SEMICONDUCTORS ARE THE NEW OIL FOR A DATA DRIVEN ECONOMY

Are Semiconductors the new oil for a data-driven economy?

Can you guess what is common between the semiconductor and oil industries: Both are dominated by a handful of countries and capital. TSMC accounts for ~55% of the global market share for contract chip manufacturing, and OPEC produces ~40% of the world’s crude oil. The majority of the advanced node semiconductors are made in Taiwan. As a result, the significance of TSMC in the world economy has considerably grown.

Oil and natural resources have always been the foundation of several emerging industries; similarly, semiconductors will dominate the technology-driven industries in the coming years. Semiconductors are at the heart of every single electronic device, from smartphones to vehicles to industrial machinery. The semiconductor market is projected to reach USD 1 trillion by 2030, and the data-driven economy will be the driving force. Today’s economy is data-driven and with the advancements in key technologies such as AI, IoT, 5G, Blockchain, Industry 4.0, Digital Twin, smart grid, smart infrastructure, wearables, cloud computing, and edge computing, semiconductors will be the hot bets for every country across the world. Though the semiconductor industry is cyclical, the long-term prospects for this critical sector are incredibly bright with the rising implementation of automation solutions across the end-user industries. The figure below depicts the sale of semiconductors and the data of unit shipments for three months, moving the average from January 2001 to November 2022.

FIGURE 1 sale of semiconductors and data of unit shipments for 3 months, moving average from January 2001 to November 2022

Source: WSTS and SIA Analysis

Semiconductors have become an increasingly scarce resource in the modern world, just like natural resources such as oil. This can be witnessed by the fact that semiconductors have become a central issue in global trade and diplomacy, wherein several countries are vying for control over the supply and production of silicon-based ICs.

Earlier in the 19th century, countries such as Iraq and Kuwait were involved in the conflict over oil reserves. The war aimed to take control of Kuwait’s vast oil reserves. This is because countries with significant control over the production and supply of oil have been able to exert considerable influence over other countries that lack these resources. Similarly, in the current technology-driven world, nations are vying to take control of the supply and production of semiconductor chips and technology. This is evident from the US-China trade war and the tussle between the US and China over Taiwan, which is the center of the world’s most advanced semiconductor manufacturing country. China claims Taiwan as a part of its territory and works in close partnership with Taiwan, while South Korea, a country that has more allegiances to the United States, but its financial interests are increasingly tied to Chinese demand.

The US imposed a ban on several Chinese companies, specifically Huawei, from gaining access to chips and banning companies from third countries, such as TSMC, from using American-made equipment to serve Chinese customers. Taiwan and South Korea account for more than 80% of global processor chip production and 70% of memory chip output.

The COVID-19 outbreak has taught everyone in the industry how crucial the semiconductor components are for the economy's survival. The supply chain issues that created a chip shortage adversely impacted most industries, specifically the automotive industry. The Automotive OEMs lost ~ USD 200 billion in sales in 2021. Semiconductors chips are very complex and expensive to produce, specifically the chips that are manufactured on advanced technology nodes. Therefore, countries such as the US and China are involved in the battle for dominance in the semiconductor business. Since TSMC controls most of the production and supply of advanced ICs, the US and China are making no stone unturned to take control of TSMC’s resources and supply networks. As a result, global semiconductor suppliers are under pressure to choose between the US and China.

Though China manufactures more than 30% of the world’s semiconductors, it primarily depends on semiconductor imports. This can be substantiated by the fact that China imported USD 350 billion of semiconductors in 2020, more than the value of the crude oil it imported the same year. With the increased trade restriction from several countries, China is purchasing chips at higher prices. As a result, China is aggressively investing in developing its domestic semiconductor sector. This can be substantiated by the fact that it is experiencing a rapid rise in revenue for fabless, foundry, IDM, and OSATs. The US, China, and other countries are heavily investing to become self-reliant in the semiconductor industry. The figure below depicts a few key investments in semiconductor fabrication plants over the year.

TABLE 1 key investments in semiconductor fabrication plants over the year

| Company | Country | Investment (USD Billion) | Investment Type | Number of Fabs |

| Intel | Arizona-US | USD 20 Billion | New | 2 |

| Intel | Ohio-US | Initial USD 20 billion (potential to grow to USD 100 Billion with eight total fabrication plants in 10 years) | New | 2 |

| TSMC | Arizona-US | 40 Billion | New | 2 |

| Samsung | Texas-US | 17 Billion | New | 1 |

| Micron Technology | Idaho-US | 15 Billion (over 2030) | New | 1 |

| Texas Instruments | Texas-US | 30 Billion (over 2030) | New | 4 |

| Wolfspeed | North Carolina-US | 5 Billion (over 10 years) | New | 1 |

| TSMC | Japan | 7 Billion | New | 1 |

| SMIC | Tianjin-China | 7.5 Billion | New | 1 |

Source: WSTA, SEMI, SIA, and MarketsandMarkets Analysis

As per SEMI, semiconductor chip manufacturers are expected to invest more than USD 500 billion in 84 global semiconductor facilities by 2024. The construction of 23 of these new chipmaking plants began in 2021, 33 began in 2022, and the construction of 28 new plants will start in 2023. The number of semiconductor fabrication plants under construction in 2022 is almost twice as much as in 2019 and 2020.

The rise in the construction of semiconductor fabrication plants is primarily due to the chip manufacturing incentives announced by the government of the respective countries to strengthen their economy and stay at the top of the value chain as “semiconductor is the new oil”. A few examples of the same have been provided below:

- In December 2022, China announced the plan to reveal a USD 143 billion investment package to boost its semiconductor industry. It is expected that most of the valuable funding will go into the purchases of domestic semiconductor equipment for foundries and companies will be entitled to a subsidy of up to 20% on the equipment cost.

- August 2022, US president Joe Biden signed the CHIPS and Science Act, including the USD 280 billion packages to strengthen domestic semiconductor manufacturing, design and research, and reinforce America’s chip supply chains. Approximately USD 52 billion will be allocated for constructing semiconductor fabrication plants, or fabs.

- In February 2022, the European Commission presented and published the proposed European Chips Act. The main aim of this proposal is to increase Europe’s position in the semiconductor industry and its market share in semiconductor production to 20% in 2030. The European Chips Act is set to mobilize ~ USD 45 billion of European public and private investment.

- In December 202, the government of India announced an ~USD 10 billion production-linked incentive (PLI) scheme to encourage investments in the Indian semiconductor and display manufacturing sector. According to the Electronics and IT Ministry, semiconductor demand in India will increase to USD 70-USD 80 billion by 2026 with the growing demand for digital devices and electronic products.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

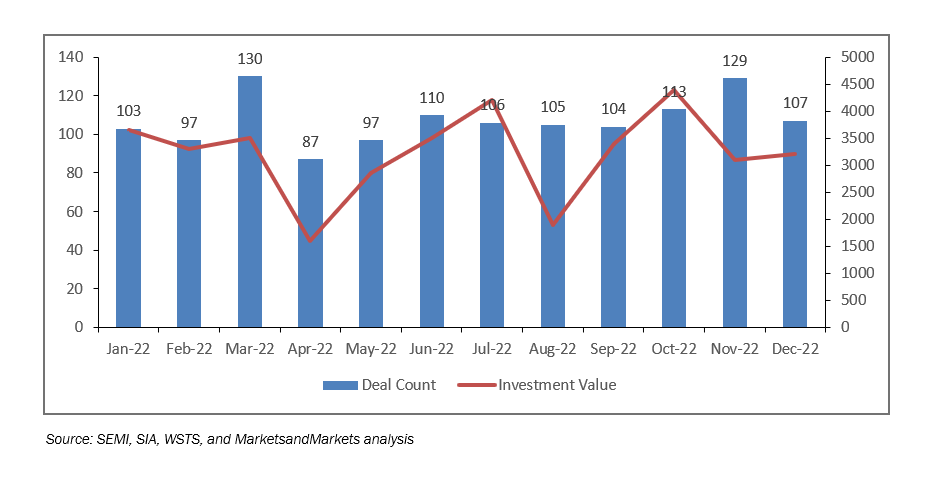

The race toward manufacturing semiconductor chips has only just begun and companies across the semiconductor supply chain are also entering the market space. Several semiconductor start-ups have secured lucrative deals in 2022 across key semiconductor segments including AR/VR, batteries, displays, quantum computing, power semiconductors, IC designs, sensors, AI, ADAS, Semiconductor materials, semiconductor equipment, wireless ICs, photonics, energy harvesting, memory, semiconductor testing and packaging, EDA tools, and electric vehicles. The figure below depicts the semiconductor deal count and investment value in 2022.

FIGURE 2 semiconductor deal count and investment value (USD Million) in 2022

Related Research Projects/Topics

IoT-based Asset Tracking and Monitoring