages, and pet food | Helps clients prioritize high-growth applications and diversify offerings |

| Price trend analysis (USD/kg) for TVP across regions and protein sources | Customized database with average selling prices, historical trends, and raw material impact | Supports pricing strategies, cost optimization, and procurement decisions |

| Consumer insights on acceptance of TVP-based products | Delivered surveys and secondary research on flexitarian, vegan, and pet food consumer preferences | Enables targeted marketing, product positioning, and demand |

RECENT DEVELOPMENTS

- February 2024 : Roquette launched NUTRALYS T Pea 700M, which would help the company cater to the new trends in organic ingredients.

- May 2023 : Cargill introduced TEX PW80 M, a plant protein blend of pea and wheat protein in Europe, designed to replicate the texture, juiciness, and bite of ground meat.

- March 2023 : ADM invested approximately USD 300 million to significantly expand its alternative protein production in Decatur, Illinois. The company continued to add capacity to meet strong demand growth.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the textured vegetable protein (TVP) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were used to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study extensively used secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the textured vegetable protein market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the textured vegetable protein market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

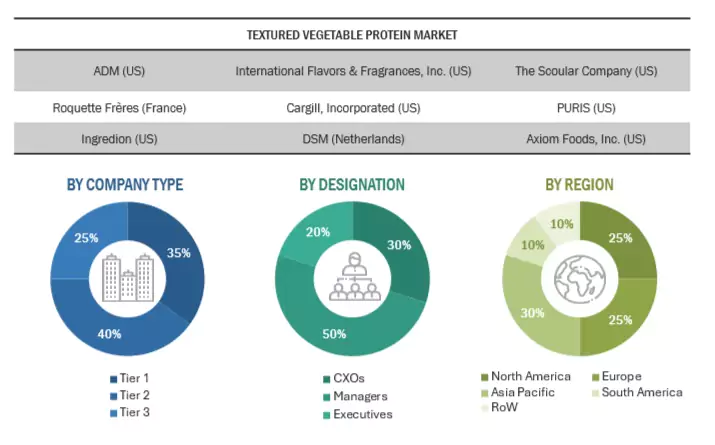

Primary Research

After obtaining information regarding the textured vegetable protein market through secondary research, extensive primary research was conducted. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East and Africa, and South America. Primary data was collected through questionnaires, emails, and telephone interviews.

The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, source, nature, and region.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, based on the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue

= USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

ADM (US) |

General Manager |

|

DSM (Netherlands) |

Sales Manager |

|

Axiom Foods, Inc. (US) |

Manager |

|

Cargill, Incorporated (US) |

Head of Processing Department |

|

PURIS (US) |

Marketing Manager |

|

The Scoular Company (US) |

Sales Executive |

Market Size Estimation

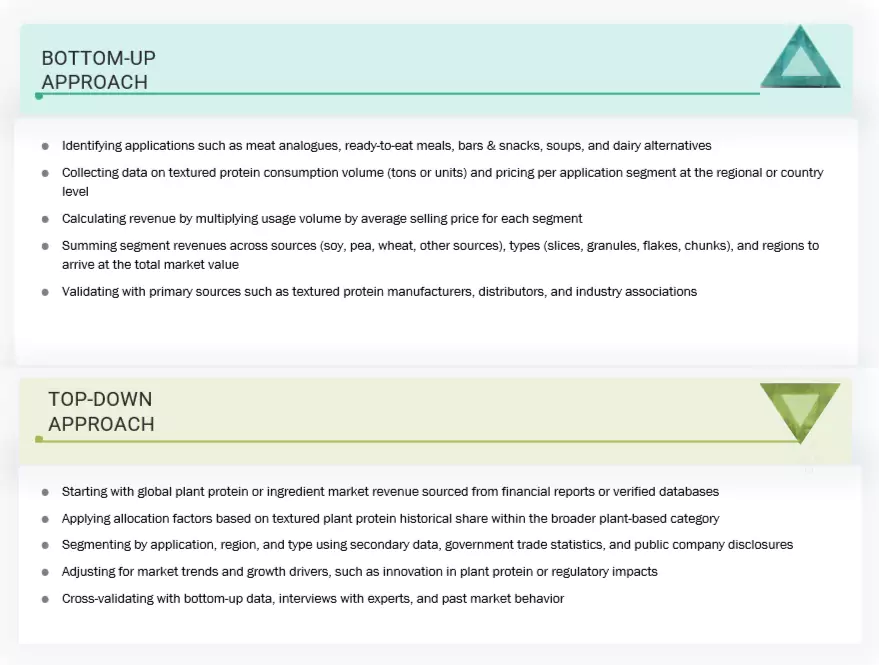

The top-down and bottom-up approaches were used to estimate and validate the total size of the textured vegetable protein market. These approaches were used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the textured vegetable protein market in a consolidated format.

The following sections (bottom-up and top-down) depict the overall market size estimation process employed in this study.

Global Textured Vegetable Protein Market: Bottom-Up Approach and Top–Down Approach

In the TVP market, the top-down approach involves analyzing the overall plant-based protein or alternative protein market size and estimating the TVP segment based on its historical and projected share. Conversely, the bottom-up approach calculates the market size by aggregating revenue or volume data from key players, production facilities, product launches, and regional consumption trends to build a more granular and accurate picture from the ground level. Combining both approaches ensures the validation and reliability of market estimates.

Textured Vegetable Protein Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall textured vegetable protein market and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using the top-down and bottom-up approaches.

Market Definition

According to the United States Department of Agriculture (USDA), textured vegetable protein (TVP) is a “meat or poultry replacer.” The use of TVP as a fat-replacing ingredient in a standardized substitute product is subject to the general standard. According to the United States Agency for International Development (USAID), a government agency, textured soy protein (TSP) is a processed food product manufactured from either soymeal flakes, soy flour, or soy protein concentrate. It can be uncolored or in caramel color and contains at least 52 percent protein on a dry basis.

Stakeholders

- Manufacturers, dealers, and suppliers of textured vegetable protein

- Raw material suppliers of plant-based textured vegetable proteins

- Manufacturers and traders of meat, meat alternatives, cereals and snacks, dairy and confectionery, dairy alternatives, soups, stews, ready meals, and other food manufacturers

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Technology providers

- Industry associations

-

Regulatory bodies and institutions

- Food and Agricultural Organization (FAO)

- United States Department of Agriculture (USDA)

- National Grain and Feed Association (NGFA)

- European Food Safety Authority (EFSA)

- Plant-based Foods Association (PBFA)

- Good Food Institute (GFI)

- The Vegan Society

- European Vegetable Proteins Association (EUVEPRO)

- Organisation for Economic Co-operation and Development (OECD)

- Logistics providers & transporters

- Research institutes and organizations

Report Objectives

MARKET INTELLIGENCE

- To determine and project the size of the textured vegetable protein market based on type, application, source, nature, and region

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework and market entry process related to the textured vegetable protein market

- To analyze the micro markets concerning individual growth trends, prospects, and their contribution to the total market

COMPETITIVE INTELLIGENCE

- To identify and profile the key players in the textured vegetable protein market

-

To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across the country

- To provide insights on key product innovations and investments in the textured vegetable protein market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe feeding systems market into key countries

- Further breakdown of the Rest of Asia Pacific feeding systems market into key countries

- Further breakdown of the Rest of South America feeding systems market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Which are the major companies in the textured vegetable protein market? What are their major strategies to strengthen their market presence?

The key players in this include ADM (US), Roquette Frères (France), Ingredion (US), DSM (Netherlands), The Scoular Company (US), Beneo (Germany), International Flavors & Fragrances, Inc. (US), Cargill, Incorporated (US), MGP (US), PURIS (US), Shandong Yuxin Bio-Tech Co., Ltd. (China), Gushen Biological Technology Group, Co., Ltd. (China), Axiom Foods, Inc. (US), Foodchem International Corporation (China), and Dacsa Group (Spain). These players are increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the textured vegetable protein market?

The rise in veganism and flexitarian diets, particularly among millennials, is a key driver. For example, the Veganuary campaign reported ~5.8 million participants in 2021, reflecting a global shift toward plant-based eating. The growing trend of hybrid diets combines plant-based proteins, such as TVP, with small amounts of animal-based ingredients, thereby expanding the market.

Which region is expected to hold the largest market share?

The largest market for textured vegetable protein is in North America. Consumers are increasingly demanding plant-based diets in the interests of health, environment, and ethics. In fact, this region is associated with advanced food processing industries and a trend of continuous innovation in all plant protein-based food products.

What are the key technology trends prevailing in the textured vegetable protein market?

Some of the major technology trends shaping the textured vegetable protein market are advanced extrusion technology and high-moisture extrusion, which give plant-based proteins a near-to-meat texture, taste, and appearance. Precision fermentation improves protein quality and flavor, while blending legume proteins such as soy, pea, and wheat enhances the overall texture and raises nutritional value.

What is the total CAGR expected to be recorded for the textured vegetable protein market during 2025-2030?

The market is expected to grow at a CAGR of 7.1% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Textured Vegetable Protein Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Textured Vegetable Protein Market