Internet of Things (IoT) Market

Internet of Things (IoT) Market, by Module Type (Hardware [Modules/Sensors, Security Hardware], Connectivity [Cellular, LP-WAN, Satellite], Software [IOT Platforms, Application Software, Analytics Software, Security & Safety Software], Services [Implementation, Design, Managed Services]), by Focus Area (Smart Transportation/Mobility, Smart Buildings, Smart Energy/Utilities, Smart Healthcare, Smart Agriculture, Smart Manufacturing, Smart Retail), by Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

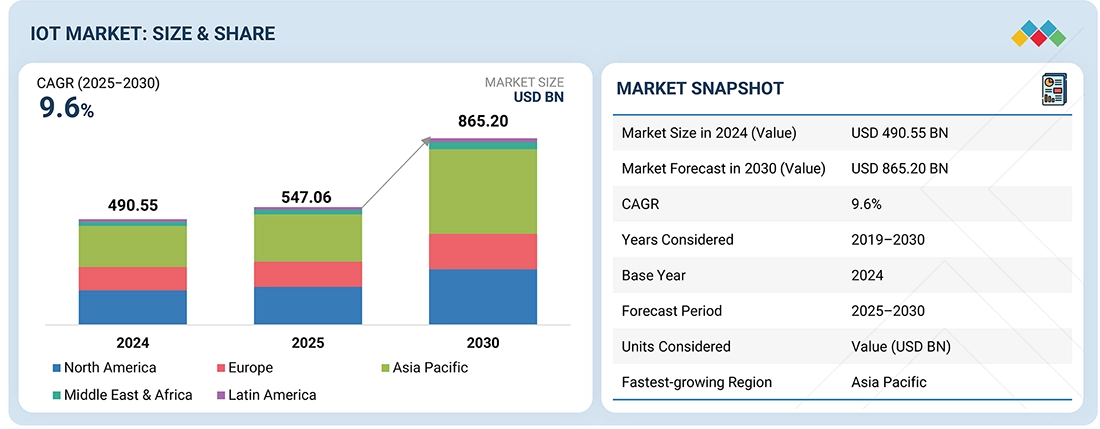

The global Internet of Things (IoT) market is projected to expand from USD 547.06 billion in 2025 to USD 865.20 billion by 2030, at a CAGR of 9.6% during the forecast period. The IoT market is accelerating as organizations embed sensors and connected devices across operations to digitize assets and workflows. End users demand scalable device management, secure end-to-end connectivity, low-latency edge compute, and integrated analytics to convert telemetry into real-time action. The players offer unified IoT platforms that combine device lifecycle management, OTA updates, zero-trust device security, edge-to-cloud orchestration, and AI-driven analytics and automation. These capabilities are unlocking predictive maintenance, operational efficiencies, improved safety and customer experiences, and new service-based revenue models.

KEY TAKEAWAYS

-

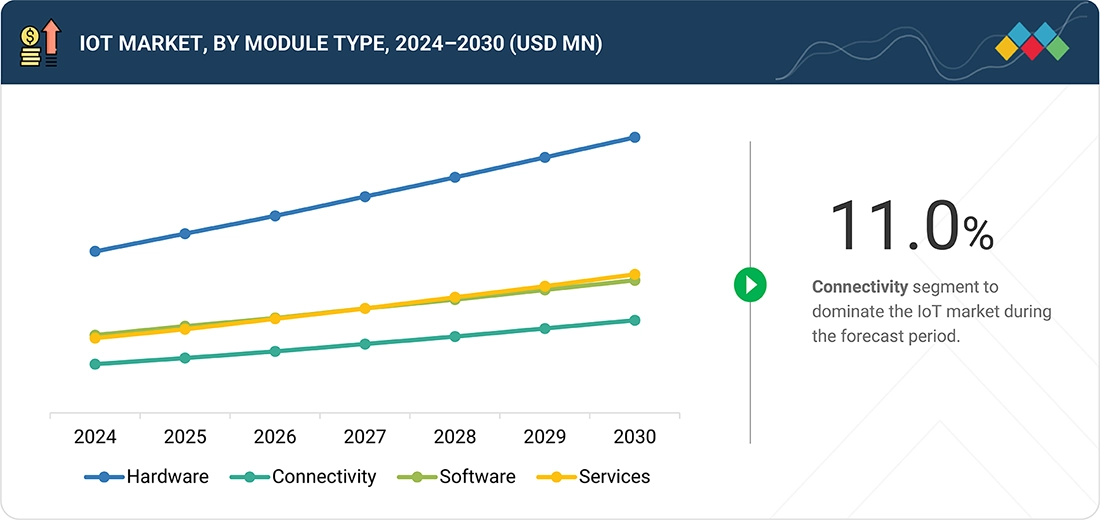

By MODULE TYPEExpansion of IoT deployments in industrial and smart city applications, coupled with advancements in low-power and high-performance computing, drives demand for IoT hardware like sensors and processors.

-

BY HARDWARERising cybersecurity concerns, regulatory mandates for data protection, and increasing IoT device proliferation are boosting the demand for secure hardware.

-

BY CONNECTIVITYLPWAN technologies such as NB-IoT, LTE-M, and LoRa are ideal for cost-efficient, long-range IoT applications in sectors such as agriculture, energy, and infrastructure, where wide coverage and low power consumption are critical.

-

BY SOFTWAREThe IoT platform segment is projected to lead the IoT market during the forecast period. It is driven by its essential role in connecting, managing, integrating, and analyzing IoT devices and data, enabling seamless operations and advanced insights across industries.

-

BY SERVICESIn the IoT market, professional services are expected to dominate from 2024 to 2030, fueled by the need for tailored consulting, seamless IoT integration, and ongoing system optimization across industries.

-

BY FOCUS AREASSmart manufacturing is anticipated to lead the IoT market, due to its ability to optimize production, reduce downtime, and enhance efficiency through real-time data and automation

-

BY REGIONThe IoT market covers North America, Europe, Asia Pacific, Latin America, the Middle East & Africa. Asia Pacific is projected to record the highest CAGR during 2025–2030, fueled by the rapid rollout of 5G networks, large-scale government digital infrastructure, and smart city programs, increasing demand for IoT deployments and operations.

-

Asia Pacific IoT MarketIn Asia Pacific IoT Market is projected to reach USD 392.76 billion by 2030, up from USD 218.57 billion in 2025, at a CAGR of 12.4% from 2025 to 2030.

-

US IoT MarketIn US IoT Market is expected to reach USD 220.47 billion by 2030, growing from USD 152.44 billion in 2025, at a CAGR of 7.7% from 2025 to 2030.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Microsoft (US), AWS (US), Huawei (China) and Cisco (US) have entered into a number of agreements and partnerships to cater to the growing demand for IoT across innovative applications.

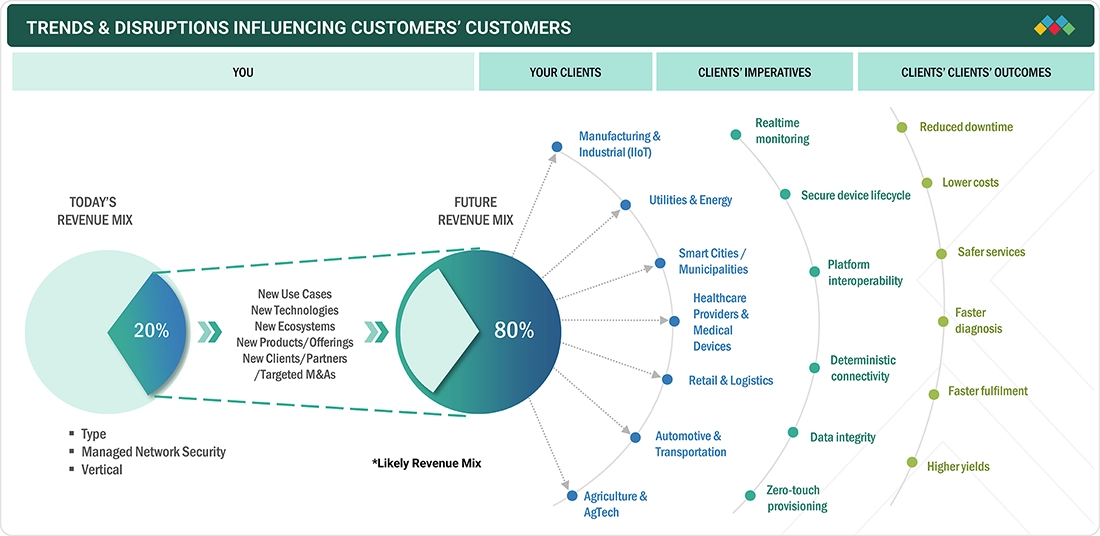

The IoT market is entering a new growth cycle as enterprises shift from owning network assets to relying on expert providers for performance, resilience, and security. Companies are increasingly prioritizing predictable service levels, simplified management, and cost efficiency while focusing internal teams on digital transformation.

IoT MARKET TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of manufacturing (IIoT), utilities, smart cities, healthcare devices, retail & logistics, automotive/transportation, agriculture, and commercial buildings, all buying managed IoT platforms, connectivity, edge compute, and device-security services. fragmentation of standards/interoperability, rising device security & privacy regulation, supplier & silicon constraints, vendor consolidation, and emergence of vertical-specific platform players and real-time analytics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of 5G and edge computing for faster, reliable connectivity

-

Broader availability and maturation of LPWAN and cellular IoT that cut connectivity cost and enable new low-power use cases

Level

-

Rising cybersecurity and data privacy concerns

-

Interoperability and Integration Challenges

Level

-

Expansion of space-based IoT Networks

-

Digital Twin technology integration across industries

Level

-

Cross-border data governance and differing privacy rules that complicate global IoT rollouts

-

Divergent regulations and standards raise compliance costs and deter global scale

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of 5G and edge computing for faster, reliable connectivity

The expansion of 5G and edge computing is a primary driver of the Internet of Things (IoT) market, enabling faster, more reliable connectivity across industries. 5G networks deliver ultra-low latency and high-speed data transfer, allowing billions of IoT devices to exchange information in real time. Meanwhile, edge computing brings data processing closer to the source, reducing dependency on centralized cloud systems and improving efficiency. Together, these technologies empower IoT applications such as smart cities, autonomous vehicles, healthcare monitoring, and industrial automation. Organizations benefit from improved decision-making, reduced operational delays, and enhanced user experiences. As 5G coverage expands globally, more connected devices will come online, creating a scalable, high-performance ecosystem for IoT innovation. This combination of speed, reliability, and localized processing is reshaping how data is generated, transmitted, and utilized, forming the foundation for the next phase of digital transformation across sectors.

Restraint: Rising cybersecurity and data privacy concerns

Despite rapid growth, the IoT market faces significant restraints from cybersecurity and data privacy challenges. As billions of devices become interconnected, the risk of data breaches, unauthorized access, and system vulnerabilities increases dramatically. Many IoT devices lack built-in security features, making them easy targets for hackers. Sensitive data from sensors and connected systems, especially in sectors like healthcare, finance, and smart agriculture, can be exposed or misused if not properly protected. Additionally, inconsistent security standards and weak encryption protocols across device manufacturers add complexity. Consumers and enterprises are becoming more cautious, often delaying adoption until stronger safeguards are in place. Regulatory frameworks like GDPR and other data protection laws are forcing companies to reassess how they collect, process, and store IoT data. Addressing these security and privacy risks is essential for sustaining trust and ensuring that IoT continues to evolve as a safe, scalable technology ecosystem.

Opportunity: Expansion of space-based IoT networks

The expansion of space-based IoT networks presents a groundbreaking opportunity for the global IoT market. Traditional IoT connectivity often relies on terrestrial networks, which can be limited in remote or hard-to-reach areas. Satellite-based IoT systems overcome these barriers, enabling worldwide coverage across oceans, deserts, and rural regions. This innovation allows continuous monitoring and data transmission for industries like agriculture, maritime logistics, environmental tracking, and defense. With the deployment of low-Earth orbit (LEO) satellites, latency is being reduced, improving communication speeds and reliability. These networks open doors for new applications, from precision farming to global asset tracking, while supporting disaster response and climate observation. The integration of satellite connectivity with terrestrial IoT systems will create a seamless, hybrid network infrastructure. As costs for satellite deployment decrease, space-based IoT will accelerate the development of truly global, always-connected smart systems that enhance efficiency and sustainability.

Challenge: Cross-border data governance and differing privacy rules that complicate global IoT rollouts

One of the most complex challenges in the IoT market is managing cross-border data governance and differing privacy regulations. IoT devices generate vast amounts of data that often travel across countries and jurisdictions, each with unique compliance requirements. Variations in data protection laws, such as GDPR in Europe or CCPA in the United States, create operational friction for global IoT deployments. Companies must navigate conflicting mandates on data localization, user consent, and information sharing, which complicates integration and scalability. These inconsistencies not only slow down international IoT rollouts but also increase costs related to legal compliance, data management, and infrastructure modification. Moreover, ensuring that data sovereignty and privacy are respected while maintaining interoperability remains a balancing act. To overcome these governance hurdles, global standardization and cooperative regulatory frameworks are needed to foster trust and facilitate seamless, secure IoT operations worldwide.

IoT Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Smart-city deployments connecting streetlights and municipal sensors to central platforms for remote management, analytics and new city services. | Lower energy costs, faster rollouts, platform for additional services. |

|

Real-time fleet and asset tracking using telematics and connected sensors to monitor location, condition, and route adherence for large shippers and logistics providers. | Real-time visibility, reduced loss, improved routing and asset utilization. |

|

Industrial IoT solutions that connect factory equipment and plant networks to edge and cloud platforms to enable telemetry, automation and operations integration. | Improved uptime, faster incident resolution, better OT/IT alignment |

|

Connected-vehicle and workshop data solutions that transmit vehicle diagnostics and service-relevant telemetry to OEMs and service providers. | Faster diagnostics and servicing, better aftersales experience, secure data exchange. |

|

Scalable IoT ingestion and platform services that connect medical devices and healthcare equipment for secure data processing and analytics at scale. | Secure device connectivity, scalable data processing, accelerated analytics and ML. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

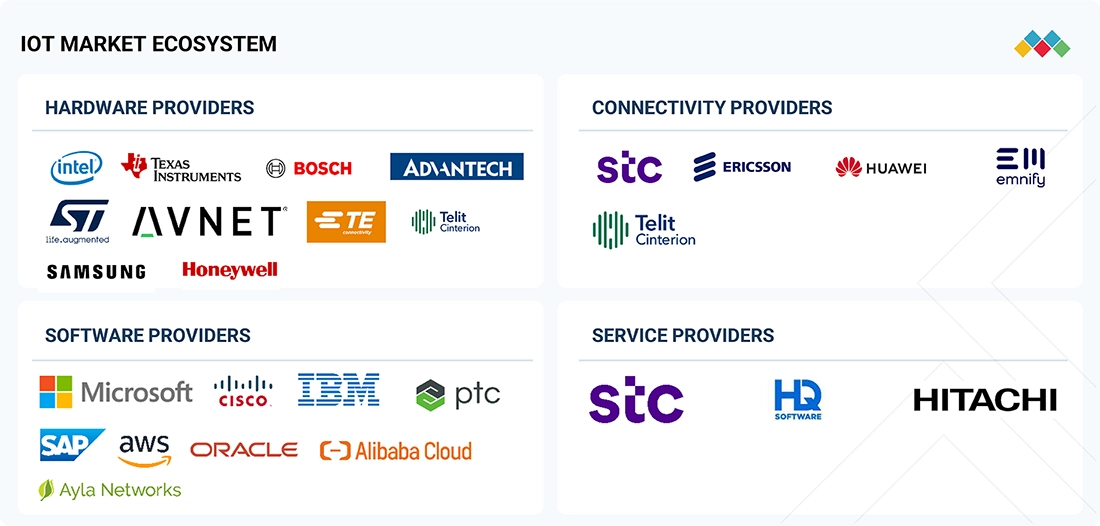

MARKET ECOSYSTEM

The IoT market is highly competitive and comprises many vendors who offer solutions to a specific or niche market segment. Several changes have occurred in the market in recent years. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

IoT Market, By Module Type

Hardware forms the foundation of the global Internet of Things (IoT) market, acting as the bridge between the physical and digital worlds. It includes sensors, processors, communication modules, and gateways that enable devices to collect, transmit, and process data. As IoT adoption expands across industries, demand for advanced and energy-efficient hardware continues to surge. Miniaturization and integration of AI chip are improving edge intelligence, allowing devices to make real-time decisions without relying solely on the cloud. Hardware innovation is also driving new use cases in automotive systems, smart cities, and industrial automation. Companies are investing heavily in modular and interoperable components to ensure scalability and compatibility across diverse IoT ecosystems. The ongoing advancement of semiconductor technology, coupled with declining production costs, is making IoT hardware more accessible and powerful, cementing its role as a key enabler of digital transformation worldwide.

Internet of Things Market, By Hardware

Security hardware is a crucial subsegment of the IoT market, designed to safeguard connected devices and networks from cyber threats. As IoT ecosystems expand, the number of vulnerable endpoints increases, elevating the need for dedicated security components such as trusted platform modules (TPMs), secure microcontrollers, and encryption chips. These hardware-based safeguards provide tamper resistance, secure boot processes, and authentication mechanisms that protect sensitive data at the device level. Industries such as healthcare, finance, and manufacturing are increasingly relying on embedded security solutions to ensure the integrity and confidentiality of information exchanged between connected systems. The rising sophistication of cyberattacks has prompted IoT vendors to adopt hardware root-of-trust architectures and integrate security into the design phase rather than as an afterthought. With privacy regulations tightening worldwide, the demand for robust, hardware-anchored protection continues to grow, making security hardware an indispensable component of the global IoT landscape.

IoT Market, By Connectivity

Satellite connectivity is becoming a transformative force within the IoT market, enabling communication in regions beyond the reach of terrestrial networks. This segment addresses the growing need for continuous, global coverage across industries like logistics, agriculture, energy, and maritime operations. By leveraging low-Earth orbit (LEO) satellites, IoT solutions can transmit data with lower latency and greater reliability, ensuring uninterrupted monitoring and control of remote assets. Satellite IoT is particularly valuable for applications such as fleet tracking, environmental monitoring, and disaster management, where traditional cellular infrastructure is unavailable or unreliable. As the cost of satellite deployment decreases, more organizations are adopting hybrid connectivity models that integrate satellite and terrestrial networks for seamless performance. The ongoing expansion of space-based IoT constellations positions satellite connectivity as a key enabler of global digital inclusion, enhancing data accessibility and operational efficiency across geographically diverse environments.

IoT Market, By Software

Security and safety software are vital components of the IoT ecosystem, ensuring that connected devices operate reliably and securely. This software layer manages identity authentication, threat detection, encryption, and system resilience, protecting IoT networks from cyberattacks and data breaches. With billions of devices transmitting sensitive data, security software provides continuous monitoring and automated responses to anomalies. Safety software complements this by preventing system failures and ensuring compliance with regulatory standards, particularly in critical sectors such as healthcare, automotive, and industrial automation. Increasing integration of AI and machine learning enables predictive security, allowing early detection of vulnerabilities before they are exploited. As cyber threats evolve, companies are shifting toward unified IoT security platforms that combine endpoint protection, analytics, and cloud-based management. The growing emphasis on digital trust and system integrity makes security and safety software central to sustaining long-term IoT adoption.

Internet of Things Market, By Service

Professional services play a pivotal role in the IoT market by helping organizations plan, deploy, and manage complex IoT solutions. These services include consulting, system integration, training, and maintenance, ensuring smooth implementation and scalability. As IoT ecosystems become more intricate, businesses rely on professional expertise to align technology with operational goals and regulatory requirements. Service providers assist in designing architectures, integrating multi-vendor hardware and software, and ensuring security and compliance throughout the deployment lifecycle. With rapid digital transformation across industries, the demand for IoT professional services is rising, particularly in sectors like manufacturing, energy, and smart infrastructure. Additionally, managed services and analytics support are enabling companies to derive real-time insights from connected devices. By bridging technical gaps and optimizing IoT performance, professional service providers are becoming strategic partners, driving efficiency, innovation, and sustained growth across the global internet of things market.

IoT Market, By Focus Area

Smart healthcare represents one of the fastest-growing focus areas within the IoT market, revolutionizing patient care and medical operations. IoT-enabled devices such as wearable sensors, remote monitoring tools, and connected diagnostic systems are enhancing real-time health tracking and decision-making. These technologies allow healthcare professionals to monitor patients remotely, reduce hospital readmissions, and personalize treatment plans based on continuous data insights. In hospitals, IoT systems improve asset management, streamline workflows, and enhance patient safety through automation and predictive maintenance. Moreover, the integration of IoT with AI and cloud computing supports advanced analytics for disease prediction and population health management. Security and data privacy remain top priorities as healthcare IoT expands, with robust encryption and compliance frameworks ensuring patient data protection. As healthcare systems worldwide pursue digital transformation, smart healthcare stands out as a key driver of efficiency, accessibility, and improved patient outcomes

REGION

Asia Pacific to be largest region in global IoT market during forecast period

The Asia Pacific region has emerged as the largest market for the Internet of Things (IoT), driven by rapid industrialization, extensive urbanization, and widespread technology adoption across countries such as China, India, Japan, and South Korea. The region is expected to command the most device connections and the highest IoT spending globally, thanks to strong government backing for smart infrastructure, the rollout of 5G and LPWA networks, and a broad base of manufacturing, logistics, and consumer IoT use cases. A recent key development illustrates this trend: the number of cellular machine-to-machine (M2M) and IoT connections in the Asia Pacific is projected to reach 1.3 billion connections by 2030. This surge in connectivity highlights the region’s dominance and its role as the global engine of IoT growth.

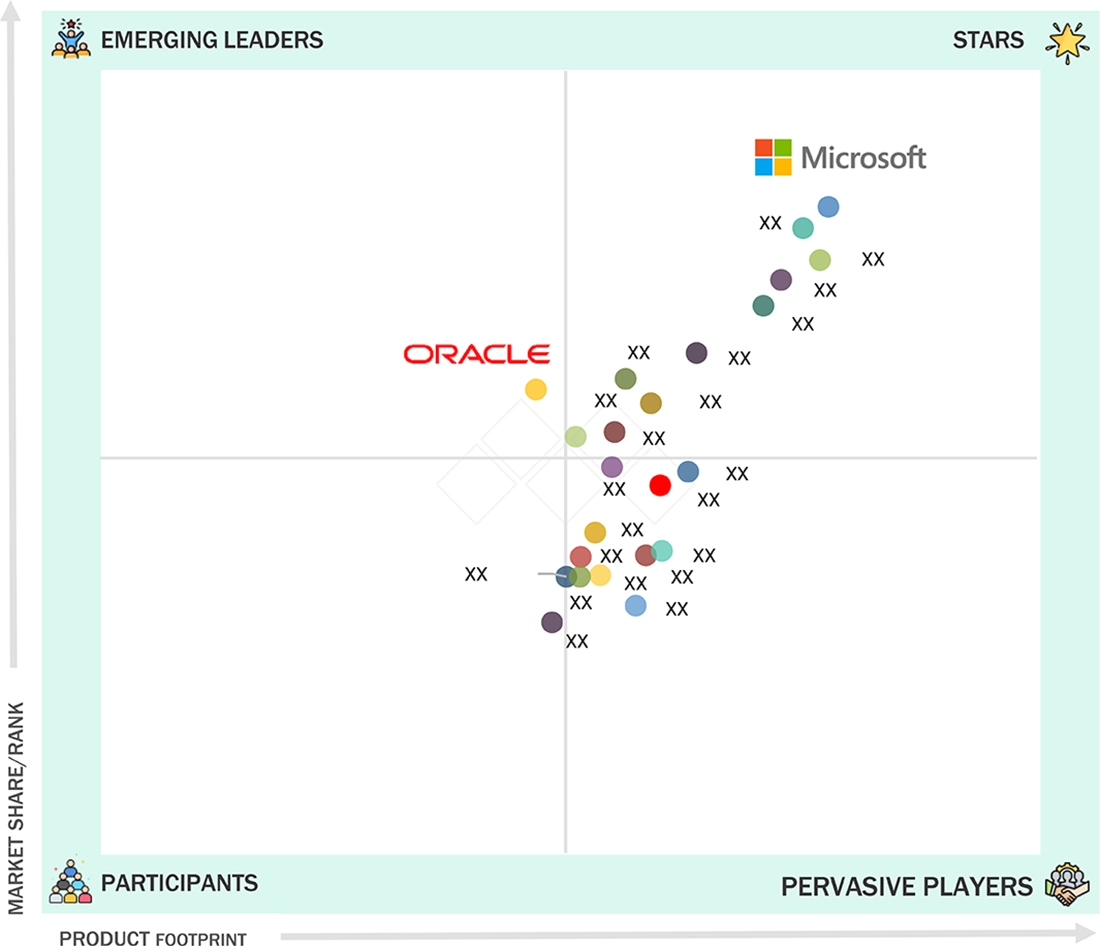

IoT Market: COMPANY EVALUATION MATRIX

In the IoT market matrix, Microsoft (Star) leads with a strong market share and extensive product footprint, driven by its offering customized solutions as per customers' requirements and adopting growth strategies to achieve advanced technology consistently. Oracle (Emerging Leader) is gaining visibility with its innovative solutions to cater to future IoT demands. While Microsoft dominates through scale and a diverse portfolio, Oracle shows significant potential to move toward the leaders’ quadrant as demand for IoT continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 490.55 Billion |

| Market Forecast in 2030 (Value) | USD 865.20 Billion |

| Growth Rate | CAGR of 9.6% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

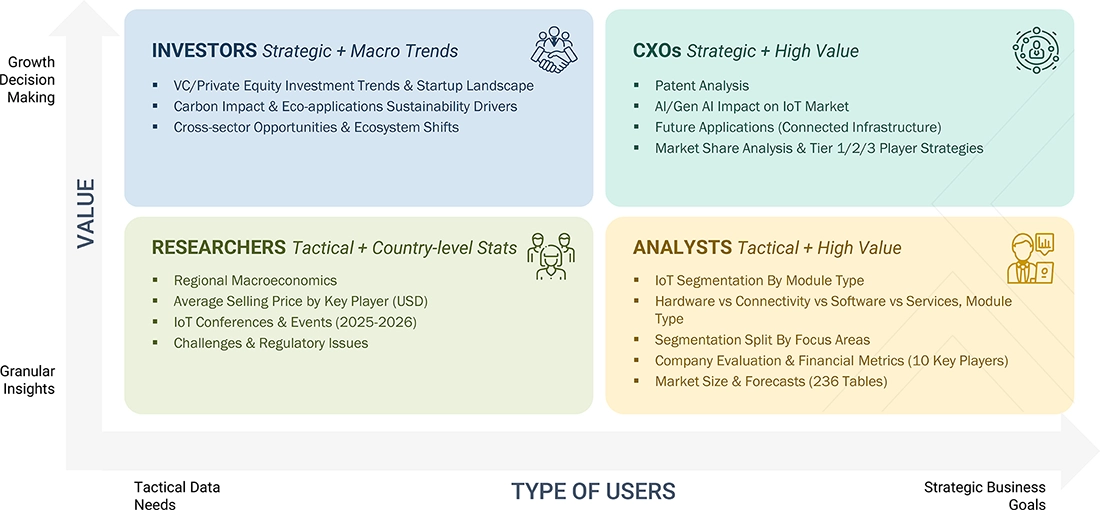

WHAT IS IN IT FOR YOU: IoT market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio of each company | Enhanced understanding of competitive positioning and product offerings |

| Leading Service Provider (EU) | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Deeper insights into market dynamics and potential strategic partnerships |

RECENT DEVELOPMENTS

- October 2025 : AT&T and Ericsson launched the AT&T IoT Marketplace, a cloud-based platform on Microsoft Azure that simplifies IoT service management for industries like transportation and healthcare. Powered by Ericsson’s Digital Experience Platform, it streamlines selling, provisioning, and billing, reducing order times and boosting efficiency.

- October 2025 : Tata Communications and Cisco partnered to integrate Tata’s MOVE™ eSIM solution, covering 350+ million eSIM OS across 200+ countries, with Cisco’s IoT Control Center, managing 270 million+ devices for 32,000+ enterprises. The collaboration streamlines device activation, enhances scalability, and reduces integration complexity for industries like transportation and manufacturing.

- March 2025 : Qualcomm Technologies Inc. acquired Edge Impulse to enhance its AI and Internet of Things (IoT) capabilities. The acquisition aims to combine Qualcomm's hardware with Edge Impulse's software platform for AI development, making it easier for developers to create and deploy AI models on edge devices.

Table of Contents

Methodology

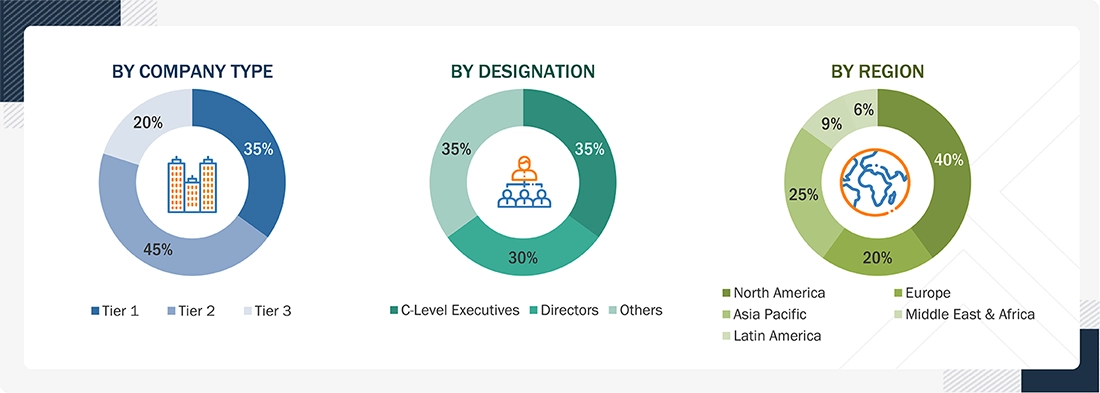

This research study extensively utilized secondary sources, directories, and databases, including Dun & Bradstreet (D&B), Hoovers, and Bloomberg Businessweek, to identify and collect information relevant to a technical, market-oriented, and commercial study of the IoT market. The primary sources have primarily consisted of industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering IoT worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams, related key executives from IoT solution vendors, professional service providers, and industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data collected from solutions and services, market segmentations, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using IoT solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of IoT solutions, which would impact the overall IoT market.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million to 1 billion; and Tier 3

companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Internet of Things Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the IoT market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of IoT solutions.

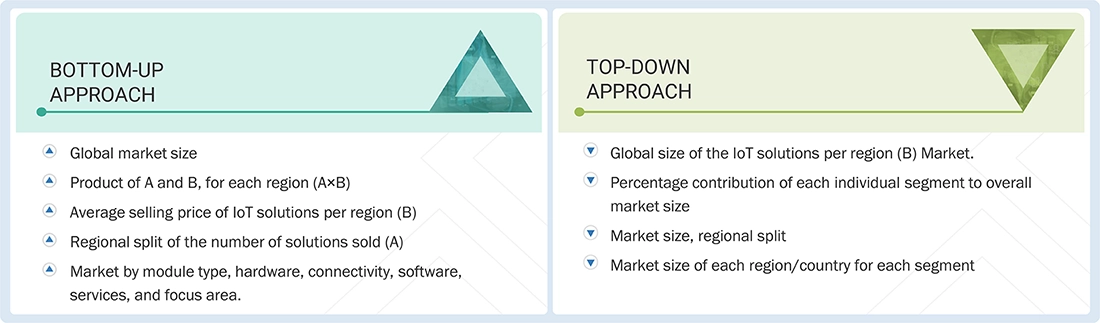

Top-down and bottom-up approaches were used to estimate and validate the total size of the IoT market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through a combination of primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

IoT Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the IoT market was segmented into several categories and subcategories. A data triangulation procedure was employed to complete the overall market engineering process and derive the exact statistics for all segments and subsegments, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition to data triangulation and market breakdown, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Internet of Things (IoT), is a network of physical devices embedded with sensors and software that can collect and exchange data over the internet, enabling them to communicate and interact with each other without human intervention; essentially, it encompasses hardware, software, connectivity, and services used to build and operate IoT systems across various focus areas such as smart transportation, smart energy & utilities, smart manufacturing, smart retail, among others.

Stakeholders

- Government agencies

- IoT service providers

- Telecom companies

- System integrators

- Smart device manufacturers

- Healthcare providers and institutions

- Automotive and mobility solution providers

- Energy and utility companies

- Retailers and E-commerce platforms

- Industrial enterprises

- Construction and real estate developers

- Agricultural enterprises

- Financial institutions and banks

- Research and development institutions

- Educational and training organizations

Report Objectives

- To determine and forecast the global IoT market by module type, hardware, connectivity, software, service, focus area, and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the IoT market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall IoT market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the IoT market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product development, partnerships and collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Internet of Things (IoT) Market, by Module Type (Hardware [Modules/Sensors, Security Hardware], Connectivity [Cellular, LP-WAN, Satellite], Software [IOT Platforms, Application Software, Analytics Software, Security & Safety Software], Services [Implementation, Design, Managed Services]), by Focus Area (Smart Transportation/Mobility, Smart Buildings, Smart Energy/Utilities, Smart Healthcare, Smart Agriculture, Smart Manufacturing, Smart Retail), by Region

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Internet of Things (IoT) Market, by Module Type (Hardware [Modules/Sensors, Security Hardware], Connectivity [Cellular, LP-WAN, Satellite], Software [IOT Platforms, Application Software, Analytics Software, Security & Safety Software], Services [Implementation, Design, Managed Services]), by Focus Area (Smart Transportation/Mobility, Smart Buildings, Smart Energy/Utilities, Smart Healthcare, Smart Agriculture, Smart Manufacturing, Smart Retail), by Region