Green Hydrogen and Traditional Production Cost Comparison

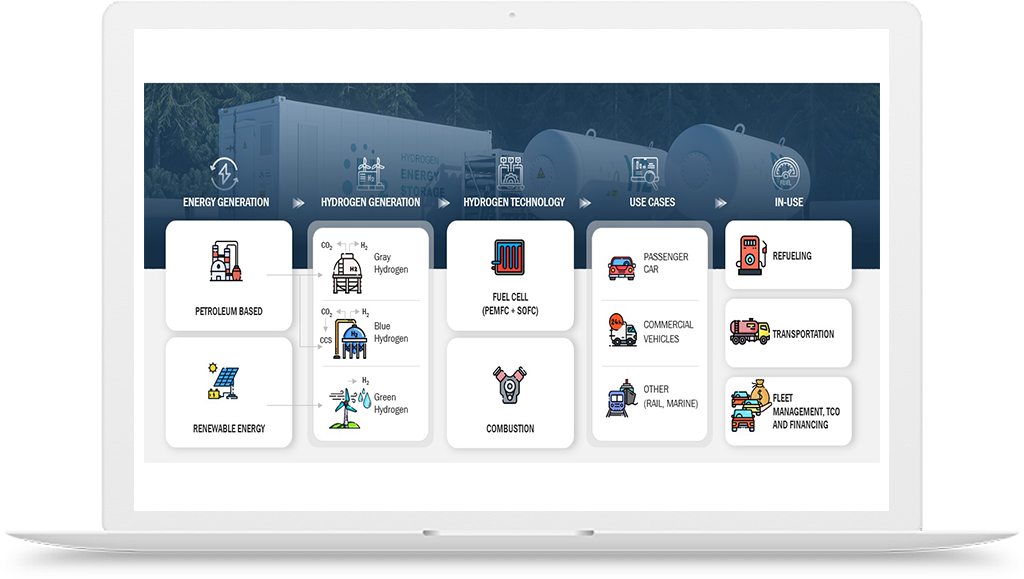

A possible way to meet the increasing demand for clean, sustainable energy on a worldwide scale is hydrogen. Conventionally, the production of hydrogen has involved the release of substantial volumes of carbon dioxide into the environment through procedures like coal gasification and steam methane reforming (SMR). Green hydrogen production techniques, which use renewable energy sources to produce hydrogen with little environmental impact, have gained popularity in recent years. The purpose of this article is to present a thorough analysis of the production costs related to conventional hydrogen production techniques and Green Hydrogen and Traditional Production Cost Comparison.

Here are some key points to consider about Green Hydrogen and Traditional Production Cost Comparison:

-

Cost Reduction Trajectory:

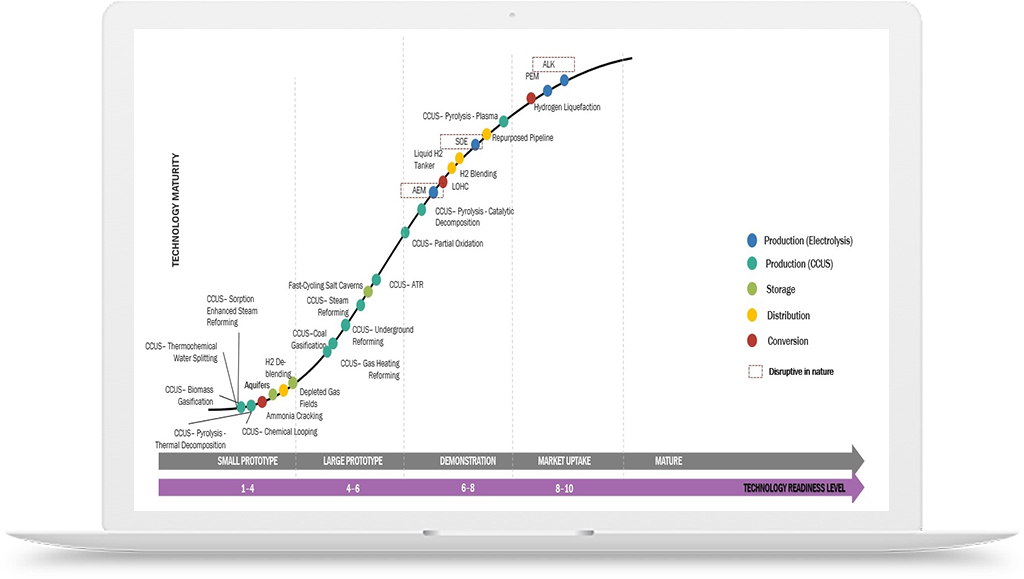

Costs of Renewable Energy: With regard to green hydrogen production, renewable energy sources like solar and wind power are becoming more and more affordable. Green hydrogen costs are immediately lowered as long as the price of renewable electricity keeps going down.

Electrolyzer Technology: Improvements in electrolyzer technology, increasing production volume, and improved manufacturing efficiency are bringing down the initial and ongoing expenses of producing green hydrogen.

Economies of Scale: These will become important as demand for green hydrogen rises. Through enhanced manufacturing procedures, standardization, and supply chain optimization, higher production volumes and larger electrolyzer installations can result in cost savings.

Current Cost Trends:

Reduction of Green Hydrogen Cost: According to industry data and recent studies, the cost of green hydrogen has been steadily reducing and is expected to do so in the future. Within the next ten years, green hydrogen costs could potentially become equal to those of gray and blue hydrogen, according to estimates.

Example: For instance, according to projections made by the Hydrogen Council, a global CEO-led initiative, green hydrogen might become as cheap as $2 per kilogram (kg) by 2030, making it comparable to gray hydrogen in many areas.

-

Inflection Point and Market Dynamics:

Reaching Cost Parity: An inflection point is reached when the production costs of green hydrogen are equal to or less than those of gray or blue hydrogen. Green hydrogen becomes a viable alternative on the basis of cost parity, independent of substantial carbon price or regulatory incentives.

Market Dynamics: A shift in demand for green hydrogen is anticipated to be brought about by cost parity. As a more affordable and sustainable alternative to fossil fuels, industries and sectors that currently rely on them may progressively switch to green hydrogen, which would boost market penetration and result in additional cost savings through economies of scale.

-

Examples of Cost Reduction Initiatives:

Renewable Energy Auctions: To reduce the cost of renewable energy, governments all over the world are holding renewable energy auctions and encouraging competitive bidding. The cost of producing green hydrogen is directly affected by falling prices for renewable energy.

Research and Development: The main goals of public and commercial investments in R&D projects are to increase the efficiency of electrolyzers, investigate novel materials for catalysts, and advance other parts of green hydrogen generation systems. These initiatives seek to cut expenses while accelerating technical developments.

Green Hydrogen and Traditional Production Cost Comparison:

-

Capital Expenses:

Fossil fuels must typically be processed and refined using costly infrastructure using traditional processes.

Electrolyzers and renewable energy facilities are necessary investments for the generation of green hydrogen, especially electrolysis.

-

Running Expenses:

Conventional techniques rely on the erratic cost of fossil fuels.

Because the cost of renewable energy has been declining, green hydrogen production has become more competitive.

-

External Expenses:

The usage of traditional methods contributes to climate change by emitting greenhouse gases.

One way to decarbonize the energy sector and lower external environmental costs is through green hydrogen production.

-

Rewards and Policy Assistance:

Governments everywhere are encouraging the switch to green hydrogen by enacting laws, tax breaks, and other incentives.

A crucial first step in building a low-carbon, sustainable future is the transition to green hydrogen production techniques. Green hydrogen is starting to show advantages both economically and environmentally, even though conventional hydrogen generation techniques have dominated the market for decades. In the end, environmental sustainability, economic feasibility, and the worldwide commitment to reducing climate change will choose which type of hydrogen to use traditional or green.